Venture Deals: A Book Review

Summary

'Venture Deals' by Brad Feld and Jason Mendelson is a comprehensive guide to venture capital, focusing on term sheets, negotiation strategies, funding stages, and investor relationships. It empowers entrepreneurs with practical insights, from understanding key terms like valuation and equity dilution to fostering strong post-investment dynamics.

Key insights:

Term Sheets Explained: Key terms like valuation, liquidation preferences, and equity dilution are broken down for entrepreneurs to make informed decisions.

Negotiation is Key: Successful outcomes require understanding VC motivations, preparing strategically, and using checklists to guide discussions.

Stages of Fundraising: Tailor investor approaches to each stage—angel investments, Series A, and beyond—with clear milestones and timing.

Post-Investment Dynamics: Transparent communication and trust with investors are critical for effective board management and exit strategy planning.

Building VC Relationships: Networking with venture capitalists early establishes trust and provides insight into their investment criteria and processes.

Strategic Fundraising Roadmap: Develop a timeline targeting the right investors at the appropriate business stages for smoother capital acquisition.

Focus on Control: Understanding financial agreements ensures founders avoid deals that undermine their long-term control or ownership.

Book Overview

Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist by Brad Feld and Jason Mendelson is a guide on navigating the complex world of venture capital. Published in 2011 by Wiley, with the following updated editions, this book falls into the entrepreneurship and business finance category. The primary objective of this book is to demystify the venture capital process and empower entrepreneurs, startup founders, and investors with the knowledge to negotiate effectively and understand the technical aspects of term sheets, funding processes, and VC dynamics. Feld and Mendelson, both experienced venture capitalists, provide readers with a comprehensive toolkit to make informed decisions, emphasizing clear communication and strategic preparation throughout the fundraising journey.

Key Learnings and Concepts

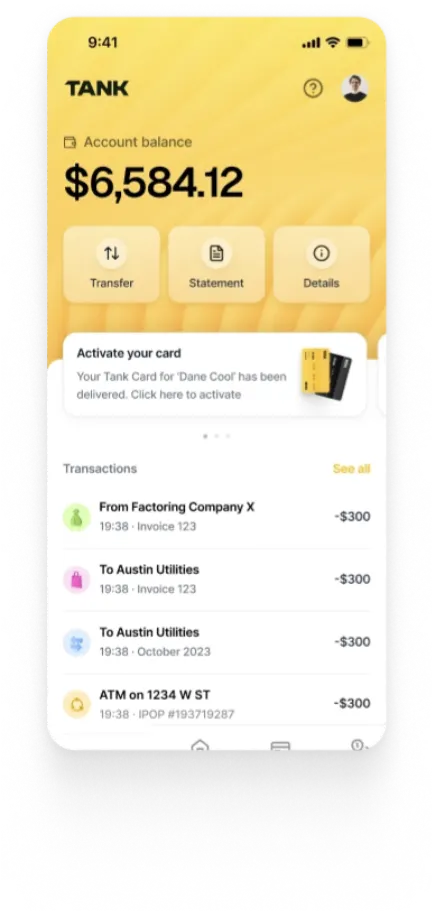

Term Sheet: This serves as the foundational document that outlines investment terms. A clear understanding of key terms like valuation, liquidation preferences, and equity dilution helps entrepreneurs comprehend the implications of financial agreements on their control and ownership of the business. Feld and Mendelson break down these complex financial terms into simple, understandable language. For example, they explain liquidation preferences by illustrating how these terms impact fund distribution in scenarios like acquisitions or liquidation, providing entrepreneurs with clarity on their value.

Role of Negotiation: The authors highlight the role of negotiation, stressing that founders must understand venture capitalists' motivations, communicate effectively, and prepare carefully to secure favorable terms. Negotiation is presented as a skill that founders must learn to align the deal with their business objectives. Building on their experience, the authors share practical examples of successful and unsuccessful negotiations, showing how preparation and understanding investor priorities can influence outcomes. They also provide negotiation checklists to help readers approach discussions strategically.

