Ways to Invest in a Startup 2024

Summary

Investing in startups can be highly lucrative through investment methods such as direct equity investments, angel investing, venture capital, debt financing, and crowdfunding. Comprehensive tools and platforms such as Crunchbase, PitchBook, and AngelRoom offer essential data and connectivity, enhancing investor capability to assess, engage, and manage startup investments effectively.

Key insights:

Investing in startups offers high returns and supports innovation through various methods such as equity financing, angel investing, venture capital, debt financing, and crowdfunding.

Equity financing involves purchasing shares in startups, with angel investors providing capital, mentorship, and industry connections.

Venture capital is a major source of funding, using pooled resources to invest in high-growth startups, and includes stages from seed funding to later series rounds.

Debt financing options like convertible notes and revenue-based financing provide startups with capital while delaying valuation or aligning returns with performance.

Crowdfunding, including equity and reward-based, allows a broad participation in startup funding, democratizing investment opportunities.

Tools like Crunchbase, PitchBook, AngelList, and SeedInvest assist investors in making informed decisions by providing detailed data and facilitating investment processes.

Introduction

Investing in startups can be a lucrative endeavor, offering the potential for high returns while supporting innovation and entrepreneurship. However, understanding the various methods of investment and the tools available can significantly enhance an investor's success. This insight delves into the various ways investors can invest in startups.

Types of Startup Investments

Equity Financing

Equity financing involves investors purchasing shares directly from startups, gaining ownership stakes. This method typically involves negotiation between the investor and startup founders to determine the equity amount received in exchange for the investment.

Direct Investment

Direct investments allow investors to buy shares from the startup, often at an early stage when the valuation is low, which can lead to significant returns if the company grows. This type of investment requires careful evaluation of the startup’s business model, market potential, and the founding team’s capabilities.

An angel investor funds a startup in exchange for equity, often providing not just capital but also mentorship and industry connections. Likewise, Direct investments accounted for over 30% of all startup funding in 2023, according to the National Venture Capital Association. This indicates the popularity and effectiveness of direct equity investments in fueling startup growth.

Angel Investing

Wealthy individuals, known as angel investors, provide capital to early-stage startups in exchange for equity or convertible debt. These investments are often critical in the early stages of a startup when traditional financing options are unavailable. Angel investors usually bring valuable industry experience, mentorship, and a network of contacts that can help startups succeed.

Angel investors invested over $25 billion in startups in 2023, with the average investment being $100,000. These figures underscore the significant impact angel investors have on the startup ecosystem. Prominent angel investors include Ron Conway, known for his investments in Google and Facebook, and Jason Calacanis, an early investor in Uber and Robinhood. Their successful investment strategies highlight the potential benefits of angel investing.

Venture Capital

Professional venture capital firms manage pooled funds from multiple investors to invest in high-growth startups. Venture capitalists (VCs) typically look for startups with strong growth potential, innovative products or services, and scalable business models. VCs provide not only capital but also strategic guidance and industry connections. Venture capital investments reached $300 billion globally in 2023, according to PitchBook.

This significant investment volume highlights the critical role of venture capital in driving startup growth and innovation. Venture capital is divided into different stages, including seed funding, Series A, B, C, etc. Seed funding is the earliest stage, used to support initial product development and market research. Subsequent rounds (Series A, B, C, etc.) are used to scale operations, expand market reach, and achieve profitability.

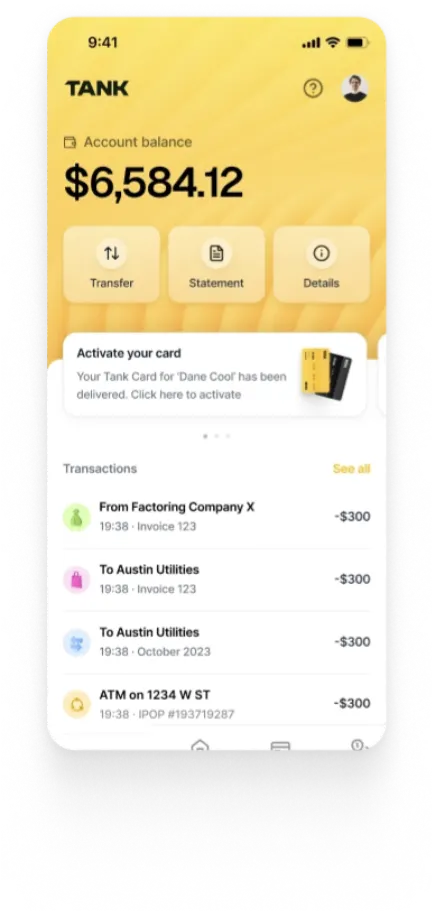

Debt Financing

Debt financing involves startups borrowing funds that they must repay, often with interest. Two common forms of debt financing in the startup world are convertible notes and revenue-based financing.

