Mastering the VC Pitch: Balancing Emotion, Clarity, and Strategy for Investor Success

Summary

A successful VC pitch balances emotion, clarity, and strategy to captivate investors. Khosla Ventures emphasizes storytelling, simplicity, and transparency as key factors. Founders must craft a compelling narrative, address investor objections, present realistic financials, and highlight their team’s execution capability. By structuring the pitch effectively, entrepreneurs can maximize their chances of securing funding.

Key insights:

Emotional Storytelling Matters: Investors connect more with pain-driven narratives than raw data alone.

Clarity is Key: Simplify complex ideas and use engaging, easy-to-follow messaging.

Address Risks Proactively: Acknowledging weaknesses and providing solutions builds investor trust.

Strong Financial Transparency: Realistic, bottom-up projections and milestone-based funding needs strengthen credibility.

Investor Engagement Wins: Anticipating questions, refining presentations, and iterating on feedback enhances pitch effectiveness.

Introduction

Understanding the way venture capitalists (VCs) evaluate pitches is fundamental for entrepreneurs seeking to secure funding. Khosla Ventures provides an insightful look into the dynamics of investor decision-making, emphasizing the importance of balancing emotional appeal with clear, concise, and transparent rationality. Founders who understand these nuances can significantly improve their chances of successfully connecting with investors.

Pitching with Emotion

Investors often make decisions driven by emotional resonance rather than purely rational arguments. Entrepreneurs should therefore prioritize crafting a compelling narrative that resonates emotionally while remaining authentic and transparent.

1. Emotion Over Facts

The power of emotional storytelling cannot be overstated when pitching to VCs. Investors are frequently motivated by their emotional responses, including excitement, greed, and fear, more than the hard facts alone.

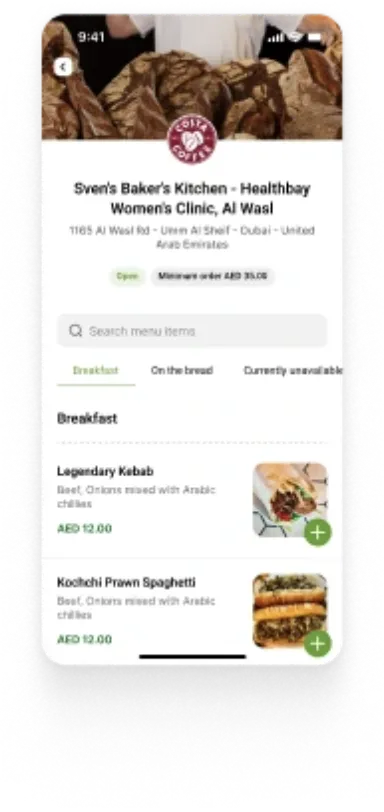

Compelling Pain Points: Clearly articulate a profound problem your product addresses, emphasizing its emotional appeal and relevance to customers. A solution addressing significant pain, rather than mere enhancements, attracts greater investor interest.

2. Simplicity and Clarity

Investors become wary when faced with overly complex presentations. Simplifying the narrative and using clear, accessible language helps keep investors engaged, confident, and interested.

Simplify Complexity: Employ the KISS (Keep It Simple, Stupid) principle, avoiding technical jargon and overly complex language to clearly communicate your product, problem, and market potential effectively.

Crafting the Investor Narrative

The story of your pitch should focus squarely on the problems your startup aims to solve and how it uniquely addresses these issues. Investors must understand why your solution matters and why your company is uniquely positioned.

1. The Importance of a Clear Problem Statement

Clearly articulating the problem you are solving is critical. Investors must immediately understand why your solution matters and why it is essential right now.

Specific Pain Points: Rather than presenting a generic issue, specify the tangible pain experienced by your target market. Emphasize a compelling narrative about the urgency and importance of your solution.

2. Slide Headlines as Emotional Messages

Slide headlines should be crafted as impactful, emotion-driven statements rather than simple topic labels. Each slide should advance your story with clarity and emotional impact.

Engaging Headlines: Use emotive and vivid language in your slide headlines to consistently reinforce your core narrative and maintain investor attention.

Crafting the Investor Narrative

Entrepreneurs need to create a balance between emotional appeal and logical reasoning, clearly presenting reasons to invest while proactively addressing potential objections.

1. Key Reasons to Invest

Identify and clearly communicate the primary reasons investors should be excited about your venture. Highlight competitive advantages and demonstrate your unique capabilities convincingly.

