Top 20 GenAI Products for Finance

Summary

This article explores twenty innovative GenAI-powered products tailored for the finance industry, designed to enhance productivity and streamline workflows for finance professionals. Each tool offers unique capabilities to handle diverse finance-related tasks efficiently, emphasizing the transformative impact of GenAI across financial operations.

Key insights:

Specialization in Finance: Tools like BloombergGPT are trained on domain-specific data, providing tailored functionalities that enhance financial analysis and decision-making.

Enhanced Data Handling and Visualization: Platforms like Datarails integrate seamlessly with existing systems, offering real-time insights and data visualizations that improve financial planning and reporting.

Automation of Routine Tasks: Products such as Booke.ai and Stampli automate repetitive tasks like bookkeeping and invoice processing, significantly boosting efficiency.

Integration and Customization: Many GenAI tools offer extensive customization options and easy integration with existing financial systems, ensuring flexibility and scalability in their application.

Accessibility and User Support: With features ranging from no-code solutions to multilingual support, these GenAI products are accessible to a broad range of users, from tech-savvy developers to professionals with limited programming skills.

Introduction

Generative AI (GenAI) is rapidly transforming several industries across the globe by offering products with capabilities like chatbots, predictive analytics, and automated systems. In this article, we explore twenty useful GenAI-powered products for the finance industry that can help finance professionals save time and improve their workflow.

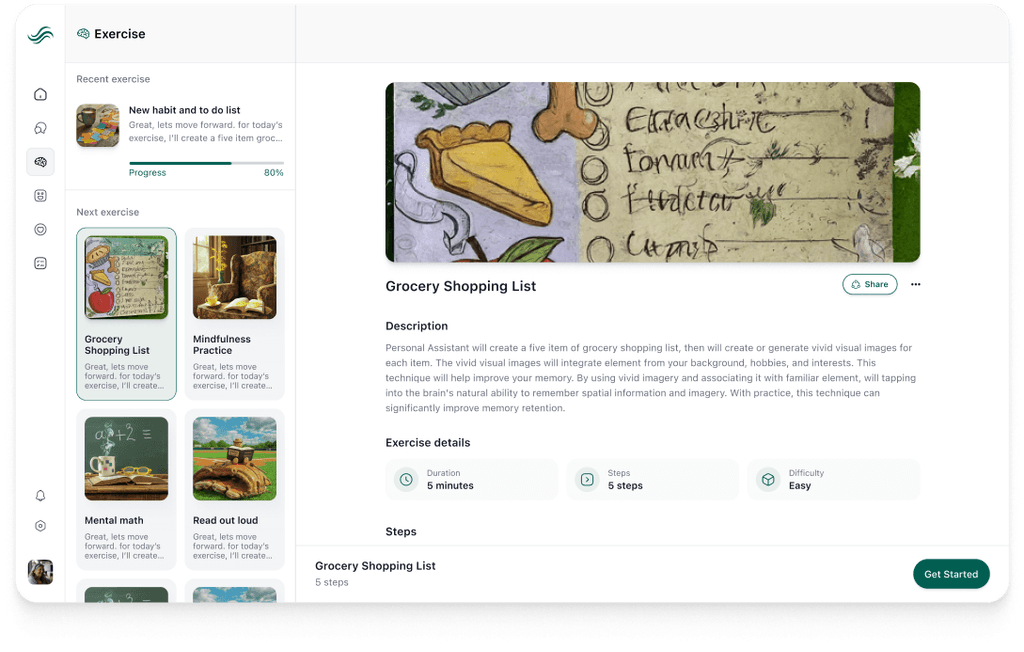

BloombergGPT

Bloomberg is a global company that specializes in financial, software, data, and media services. In March 2023, they announced “BloombergGPT”, which is a 50-billion parameter large language model (LLM) built specifically for finance-related tasks. Some of the features that it includes are:

Dataset: BloombergGPT was trained on specifically finance-related data that was stored and generated by Bloomberg over four decades. This ensures that the model is specialized in finance and performs well.

Risk Assessment: Analyzes financial data to assist with the evaluation of risks.

Sentimental Analysis: Performs sentimental analysis of financial data and news articles to provide insights into market sentiment and predict market movements.

Bloomberg Query Language (BQL) Conversion: Capable of converting natural language queries into BQL to make the process of interacting with the Bloomberg terminal easier.

BloombergGPT equips finance professionals with a powerful AI tool, enabling them to save time by leveraging its large domain-specific knowledge. It can be accessed through Bloomberg’s terminal software.

Datarails

Datarails is a Financial Planning & Analysis platform that is designed to enhance Excel’s capabilities with a focus on finance. Datarails has incorporated GenAI into its platform through a tool called “Genius”, which is a chatbot for finance professionals. Some of the key features that Genius offers include:

Real-time Data Connectivity: Genius is directly linked to real-time data, which ensures that financial decisions are informed by the latest and most accurate information available.

Unified Data Ecosystem: Aggregates all financial data integrations and sources into a single source of truth, which simplifies data management and increases the reliability of financial insights derived from the system.