Convertible Notes

Convertible notes are a type of short-term debt that converts into equity during a later financing round, typically when a startup raises a Series A round. This method allows startups to delay valuation discussions until they have more traction and a clearer picture of their worth. Convertible notes account for 20% of early-stage startup funding.

According to a study by the Angel Capital Association, the average size of convertible note investments was $500,000 in 2023. Convertible notes are attractive because they provide immediate funding without the need for detailed valuation discussions. They also offer the potential for significant returns if the startup's valuation increases significantly during subsequent funding rounds.

Revenue-Based Financing

Revenue-based financing involves investors receiving a percentage of the startup's ongoing gross revenues until the initial investment and a multiple are repaid. This type of financing aligns the investor's returns with the startup's performance, making it a flexible and performance-based funding option. Lighter Capital offers revenue-based financing to SaaS companies, typically taking 2-8% of monthly revenues until the loan is repaid.

Revenue-based financing has grown in popularity, with a market size of $3 billion in 2023, according to the Revenue Capital Report. This growth reflects the increasing acceptance of revenue-based financing as a viable alternative to traditional equity and debt financing.

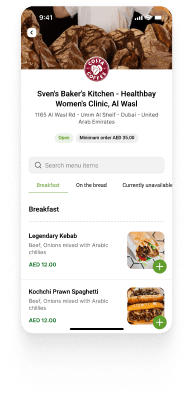

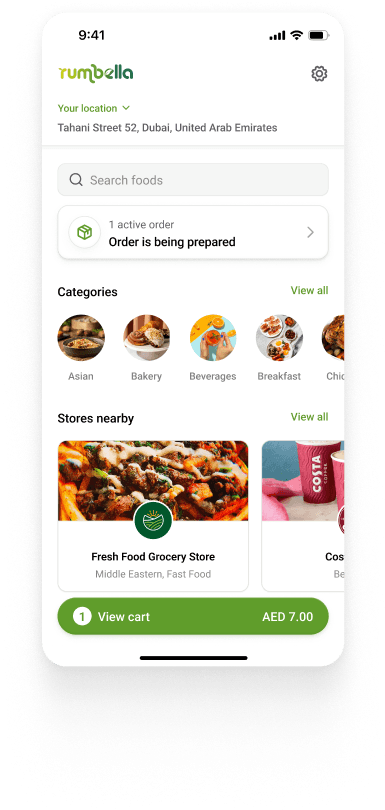

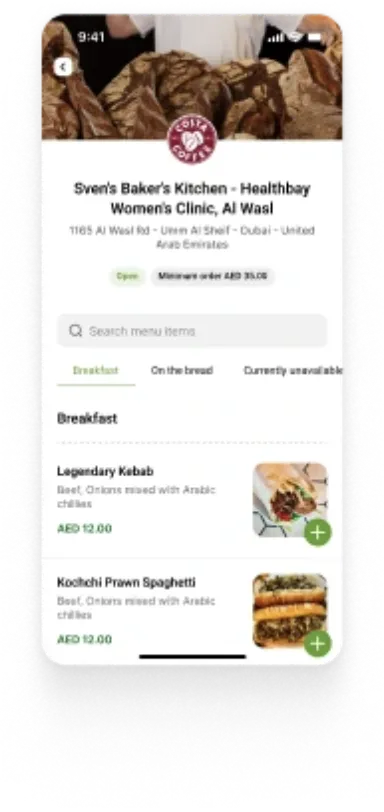

Crowdfunding

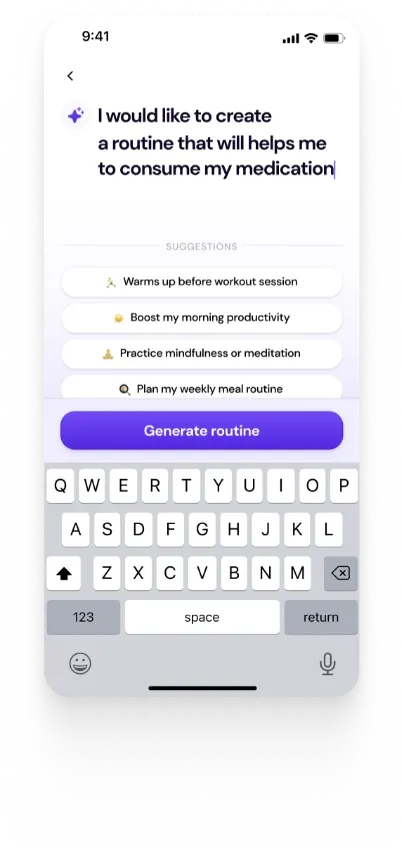

Crowdfunding democratizes startup investing by allowing a large number of individuals to contribute small amounts of capital, usually through online platforms.

Equity Crowdfunding

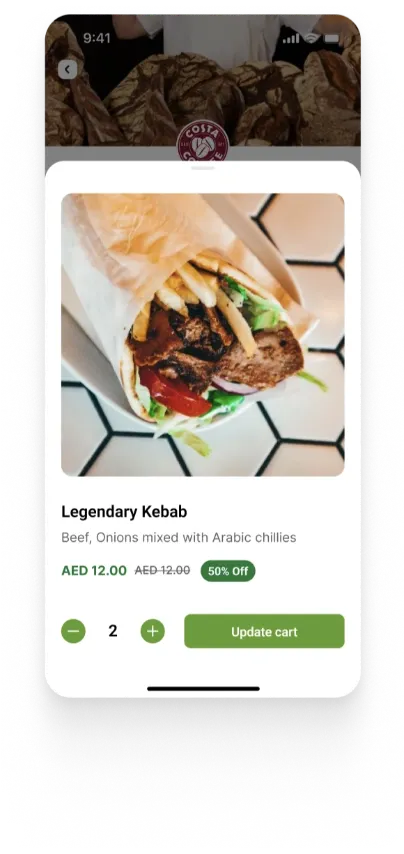

Startups raise capital from many investors, typically through online platforms. This method democratizes access to startup investing, allowing non-accredited investors to participate in equity investments. Popular platforms include SeedInvest and Crowdcube, which provide a marketplace for startups to connect with potential investors. Equity crowdfunding raised over $5 billion in 2023, according to Crowdfunding Insider.

This growth highlights the increasing popularity of crowdfunding as a viable funding option for startups. BrewDog, a craft brewery, successfully raised over $20 million through multiple equity crowdfunding campaigns, expanding its operations significantly as a result. This example demonstrates how equity crowdfunding can provide substantial funding for growth.