Highlight Key Advantages: Detail tangible advantages, such as superior economics, technological breakthroughs, and strong competitive positioning to excite investor interest.

2. Reasons Not to Invest and Risk Mitigation

Acknowledging potential investor objections or reasons they might hesitate is equally critical. This transparency builds trust and demonstrates your preparedness.

Directly Address Risks: Clearly outline potential risks and provide thoughtful, detailed contingency plans, underscoring your team's proactive stance and ability to manage uncertainty.

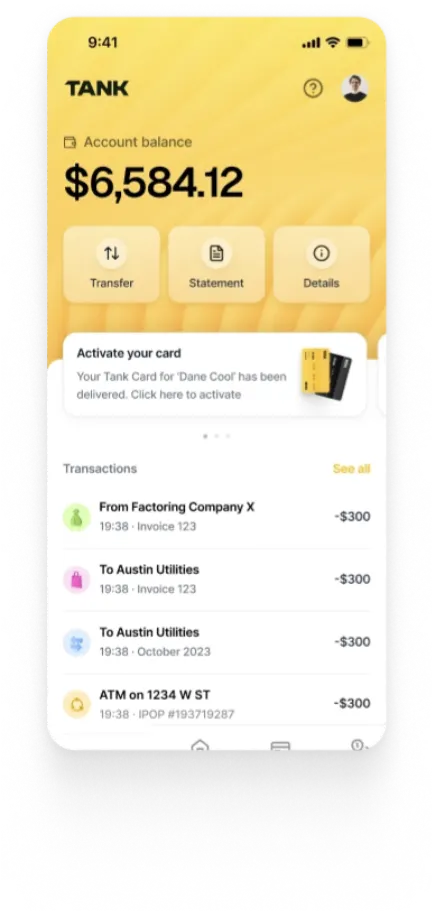

Communicating Financials and Metrics

Presenting financial data clearly, consistently, and credibly is essential. Investors scrutinize financial details and metrics closely to gauge reliability and the entrepreneur’s business acumen.

1. Consistency and Credibility

Financial details should consistently match throughout your pitch. Present accurate and believable projections to strengthen investor confidence.

Matching Numbers: Ensure all financial metrics and data are consistent across slides to avoid raising concerns over your credibility or accuracy.

2. Bottom-Up Financial Projections

VCs value detailed, data-driven financial plans grounded in realistic assumptions over inflated market speculations.

Data-Driven Forecasts: Provide clear and realistic financial projections derived from solid, bottom-up market analysis, demonstrating thoroughness and realistic expectations.

Team and Execution Strategy

The capabilities and uniqueness of your team are key deciding factors for VCs. Demonstrating the relevance and effectiveness of your team for executing your business plan is essential.

1. Demonstrating Team Strength

Highlight specific team strengths and prior experiences that uniquely position them to solve the stated problem effectively.

Gene Pool Advantage: Clearly articulate how your team’s background, experience, and skill set align specifically with the requirements of your business venture.

2. Execution and Strategy

Your execution strategy must clearly demonstrate how you will achieve critical business milestones and overcome challenges efficiently and realistically.

Actionable Strategy: Present a clear, step-by-step strategy detailing how your team will navigate the business plan from inception to market penetration and growth.

Communicating Financials and Metrics

Financial details and metrics must be strategically presented to emphasize the viability and profitability of your startup.

1. Simplicity and Readability in Financials

Keep your financial presentations concise and straightforward, facilitating easier comprehension and a clearer assessment from investors.

Concise Presentation: Limit financial slides to a maximum of seven rows of data, providing quarterly and yearly breakdowns to support investor decision-making without overwhelming them.

2. Realistic Financial Planning

Provide realistic financial plans, clearly explaining the assumptions and demonstrating deep knowledge and control of your financial landscape.

Realistic Milestones: Clearly tie the financial ask to specific milestones that will de-risk the investment, making your ask reasonable and strategically grounded.

Preparation and Delivery

Preparation involves more than just crafting slides; it also means anticipating questions, objections, and the dynamics of the investor meeting.

1. Cohesive Storytelling

Create a clear narrative flow throughout your pitch to maintain investor interest and reinforce key messages consistently.

Narrative Consistency: Structure your pitch to unfold logically, clearly, and compellingly, emphasizing narrative coherence and message reinforcement throughout your presentation.

