7 Best Money Management Apps for College Students

Summary

Managing finances as a college student can be challenging. This article reviews seven financial management apps that are perfect for students: Mint, PocketGuard, Acorns, Chime, Honeydue, Goodbudget, and YNAB. These apps offer features like budget tracking, expense management, saving tools, and investment options to help students stay on top of their finances and save money efficiently.

Key insights:

Mint: Connects all financial accounts, tracks expenses, and offers budgeting tools and free credit score monitoring.

PocketGuard: Provides a daily spending limit, automated budget tracking, and savings suggestions.

Acorns: Invests spare change from purchases, offers cash back from partner companies, and provides diversified portfolios.

Chime: Offers fee-free checking, high-interest savings, and early direct deposit.

Honeydue: Helps couples manage shared expenses, create budgets, and communicate about finances.

Goodbudget: Uses the envelope system for budgeting, offers syncing across devices, and provides reports and charts.

YNAB: Helps create budgets, track expenses, and set financial goals with real-time tracking and personalized support.

Introduction

As a college student, managing your finances can be a challenge. Between tuition, textbooks, and other expenses, it can be tough to stay on top of your budget and save money.

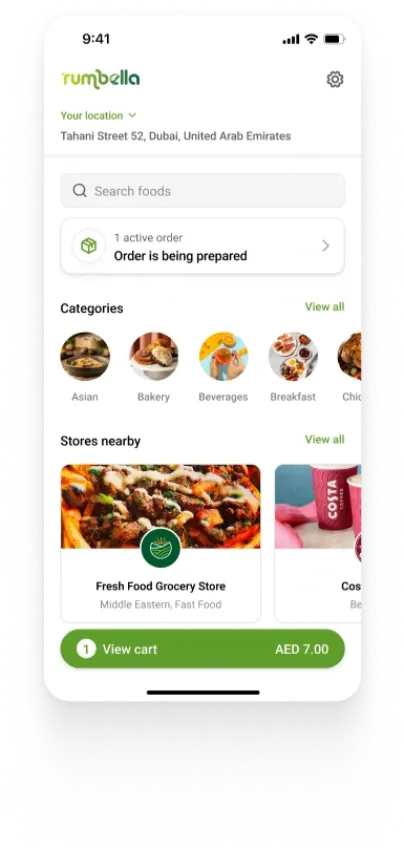

Fortunately, there are many financial management apps available that can help you track your expenses, create budgets, and find ways to save money. In this blog post, we'll take a look at 7 financial management apps that are perfect for college students.

Mint

Mint is a highly popular financial management app that was founded in 2006 and is based in the United States. It is owned by Intuit, which is a well-known financial software company that also owns QuickBooks and TurboTax. Mint has a simple and user-friendly interface that makes it easy for college students to manage their finances.

It allows you to connect all your financial accounts such as bank accounts, credit cards, loans, investments, and even your PayPal account, giving you an overall view of your financial status in one place. This feature makes it an excellent choice for college students who have multiple accounts to manage.

Mint's budgeting tools help college students to create budgets and track their spending in real-time. You can set up categories for different expenses such as rent, utilities, groceries, transportation, entertainment, and more. The app automatically categorizes transactions, and you can manually adjust categories if needed.

Mint also provides customized alerts and reminders to help you stay on track with your budget. For example, if you're nearing your budget limit in a particular category, the app will notify you, allowing you to make adjustments.

One of the unique features of Mint is that it provides free credit score tracking. It allows you to monitor your credit score and get regular updates on any changes, as well as personalized advice on how to improve it. This feature is particularly useful for college students who are just starting to build their credit history.

Mint is also equipped with excellent tools for tracking and analyzing your expenses. The app provides insights on where you are spending your money, helping you to identify areas where you can cut back and save. You can see your spending trends over time and get alerts for unusual or suspicious transactions, which can be helpful for detecting fraud.

PocketGuard

PocketGuard is a free mobile app that is designed to help college students track their finances and save money. It was founded in 2014 and is based in the United States. The app is available on both iOS and Android platforms, and it is known for its simple and easy-to-use interface.

One of the unique features of PocketGuard is its "In My Pocket" feature, which provides you with a daily spending limit based on your income, expenses, and financial goals. This feature helps you to keep track of your spending and avoid overspending, allowing you to stay within your budget.

PocketGuard also offers an automated budget tracking feature that allows you to connect all your financial accounts, including bank accounts, credit cards, loans, and investments. The app tracks your spending automatically and categorizes your expenses, giving you a clear picture of your spending habits. This feature is particularly helpful for college students who are looking to manage their finances efficiently.

Another unique feature of PocketGuard is the "Find Savings" tool, which analyzes your spending patterns and provides you with suggestions on how to save money. The app looks for ways to reduce your bills, find better deals on subscriptions, and suggests ways to cut back on unnecessary expenses. This feature can be incredibly beneficial for college students who are on a tight budget.

Acorns

Based, in the United States, Acorns is a financial management app that was founded in 2012. Acorns is available across both iOS and Android devices and offers a unique way to save money and invest in the stock market.