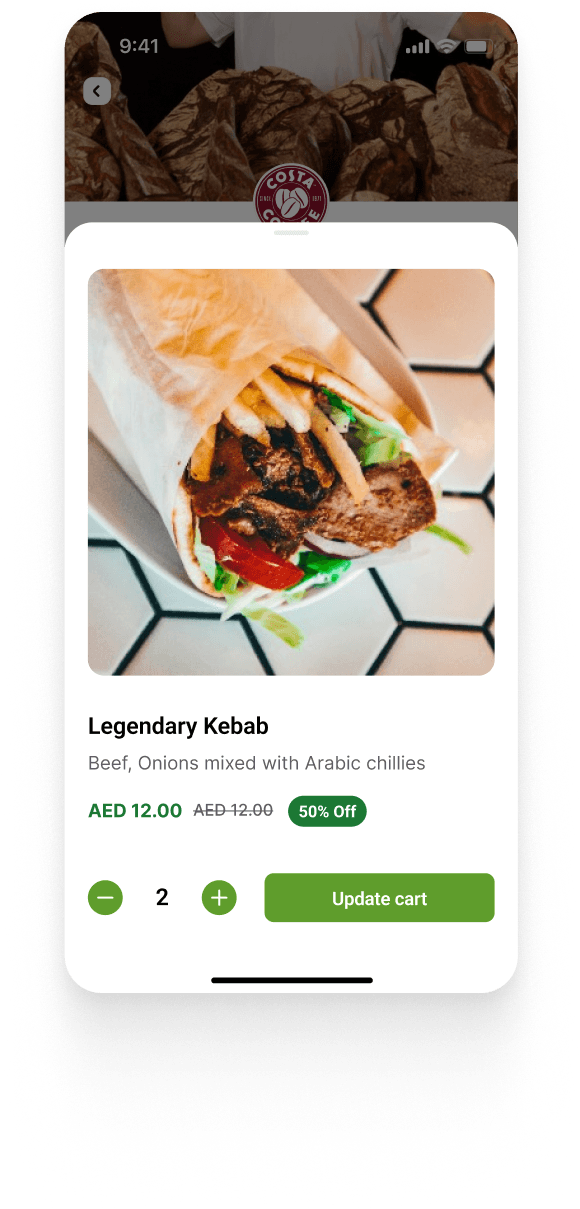

Reward-Based Crowdfunding

Backers contribute money in exchange for rewards, usually the product or service offered by the startup. This type of crowdfunding is often used for product launches and creative projects. Kickstarter campaigns, such as the Pebble Watch and Oculus Rift, have raised over $5 billion since the platform's inception.

These successful campaigns highlight the potential of reward-based crowdfunding to generate significant capital for innovative products. In 2023 alone, Kickstarter saw over 20,000 successful projects, raising more than $700 million. This figure underscores the ongoing popularity and effectiveness of reward-based crowdfunding in supporting creative and entrepreneurial endeavors.

Initial Coin Offerings (ICOs)

ICOs involve startups issuing digital tokens in exchange for cryptocurrencies. These tokens may represent a stake in the company or utility within the startup's ecosystem.

Cryptocurrency Investment

Startups raise funds by issuing digital tokens, which investors purchase using cryptocurrencies such as Bitcoin or Ethereum. ICOs are popular among blockchain and cryptocurrency startups as they provide a decentralized and efficient way to raise capital. ICOs raised $20 billion globally in 2023, according to CoinDesk.

This substantial fundraising activity underscores the importance of ICOs in the blockchain and cryptocurrency sectors. Notable projects that have raised funds through ICOs include Ethereum, which raised $18 million in 2014, and EOS, which raised $4 billion in 2018. These successful ICOs have significantly impacted the blockchain industry, driving innovation and development.