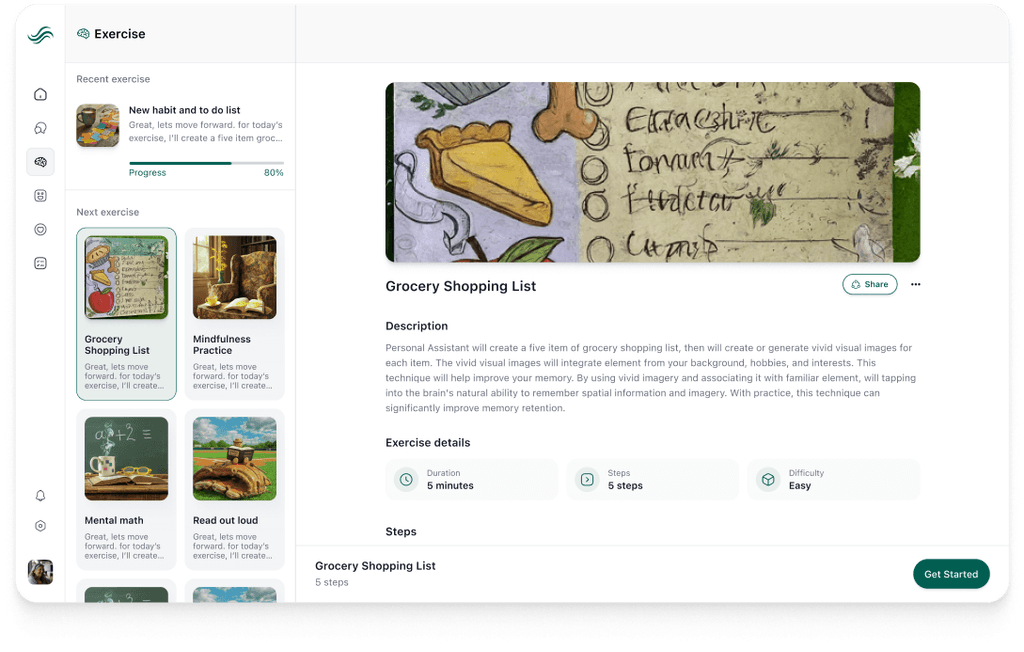

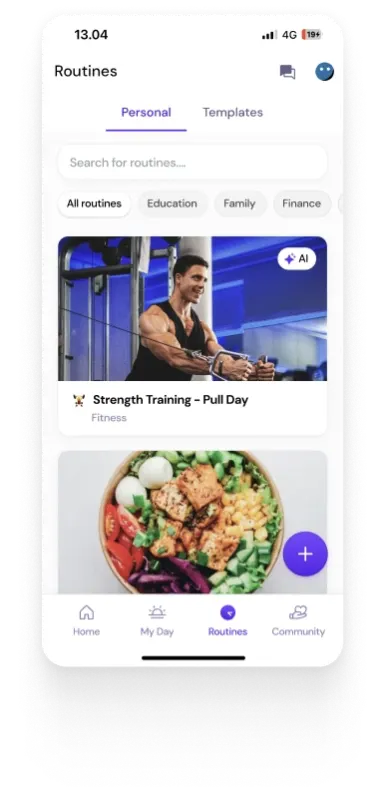

2. Visual Clarity and Presentation Style

Visual design and style are crucial for making your message easily digestible and impactful.

Minimalism and Impact: Utilize simple, uncluttered visuals and minimal text to draw investor attention directly to your key points, enhancing their retention and understanding of the pitch.

3. Proactive Investor Engagement

Engaging proactively with investors by anticipating questions and concerns can drastically enhance credibility and persuasiveness.

Preparedness for Questions: Develop comprehensive Q&A appendices to quickly address investor queries, demonstrating thoughtfulness and readiness.

4. Effective Pitch Testing and Iteration

Testing your pitch with secondary investors or advisors allows you to refine your presentation and optimize it for your target investors.

Refine and Iterate: Use feedback from test pitches to continuously refine your approach, enhancing clarity, focus, and emotional impact.

Conclusion

In conclusion, by deeply understanding how VCs think and evaluate investment opportunities, entrepreneurs can craft pitches that resonate both emotionally and rationally. Through strategic simplification, clear narrative construction, and thorough preparation, founders will significantly enhance their potential to secure venture funding.

Authors

References

Khosla Ventures. Pitch the Way VCs Think.