One of the standout features of Acorns is its round-up feature, which allows you to invest your spare change from everyday purchases. The app rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of stocks and bonds. This feature is particularly helpful for college students who want to save money but may not have a lot of extra income to invest.

Another unique feature of Acorns is its Found Money program, which allows you to earn cash back from purchases made with partner companies. When you make a purchase with a partner company, a percentage of the purchase is invested in your Acorns account. This feature can help you save money while still being able to make everyday purchases.

Acorns also offers a variety of portfolio options, including conservative, moderate, and aggressive portfolios. This allows you to choose a portfolio that aligns with your financial goals and risk tolerance.

One of the benefits of using Acorns is its simplicity. The app is easy to use and offers a hands-off approach to investing. With the round-up feature and recurring investments, you can start saving and investing with minimal effort.

Chime

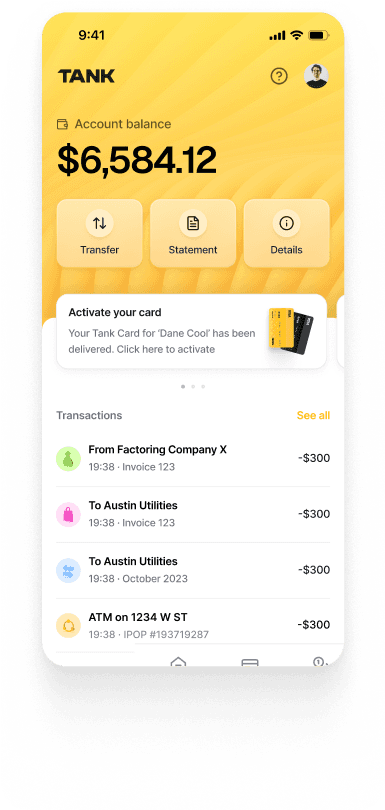

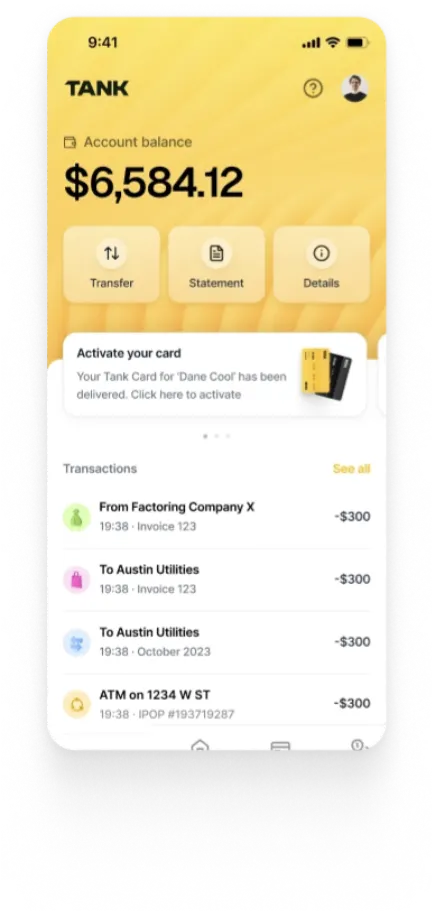

Chime is a mobile banking app that was founded in 2013 and is based in the United States. It is an online-only bank that offers a range of financial services that can be particularly useful for college students who are looking to manage their finances on the go.

One of the standout features of Chime is its fee-free checking account. This account allows you to manage your money without having to worry about monthly maintenance fees or minimum balance requirements. This feature is particularly helpful for college students who may not have a lot of money to spare.

Another unique feature of Chime is its savings account. The savings account offers an interest rate that is higher than the national average, which means that you can earn more money on your savings over time. This feature can be particularly helpful for college students who are looking to save money for big purchases or emergencies.

Chime also offers early direct deposit, which means that you can access your money up to two days early. This feature can be particularly helpful for college students who need to pay bills or make purchases quickly.

One of the benefits of using Chime is its mobile app, which is available on both iOS and Android platforms. The app is easy to use and allows you to manage your accounts, deposit checks, and transfer money on the go. The app also offers real-time notifications, which can be helpful for staying on top of your finances.

Honeydue

Are you a college student who is living with a partner and trying to manage your finances together? Look no further than Honeydue, the perfect financial management app for couples. Honeydue allows you and your partner to link your bank accounts and credit cards, track your spending together, and communicate about shared expenses all in one place.

One unique feature of Honeydue is the ability to create a shared budget that both partners can contribute to. This can be incredibly helpful for college students who are trying to manage their expenses while also sharing living costs with a partner. The app also allows you to set reminders for upcoming bills, which can help you avoid missed payments and late fees.

In addition to budgeting and expense tracking, Honeydue also offers a messaging feature that allows you to communicate with your partner about your finances. This can be incredibly helpful for avoiding misunderstandings and conflicts about money. The app also offers helpful visualizations of your spending habits, so you can easily see where your money is going each month.