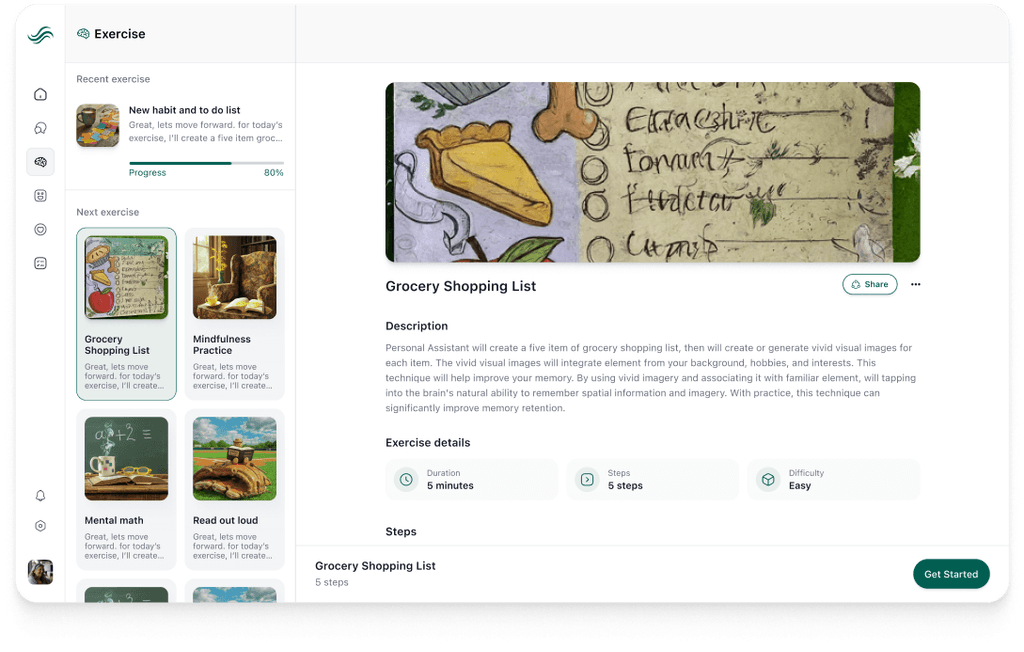

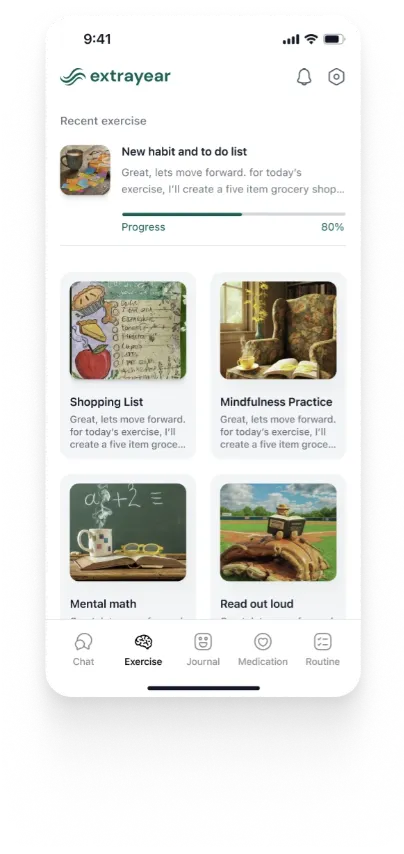

Tools to Assist Investors

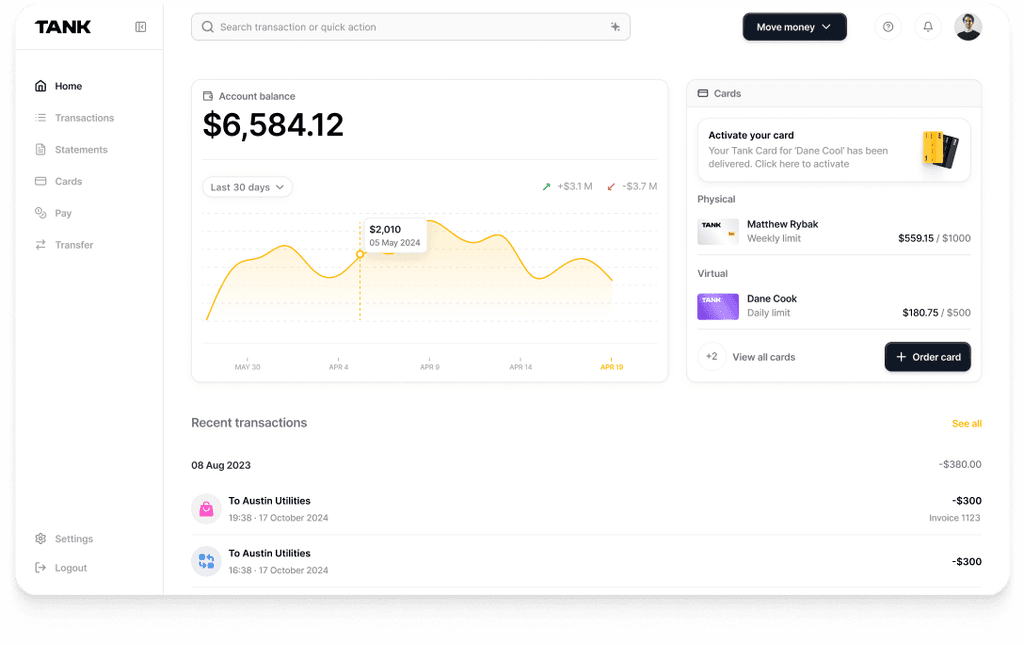

Due Diligence Platforms

Due diligence platforms provide comprehensive data on startups, allowing investors to assess viability and potential.

Crunchbase: Crunchbase provides comprehensive data on startups, including funding rounds, acquisitions, and key personnel. It is a vital tool for investors to assess the viability and potential of startups. Investors use Crunchbase to track the progress of startups, understand their funding history, and identify key personnel and stakeholders. This data helps investors make informed decisions about potential investments.