Dashboards and Visualizations: Capable of including dashboards and visual representations of data in its output which helps in presenting financial data and eliminates the need for additional tools.

The key features of Genius provide finance teams with a powerful and efficient tool for financial planning and analysis, therefore, enabling more informed decision-making. Datarails offers customized packages according to the company’s needs.

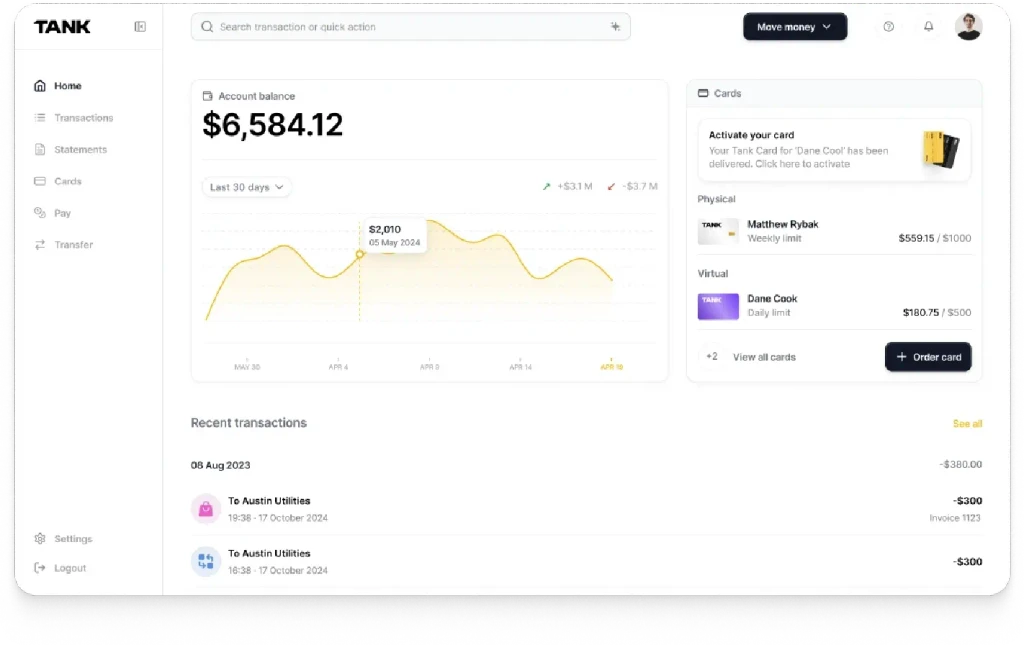

Domo

Domo is a data experience platform that is designed to help finance teams with real-time insights and tools for advanced analytics and decision-making. They have introduced a layer called “Domo AI”, which is a core component of the Domo platform that leverages GenAI to support business decision-making. Here are some of the key features that Domo offers:

Conversational AI: Allows users to ask questions about their data to receive contextual and personalized insights with the capability of incorporating visual content in the response. In addition to this, a sophisticated algorithm is used to provide the users with suggestions, deeper insights, and the next best action based on their profile.

Summaries: Condenses large information such as customer feedback into short summaries with key points.

Report Generation: Generates reports as well as other writing processes while ensuring human oversight for import decisions.

Pre-built Universal Models: Includes models for forecasting, sentiment analysis, and PII detection that users can take advantage of without the need for development skills.

Domo AI allows finance professionals to extract real-time insights, conduct advanced analytics, and streamline decision-making processes, which results in better overall financial outcomes.

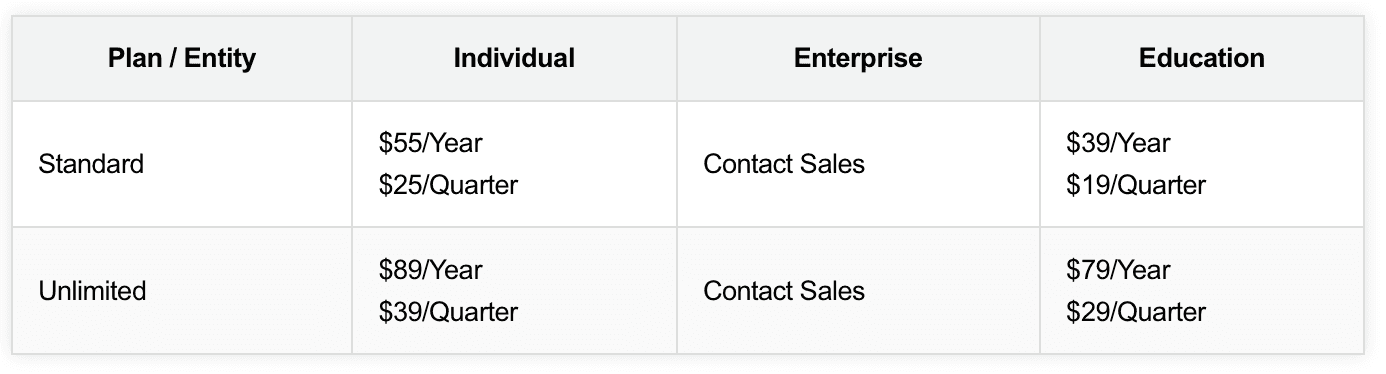

Domo AI is priced as below:

Booke.ai

Booke AI is an AI-powered automation tool to streamline the bookkeeping processes for accountants. It leverages GPT-4 to enhance efficiency and accuracy in accounting practices by offering key features that include:

Error Fixing: Automatically flags and provides possible solutions for uncategorized transactions and coding errors.