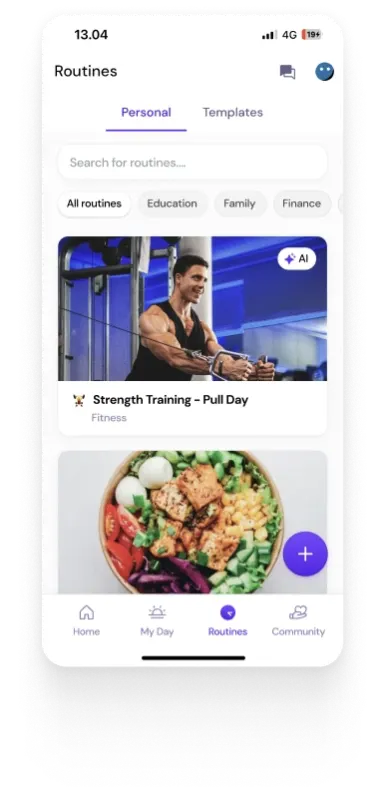

Funding Stages: The book outlines the stages of fundraising, from early angel investments to later Series A and beyond, providing insights into how entrepreneurs can target the right investors at each stage of the cycle. By documenting each funding stage, the authors help readers understand when and how to approach specific types of investors. They also have real-world examples that show how startups navigated these stages successfully, which also emphasizes timing and strategy.

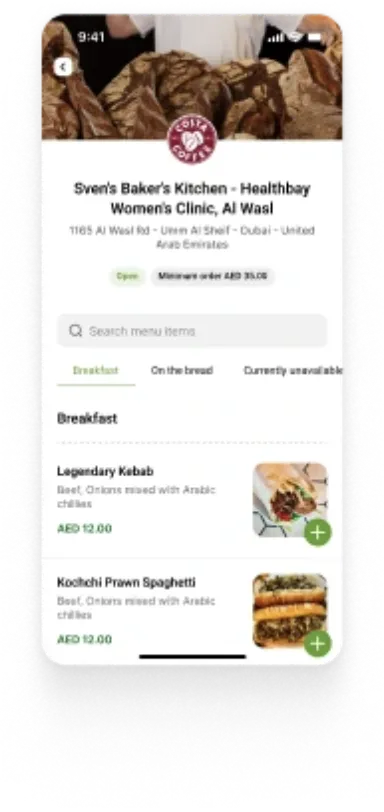

Post-Investment Relationships: Venture Deals also discusses the importance of post-investment relationships. It advises entrepreneurs on managing board dynamics, addressing challenges, and planning exit strategies like acquisitions or IPOs. The authors emphasize the value of transparency and clear communication with investors to help build trust. Examples of successful board management and strategic exits display the importance of collaboration and foresight in these areas.