PitchBook: PitchBook offers detailed financial information, funding histories, and market analysis. PitchBook is known for its robust data and analytical tools. Used by venture capitalists and private equity firms to perform deep-dive analyses of market trends and individual company performance. This information is critical for identifying high-potential investment opportunities and understanding market dynamics.

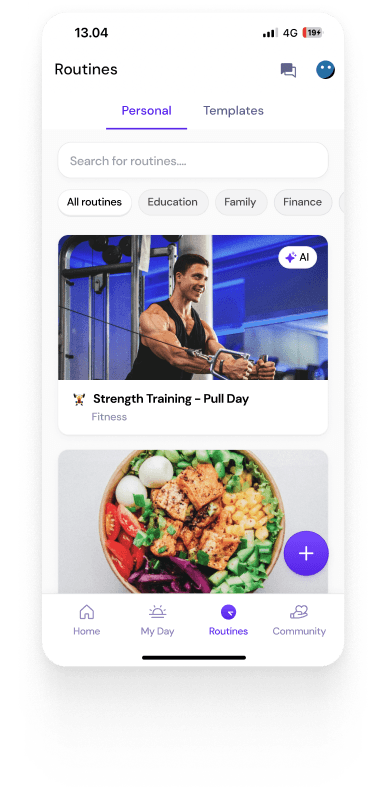

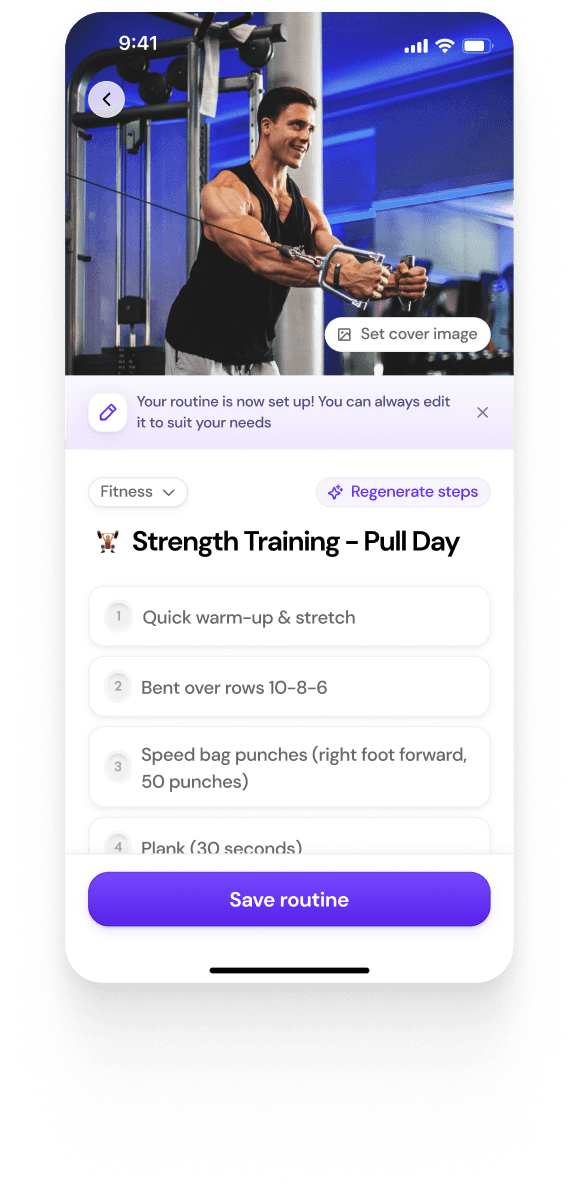

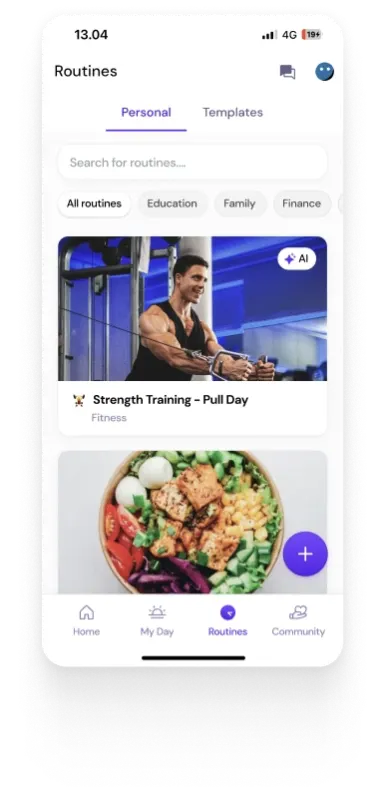

Investment Platforms

Investment platforms connect investors with vetted startups, facilitating the investment process.