OCR Extraction: Uses real-time OCR AI to extract data from various documents to streamline the conversion of physical documents to soft copies.

Categorization: Automatically places transactions into categories and provides the “confidence” level along with each suggested category to increase accuracy and reliability.

Booke AI is ideal for accountants seeking to automate repetitive tasks with high accuracy. By using this platform, professionals can significantly enhance their productivity and offer better services to their customers.

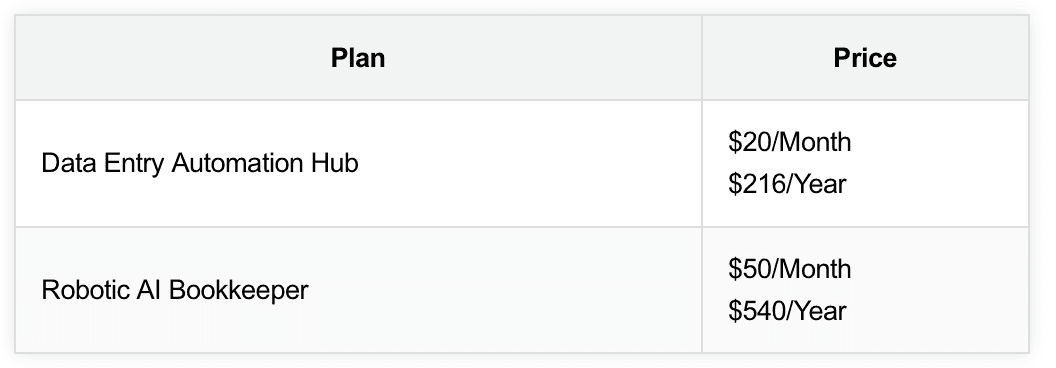

Booke AI offers two plans with pricing as below:

Stampli

Stampli is an Accounts Payable (AP) automation platform that is designed to integrate with existing systems without requiring changes to their existing Enterprise Resource Planning (ERP) or AP processes. Stampli offers several key features such as:

Minimal ERP Disruption: Stampli adapts to the business’s existing processes, which makes it deployable within days. This sets it apart from other automation tools that require major changes to the existing software within a business.

Smart AI: Billy the Bot, their dedicated AI assistant, learns from the current business processes to assist with tasks such as invoice capture, coding, approvals, fraud detection, and more.

Integration: Stamply offers integration with 70+ well-known existing ERPs, which increases its accessibility.

Stampli offers a powerful AI-driven solution to streamline AP processes. Its ability to integrate quickly and seamlessly with a wide array of ERP systems makes it a top choice for businesses looking to optimize their operations. Likewise, Stampli offers customized pricing plans for businesses.

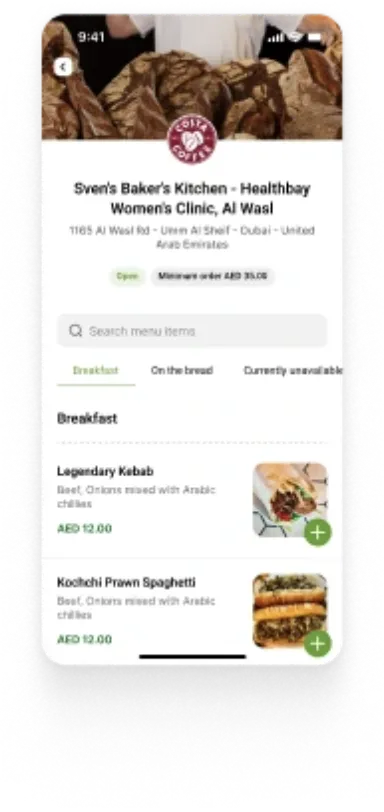

Nanonets

Nanonets is a platform designed to automate various business processes including finance. Specifically, it streamlines the processes in the AP sector through several features:

Efficiency: Enables AP teams to become up to five times more efficient by automating invoice processing and optimization.

Data Extraction and Improvements: Uses advanced AI engines to extract data from documents accurately without relying on templates. Furthermore, it offers summaries and actionable insights on extracted data to improve decision-making.

Automated Decisions: Efficiently flags, reviews, and validates files.

Integration: Supports several third-party applications to import files from Gmail, Dropbox, Google Drive, and more.