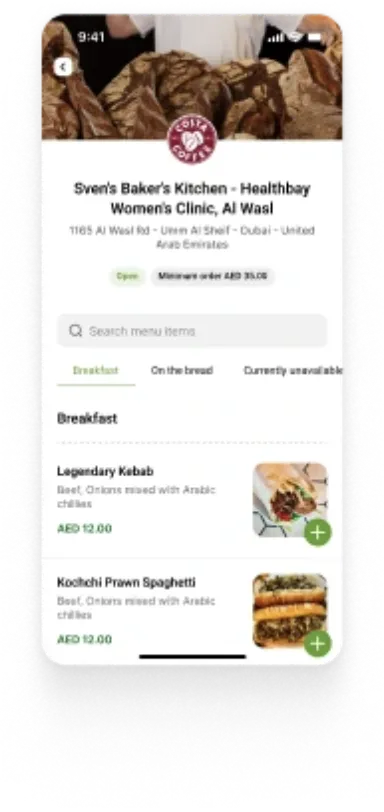

Goodbudget

If you're looking for a budgeting app that offers more than just basic tracking features, Goodbudget is a great choice. The app allows you to create customized budgets for each category of spending, so you can easily see where your money is going each month. You can even set up recurring expenses and income, so you don't have to manually enter them every time.

Goodbudget also uses the envelope system, which is a unique way of managing your money. You allocate a certain amount of money to each envelope, which represents a different category of spending, such as groceries or entertainment. As you spend money, you deduct it from the appropriate envelope. When an envelope is empty, you know you've reached your limit for that category, and you can't spend any more until the next month. This system can be incredibly helpful for keeping your spending in check and avoiding overspending.

In addition to these features, Goodbudget offers syncing across multiple devices, so you can access your budget from anywhere. The app also offers reports and charts, which can be helpful for visualizing your spending patterns and identifying areas where you can cut back. And if you need a little extra help, Goodbudget offers a range of helpful resources, such as budgeting tips and personal finance advice.

YNAB (You Need A Budget)

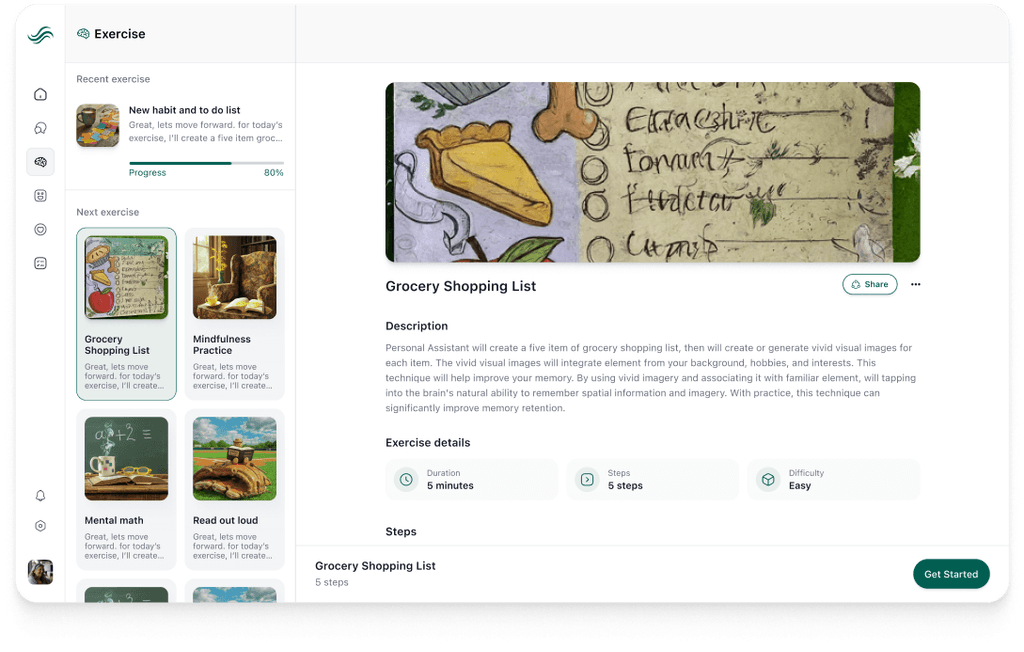

YNAB is a comprehensive financial management app that is ideal for college students who want to take control of their finances. The app is designed to help you create a budget, track your expenses, and save money. YNAB's unique approach is based on four core principles: giving every dollar a job, embracing your true expenses, rolling with the punches, and aging your money.

With YNAB, you can create a budget for all of your expenses, including bills, groceries, and entertainment. The app allows you to track your spending in real-time and provides you with insights into your spending habits. YNAB also offers a feature called "Goal Tracking," which allows you to set financial goals and track your progress towards them. Whether you're saving up for a new laptop or trying to pay off your student loans, YNAB can help you stay on track.

One of the best things about YNAB is its ease of use. The app is available on both iOS and Android, and it offers a variety of helpful features, such as automatic transaction importing, bank syncing, and debt management tools. The app also provides personalized support to help you get started and stay on track. Whether you're new to budgeting or a seasoned pro, YNAB is a really useful app that can help you take control of your finances and achieve your financial goals.