AngelList: AngelList connects investors with a curated list of vetted startups. It also allows for syndicate investments, where investors can co-invest with experienced lead investors. Investors use AngelList to find promising startups and join syndicates led by reputable lead investors, leveraging their expertise. This platform simplifies the investment process and provides access to high-quality investment opportunities.

SeedInvest: SeedInvest is an equity crowdfunding platform that allows investors to invest in vetted startups. SeedInvest conducts thorough due diligence on startups before listing them. Investors can browse vetted investment opportunities and participate in equity crowdfunding campaigns, diversifying their portfolios with high-potential startups. This platform ensures that investors have access to reliable and well-researched investment options.

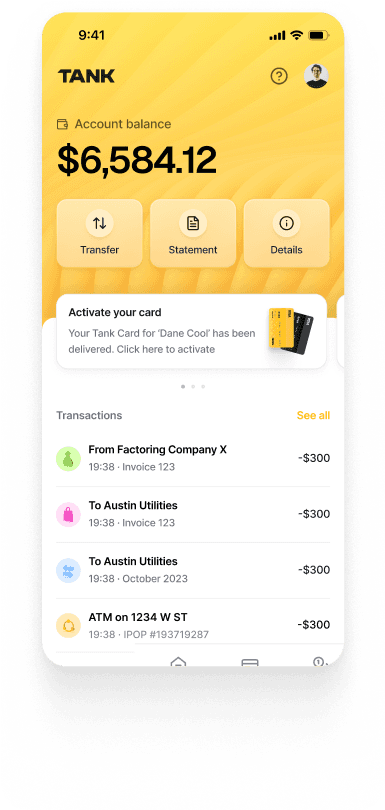

Financial Analysis Tools

Financial analysis tools help manage equity, track cap tables, and provide valuation services.

Carta: Carta helps manage equity, track cap tables, and provides valuation services. It's essential for maintaining accurate records of ownership stakes and valuations. Startups and investors use Carta to manage equity distribution, track ownership changes, and ensure compliance with valuation regulations. This tool simplifies the administrative aspects of equity management and ensures accurate record-keeping.

Gust: Gust offers tools for managing the investment process, from deal flow management to portfolio tracking. It's designed to streamline the administrative and operational aspects of investing. Investors use Gust to manage their portfolios, track investments, and facilitate communication with startups and co-investors. This tool helps in organizing and maintaining detailed records of all investment activities, ensuring transparency and efficiency.