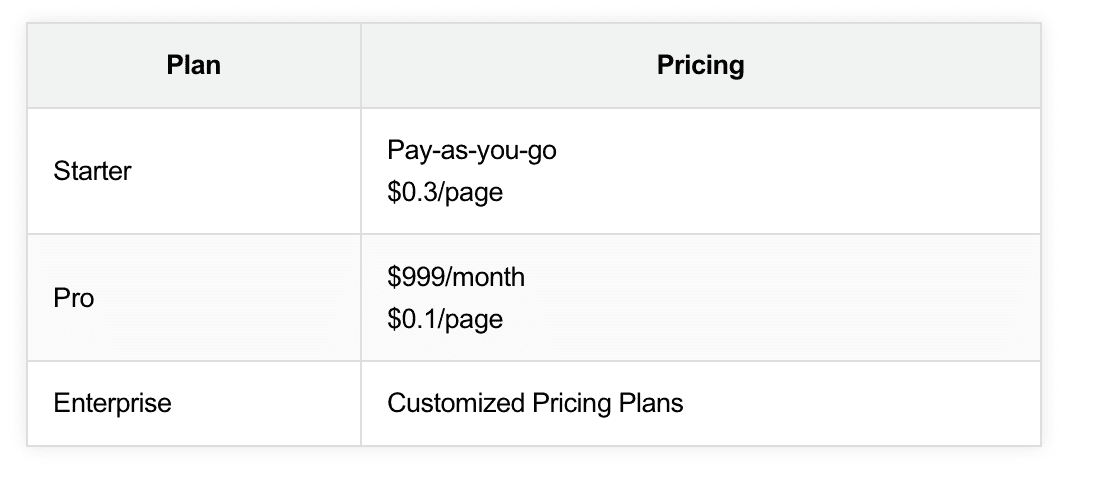

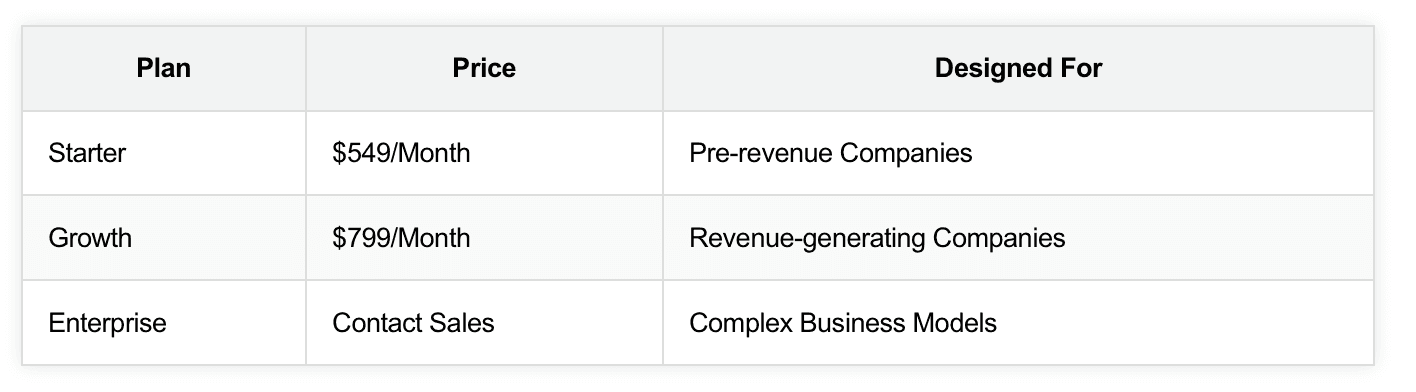

Nanonets provides a strong tool for businesses looking to optimize several sectors within the company including finance. By leveraging AI, it can optimize financial workflows, reduce costs, and improve efficiency. Nanonets currently offers three plans:

Furthermore, the Pro and Enterprise plans include additional features that the starter plan does not offer.

Planful

Planful is a cloud-based financial performance management platform. Its set of solutions includes “Planful Predict” which uses AI to automate several tasks and provide insights. Here are some of the key features Planful Predict offers:

Anomaly Detection: Detects and flags anomalies by identifying potential errors and outliers in financial data to maintain data integrity.

Project Planning: Learns your planning environment over time and generates forecasts to recommend actions to accelerate planning cycles.

Planful Predict stands out for its focus on enhancing human decisions through AI. It offers several solutions to automate and improve several tasks through its list of native AI and ML-based solutions. Moreover, Planful offers customized pricing plans for organizations.

Trullion

Trullion is an AI-powered accounting oversight platform that simplifies revenue recognition, lease accounting, and audit workflows. Here are some of the key features it offers:

Revenue Recognition: Improves key accounting functions by automating error-flagging processes and managing financial data for reporting to stakeholders.

Audits: Leverages its multi-client AI toolset to perform audits quickly and accurately.

Data Extraction: Automatically extracts key information from uploaded documents to improve workflow.

By introducing intelligent automation, Trullion aims to enhance efficiency, accuracy, and transparency in accounting-related tasks, which enables organizations to make better decisions. Trullion offers customized plans for businesses and organizations.