Practical Applications

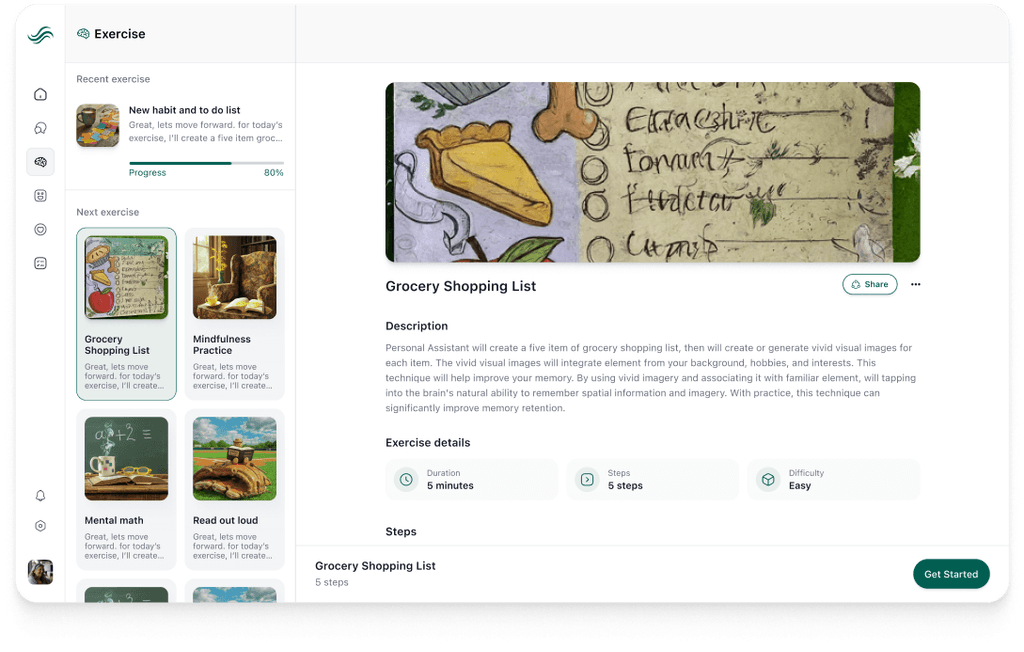

Understanding the Term Sheet: One of the key practical takeaways from Venture Deals is the importance of understanding the term sheet before entering any negotiations with investors. Entrepreneurs should take the time to familiarize themselves with the key terms commonly found in term sheets, such as valuation, liquidation preferences, and equity dilution. Each of these terms has very important implications for the long-term control and ownership of the business. For example, understanding valuation will help founders measure their company’s worth and avoid undervaluing their business. Similarly, knowing how liquidation preferences work means that entrepreneurs are aware of how funds will be distributed if the company is sold or liquidated, possibly affecting their returns. Equity dilution, another key term, refers to the reduction of ownership percentage that occurs when new shares are issued during funding rounds. By mastering these terms, entrepreneurs can avoid accepting deals that may have harsh consequences, such as giving away too much equity or agreeing to unfavorable terms. This knowledge also allows them to spot any clauses that might undermine their control over the business, giving them the confidence to secure agreements that protect their interests.

Networking: Another actionable insight from Venture Deals is the advice to build relationships with venture capitalists (VCs) well before seeking funding. Entrepreneurs should not wait until they are in immediate need of capital to start networking. Instead, they should regularly engage with VCs by attending industry events, participating in startup conferences, and leveraging social media platforms like LinkedIn to connect with investors. Regular interaction helps founders build trust, which can be priceless when it’s time to raise money. Networking also allows entrepreneurs to understand what VCs are looking for, how they think about investment opportunities, and the types of businesses they typically fund. Additionally, having established relationships with investors beforehand may make the fundraising process smoother, as these VCs are already familiar with the entrepreneur's vision, values, and potential. Entrepreneurs should attend pitch events, startup incubators, and industry meetups to expand their network, and regularly update their connections with the progress of their businesses.

Strategic Approaches to Raising Money: The book also highlights the importance of having a strategic approach to raising money. It advises entrepreneurs to target different types of investors at the right stages of their business development. In the early stages, when a company is still fine-tuning its product or business model, founders should approach angel investors or seed-stage VCs who specialize in funding high-risk, early-stage startups. These investors are more willing to take risks on new ideas and will look for entrepreneurs with strong potential and the ability to pivot if necessary. As the business grows and demonstrates, the entrepreneur can shift their focus toward institutional venture capital firms that invest at later stages, such as Series A and beyond. These investors will look for more established companies with a clear path to profitability. By understanding the right time to approach each type of investor, entrepreneurs can tailor their pitch and fundraising strategy to match the requirements of these sources. This approach not only increases the chances of securing capital but also ensures that the entrepreneur receives the appropriate type of support and guidance at each stage of their business’s growth. Entrepreneurs should consider building a timeline or roadmap for their funding strategy, mapping out the types of investors they need to target at each stage of development and the milestones they need before approaching them.

Conclusion

The book Venture Deals by Brad Feld and Jason Mendelson offers valuable insights into the world of venture capital, providing entrepreneurs with the knowledge and tools needed to navigate the complexities of raising funds and negotiating with investors. The book’s breakdown of term sheets, negotiation strategies, and investor relationships makes it an essential resource for anyone looking to secure venture funding and manage post-investment relationships effectively. Overall, Venture Deals is a comprehensive guide that allows founders to understand venture capital and use that knowledge to build more successful businesses.

Authors

References

Feld, Brad, and Jason Mendelson. Venture Deals: Be Smarter than Your Lawyer and Venture Capitalist. Hoboken, New Jersey Wiley, 2019.

“Venture Deals – Be Smarter than Your Lawyer and Venture Capitalist.” Venture Deals, www.venturedeals.com/.