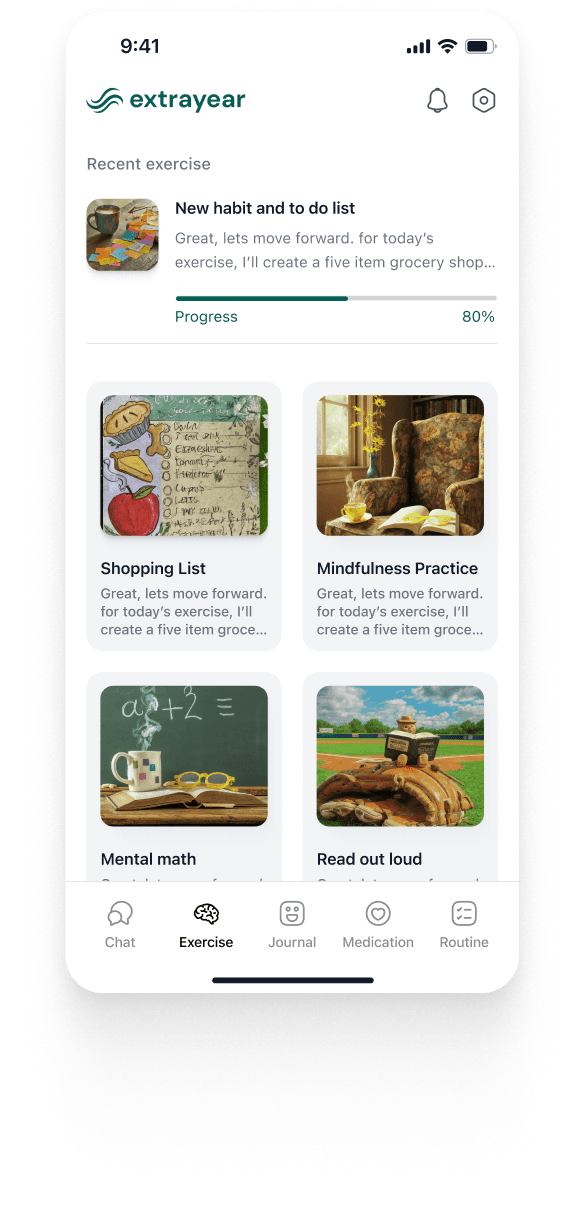

Market Research Tools

Market research tools provide insights and analytics on private companies and emerging trends, which are critical for making informed investment decisions.

CB Insights: CB Insights provides market intelligence and analytics on private companies and emerging trends. It offers comprehensive data-driven insights that help investors identify high-potential opportunities. Investors use CB Insights to identify emerging trends, track competitors, and find promising investment opportunities. The platform's robust analytics and reports help in making strategic investment decisions.

Mattermark: Mattermark offers data-driven insights into startup growth and potential investment opportunities. It aggregates data on funding, personnel, and market traction to provide a holistic view of a startup's growth prospects. Investors use Mattermark to assess the growth potential of startups, analyze market conditions, and identify high-value investment opportunities. The platform's detailed metrics help in evaluating a startup's performance and future potential.

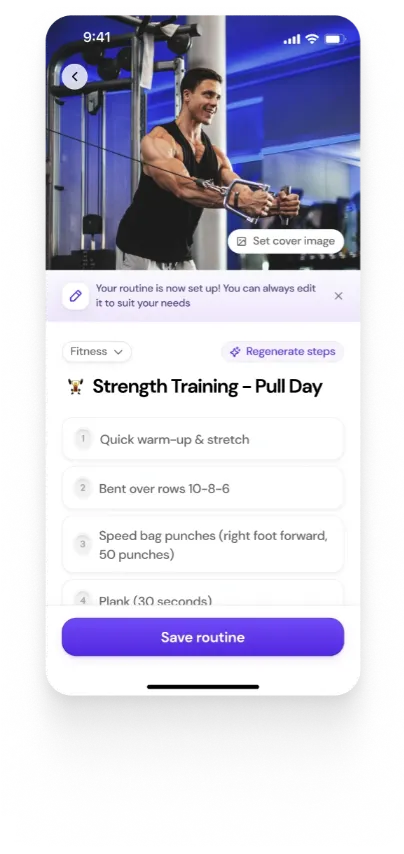

Case Study: Venture Capital Investment in AI Startups

In recent years, AI startups have seen a surge in venture capital investments, reflecting the growing interest in artificial intelligence and its applications.

Investment Statistics

Funding Amounts: AI startups received over $50 billion in venture capital funding in 2023 alone.

Number of Deals: There were 1,200 AI-related deals in the same year.

Top Investors: Leading venture capital firms such as Sequoia Capital, Andreessen Horowitz, and Accel were major contributors.

Key AI Startups

OpenAI: Received $1 billion in funding for advancements in AI research and development.

UiPath: Secured $750 million to expand its robotic process automation (RPA) capabilities.

Nuro: Raised $600 million for autonomous delivery vehicle technology.

Impact on Market

Innovation Acceleration: The influx of capital has accelerated AI innovation, leading to significant advancements in machine learning, natural language processing, and computer vision.

Market Growth: The AI market is projected to grow at a compound annual growth rate (CAGR) of 35% over the next five years. This rapid growth is driven by increasing adoption of AI technologies across various industries, including healthcare, finance, and transportation.

Conclusion

Investing in startups offers significant growth potential and the chance to support innovative ventures. By understanding the different investment methods and utilizing specialized tools, investors can make strategic decisions, optimize their portfolios, and contribute to the entrepreneurial ecosystem. This approach not only enhances financial returns but also fosters a culture of innovation and progress.