Vena

Vena is a cloud-based financial planning and analysis (FP&A) platform, with many of its features relying on AI to deliver solutions to their customers. The platform’s key features include:

Vena Copilot: An AI assistant based on Open AI’s large language models, including GPT-4, to provide a natural language interface for user queries for data, report generation, trend analysis, and forecast optimization.

Secure: Capital is designed with security, compliance, and privacy incorporated in its development process, which ensures data safety without requiring additional technical skills.

Integration: Supports integration with Microsoft 365 suite to automate workflows and enhance data analysis.

Data Analytics: Uses Microsoft’s AI and ML technology for real-time intelligent reporting and analysis to generate key insights. In addition to this, the platform is capable of performing anomaly detection.

Vena aims to streamline workflows, automate routine tasks, and provide users with valuable insights to increase the productivity of finance professionals. Likewise, Vena currently offers customized planning after an initial meeting with their representatives.

Workiva

Workiva is a platform designed to bring and enhance financial reporting, ESG auditing, and risk management in one place by using GenAI. Some of the key features that Workiva’s GenAI brings to the table are:

Content Generation and Refactoring: Generates content and natural language given the user's prompt. Furthermore, it supports refactoring of content to adjust tone, shorten, elaborate, rephrase, and change the format.

Research: Capable of brainstorming, researching several topics, and providing questions that analysts/leaders may ask to improve the quality of work.

Continuous Improvement: Workiva is continuously improving its AI models to work specifically for reporting and assurance.

Workiva is a great tool for users aiming to streamline their financial reporting, ESG, auditing, and risk management processes using GenAI. Workiva offers customized pricing plans for businesses.

AlphaSense

AlphaSense is a market intelligence and search platform designed to help its users uncover insights across content. It uses GenAI for two useful tools: “AlphaSense Assistant” and “Enterprise Intelligence”. The key features that these tools offer are:

Summaries: Instantly generate key points from company events, emerging topics, and industry-wide viewpoints.

AI Assistant: Understands and discusses markets, companies, and topics in natural language to enhance workflow and brainstorm ideas.

Robust Training Data: The AI model that AlphaSense utilizes has been trained on more than 300 Million top-tier business and financial documents, resulting in a high accuracy rate.

Enterprise Intelligence: Generates instant insights based on the user’s questions while keeping in mind the company’s perspective. Furthermore, it includes external perspectives such as broker research, industry reports, and expert insights in its output to create a detailed report.

AlphaSense is a powerful market intelligence tool that leverages GenAI to gain key insights from business data by offering tools like AlphaSense Assistant and Enterprise Intelligent for better decision-making. Similarly, AlphaSense offers customized pricing according to your organization’s needs.

UPDF

UPDF provides a user-friendly interface to work with PDF files while incorporating GenAI’s powerful capabilities to help the user navigate the document. Finance professionals can take advantage of this platform when writing reports, finding information from a large collection of documents, and translating between languages. Some of its key features that are useful for finance are:

Summarize: Quickly summarizes documents and simplifies data charts to show only the most important information concisely.

Translate: Instantly translates any PDF between any language.

Explain & Chat: Helps users understand complex technical information by explaining it in a concise and easily understandable format. Furthermore, users can interact with the PDF by asking questions through a chat interface.

Write: Generates content for users to write in PDF files by brainstorming ideas, checking grammar, polishing content, and refactoring existing content.

UPDF completely redefines PDF management techniques by streamlining and simplifying processes like summarizing, translating, and content creation.

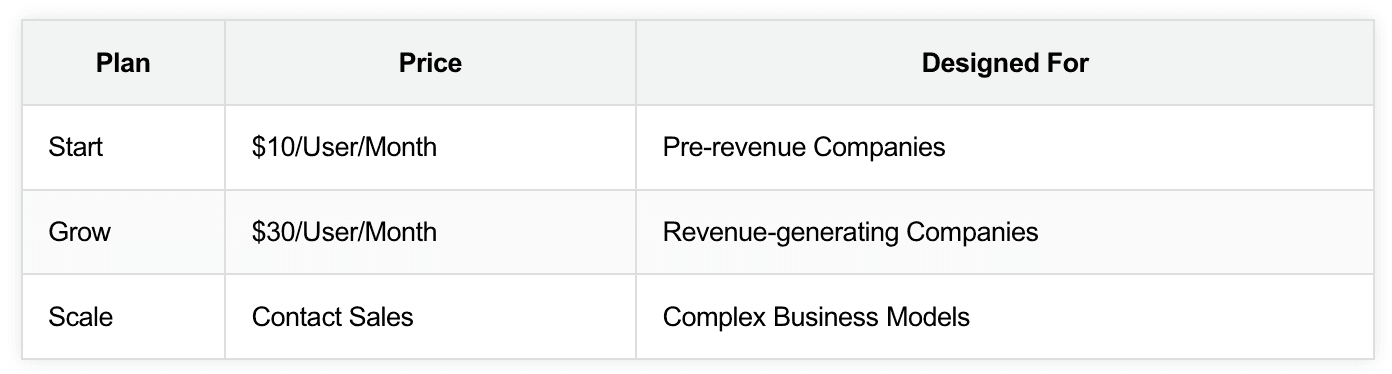

UPDF AI is priced as below:

The unlimited plan removes restrictions on the number of files uploaded, questions asked, and increased cloud storage.

ChatGPT

ChatGPT can be a valuable tool for finance-related tasks by leveraging its advanced language processing capabilities. Here are some ways you can use ChatGPT to assist with finance tasks:

Summarize: Can extract and highlight important points from large documents such as annual reports and earnings calls.

Market Research: Capable of conducting market research by compiling information on industry trends, competitive landscapes, and market news. The integration with Bing search allows it to retrieve up-to-date information.

Compliance and Regulation: ChatGPT can help navigate financial regulations by providing a list of summaries of regulatory guidelines.

Content Generation: Can generate content such as investment proposals, financial plans, and compliance reports.

Users can leverage ChatGPT for finance tasks to streamline workflows and further take advantage of integrated Bing search for up-to-date results. ChatGPT offers a free plan for its GPT 3.5 model limited to text input/output. Users that require a more advanced version with support for various input methods and the ability to generate images can subscribe to ChatGPT’s “Plus” or “Team” version at $20 and $25 per month respectively.

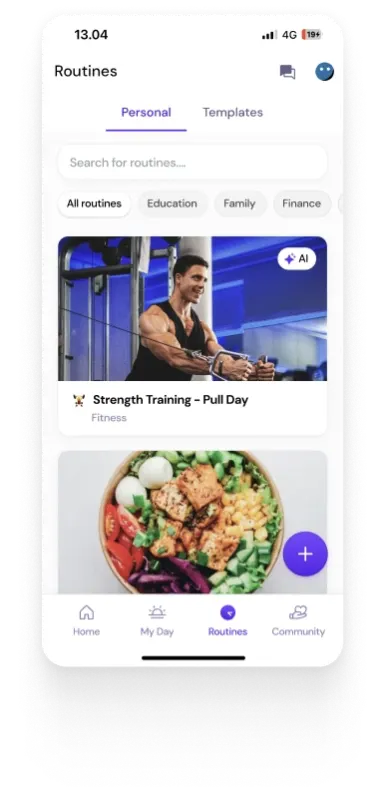

ClickUp

ClickUp is a project management and productivity software that uses GenAI to enhance tasks for financial professionals. Here are some key features that can support finance tasks:

Organize and Plan: ClickUp enables users to plan and organize financial projects including aspects such as budgeting, reporting, setting goals, and deadlines.

Automate Tasks: Repetitive tasks like data entry, task assignments, and status updates can be automated using ClickUp’s automations that include 100+ tasks.

Chat: Users can engage with a chatbot to get answers to queries related to tasks and documents.

Content Creation: Allows users to enter a query and receive accurate written content relevant to their work.

Insights: Provides key insights on data in an easy-to-understand format such as rich text tables.

ClickUP uses GenAI to streamline project management and finance-related tasks. With features specific to planning, automation, and content creation, it offers a seamless solution to handle financial projects.

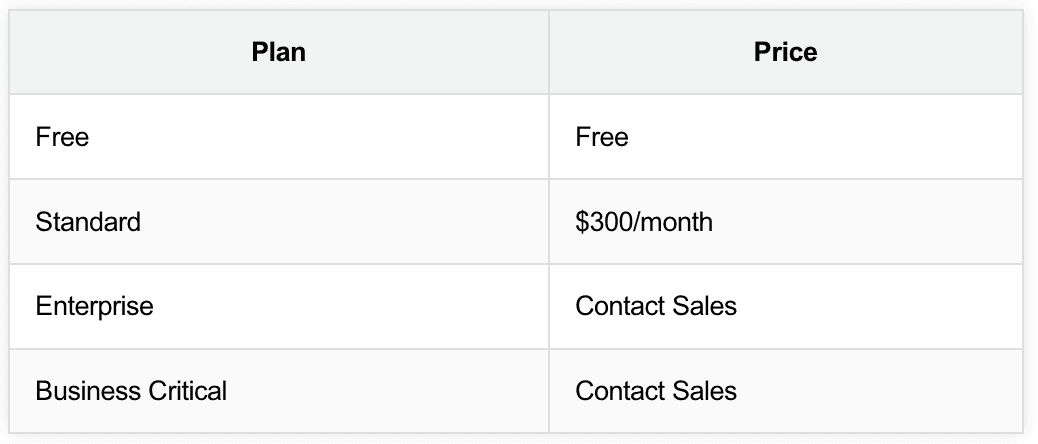

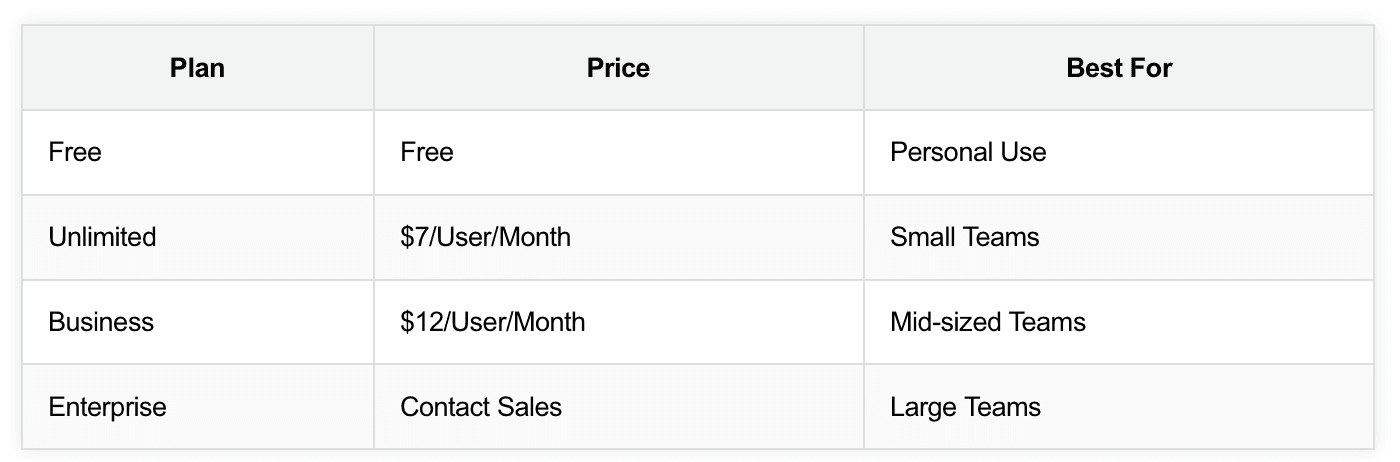

ClickUp is priced as below:

Each plan offers a distinguished set of features. For more information, visit their website.

Vic.ai

Vic.ai is an AI-powered platform designed specifically for accounting and finance-related tasks. Some of the features that Vic.ai offers are:

Invoice Processing: Automatically processes invoices by extracting data, categorizing expenses, and providing suggestions for cost allocation.

Audit and Compliance: Provides deep insights on financial transactions and patterns, which makes it easier to identify discrepancies and anomalies.

Analytics: Offers analytical capabilities that deliver actionable insights to drive financial decision-making by analyzing historical data to predict trends and manage cash flow. Additionally, it provides real-time recommendations based on its analysis.

Integration: Supports various large ERPs currently in the market by providing a “plug and play integration”, meaning that no additional work is required on existing processes.

By automating critical financial tasks, Vic.ai allows finance professionals to navigate complex operations with ease and efficiency. Vic.ai provides custom pricing plans for teams.

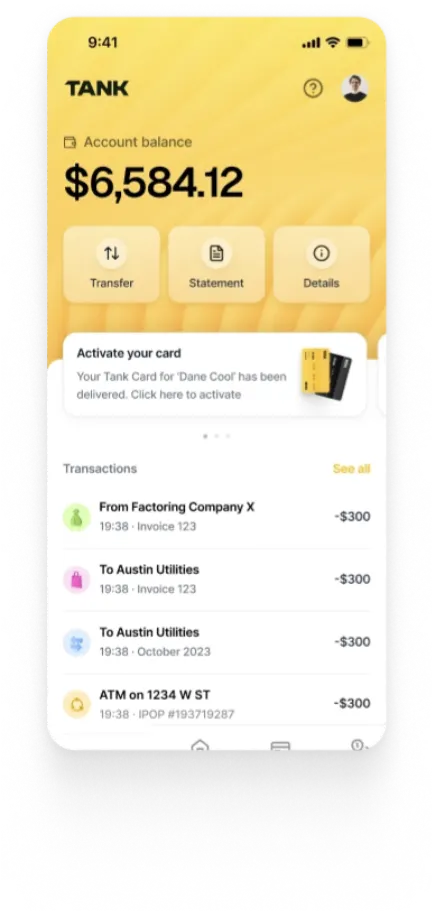

Zeni

Zeni is a financial management and bookkeeping platform powered by AI. Zeni offers a seamless approach to managing companies’ finances while the following features:

Financial Insights: Leverages GenAI to analyze financial data in real-time and provides actionable insights by forecasting bookings, revenues, workforce, expenses, and cash flows.

Report Generation: Automatically generates ready-to-go PDF reports based on the user’s requirements.

Automated Transaction Handling: Automates categorization of financial transactions with high accuracy.

Expense Management: Monitors and manages expenses by learning spending patterns to suggest actions that can identify potential savings.

Zeni simplifies finance operations and enables professionals to uncover savings and spend less time on manual tasks efficiently.

Docyt

Docyt is an end-to-end accounting platform designed to eliminate manual tasks through a solution called Docyt AI. Here are some of the key features it offers:

Expense Management: Integrates with QuickBooks to automatically handle bill pay, credit card reconciliation, expense reports, receipts, reimbursements, and vendor payments.

Revenue Accounting: Automates revenue tracking by connecting with over 30+ POS systems and offers smart insights based on the data.

Month-End Close: Achieves real-time accounting through automated expense management, continuous bank reconciliation, and AI-powered transaction categorization to make month-end close faster and more efficient.

Financial Reporting: Provides real-time financial reports to easily track trends through advanced reporting and dashboards.

Automate Tasks: Manages repetitive bookkeeping tasks and provides flexible reporting options according to your business needs.

Document Extraction: Reads and extracts accurate information from receipts and invoices to categorize them.

Docyt offers a streamlined approach for businesses to handle financial tasks by enhancing accuracy and speed in several operations. Furthermore, Docyt provides custom pricing plans for teams.

Gridlex

Gridlex offers accounting software designed to streamline various accounting-related tasks in a user-friendly interface. One of the solutions that it offers is called “AI Advisor” which includes key insights from various aspects of the business. Here are some features that the Gridlex offers:

Profit Advisor: Provides key insights as well as visualizations on the profits of the company. These include the top few items that perform the best, the net profit, and the change in net profit over the years along with their driving factors.

Revenue Advisor: Provides insights on the business’ revenue along with visualizations by showing the net revenue, top revenue-generating items, and the change over the years.

Cost / Inventory Advisor: Similar to profit and revenue advisors, this provides key insights into the respective elements of the business.

Automated calculations: Performs calculations for profitability, revenue, and expenses of the business with high accuracy.

Automate Expenses: Automatically approves expenses and reimbursements to reduce administrative processes.

With features focused on profit, revenue, and cost/inventory analysis, Gridlex not only automates, rather helps professionals easily interact with financial data to make better decisions.

Gridlex is priced as below:

Blue Dot

Blue Dot is a platform that utilizes advanced AI models to improve VAT management and compliance for global companies. Here are some of the key features it offers:

VAT Recovery Optimization: Identifies and calculates any invoice that is eligible and qualifies for VAT based on various countries’ tax regulations.

Tax Rules: A team of tax and finance experts ensures that rules and regulatory settings are always up-to-date with the ability to manually finetine settings to align with your company policy.

Compliance: Utilizes over 200 AI and ML models to automatically improve compliance levels across the globe.

Data Quality: Ensures highest level of data quality and transparency to speed efficiency, reduce human errors and disqualified claims, minimize audit risks, and simplify the VAT management process.

Blue Dot offers a robust solution for companies aiming to simplify their VAT processes and improve financial performance while adhering to global and local compliances. Likewise, Blue Dot provides custom pricing plans for businesses.

Receipt-AI

Receipt-AI is a platform that simplifies the receipt management process for businesses. It leverages AI to perform quick analyses on the receipts by offering features such as:

Receipt Submission: Allows users to submit receipts through text messages and emails.

Data Extraction and Categorization: Automatically analyses receipt content, extracts key information, and categorizes expenses accordingly.

Collaboration: Seamlessly handles multiple users to ensure all receipts are in one space.

Insights: Generates insights based on the receipts uploaded through visualizations such as pie, column, and bar charts to simplify expense analysis.

Receipt AI is an excellent tool specifically for teams that are always on the go and need a platform to simplify the receipt management process by allowing them to submit receipts via SMS and emails. It offers a subscription of $29/month before businesses commit to long-term pricing plans.

Conclusion

In this article, we have analyzed twenty different GenAI products useful for finance professionals and business owners. As more research is done in AI and more products are released for the finance sectors, finance professionals should embrace these tools to stay competitive and efficient in the market. By leveraging the capabilities of GenAI, they can significantly improve their productivity and explore new strategies to navigate complex finance-related tasks efficiently and accurately.

Authors

References

https://www.datarails.com/best-ai-tools-for-finance-teams/

https://clickup.com/blog/ai-tools-for-accounting/

https://ai.domo.com/

https://booke.ai

https://www.stampli.com

https://nanonets.com

https://planful.com/ai-ml/

https://trullion.com

https://www.zeni.ai

https://docyt.com

https://www.bluedotcorp.com/blog/vat-recovery/

https://www.bluedotcorp.com/blue-dot-platform/

https://receipt-ai.com

https://clickup.com/blog/ai-tools-for-accounting/

https://www.venasolutions.com/platform/microsoft/insights

https://www.workiva.com/platform/generative-ai

https://www.alpha-sense.com/blog/news/enterprise-launch-genai-assistant/

https://updf.com/updf-ai/

https://clickup.com/ai

https://www.vic.ai

https://www.bloomberg.com/company/press/bloomberggpt-50-billion-parameter-llm-tuned-finance/

https://www.ankursnewsletter.com/p/bloomberggpt-making-finance-smarter

https://medium.com/@gyaaninfinity/how-to-use-bloomberg-gpt-complete-guide-979cc95dbc02