Stripe vs Revenue Cat: Streamlining Mobile App Payments

Summary

This article provides a detailed comparison between Stripe and Revenue Cat, two leading payment processing platforms for mobile applications. It explores their integration capabilities, testing environments, financial management tools, and compliance with platform-specific requirements.

Key insights:

Stripe provides comprehensive SDKs and testing environments, making it ideal for developers needing extensive payment scenario testing and global transaction support.

Revenue Cat focuses on simplifying subscription management, offering easy integration with native store billing systems, which is particularly beneficial for mobile app developers.

Both platforms offer different approaches to financial management; Stripe offers detailed financial analytics and management tools, while Revenue Cat focuses on subscription metrics and simplified financial oversight.

Compliance with platform-specific billing requirements varies; Stripe requires careful integration to meet Apple and Google's guidelines, whereas Revenue Cat handles these complexities inherently.

The collaboration between Stripe and Revenue Cat offers a unified approach to manage subscriptions efficiently, combining Stripe's payment processing with Revenue Cat's subscription management.

Introduction

The choice of a payment processing system in mobile applications is crucial for enhancing user experience and optimizing revenue streams. Stripe and Revenue Cat stand out as two leading platforms that offer specialized services for managing payments in both Apple’s App Store and Google’s Play Store.

The choice between Stripe and Revenue Cat depends on several factors including the specific requirements of the application, the desired level of control over payment processes, and the complexity of integration. For developers, understanding each platform’s offerings and how they integrate with Apple and Google Play’s Billing requirements is essential.

This article aims to provide a comprehensive comparison between Stripe and Revenue Cat to help developers and business stakeholders make informed decisions that best suit their application’s monetization strategy.

Platform Integration and Support

When selecting a payment processing solution for mobile applications, the ease of integration and the level of support offered are important factors to consider. Stripe and Revenue Cat provide different approaches and tools to assist developers in integrating payment systems into their applications, each catering to distinct needs.

1. Stripe

Stripe provides an extensive SDK with support for third party integrations suitable for iOS, Android, and web platforms. This support enables seamless integration across multiple devices and operating systems, which is crucial for maintaining consistent user experiences. Stripe’s approach is beneficial for developers seeking extensive customization options and control over their payment infrastructure. Additionally, Stripe’s detailed testing environment allows developers to simulate transaction conditions, providing a robust framework to address potential issues.

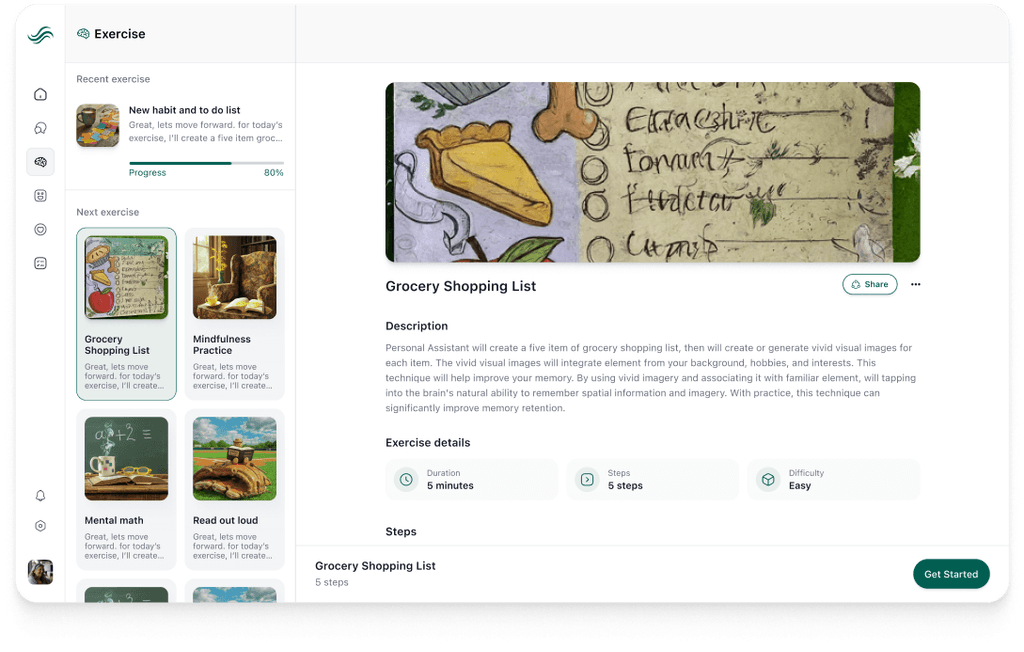

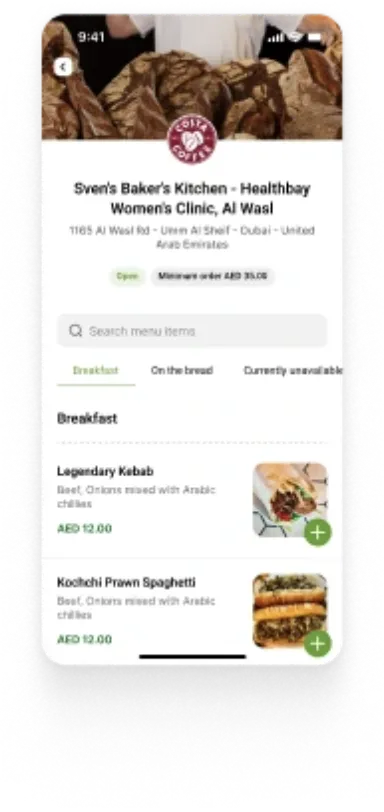

2. Revenue Cat

Likewise, Revenue Cat also offers SDKs targeted primarily towards iOS and Android, focusing on simplifying the integration of in-app purchases and subscriptions. Revenue Cat specifically excels at managing in-app subscriptions. It offers a streamlined, developer-friendly approach to working with various complexities associated with direct integrations with StoreKit and Google Play Billing. This is advantageous for developers who aim to implement and manage subscriptions across platforms without diving deep into the specifics of each billing system.

Both platforms offer robust integration capabilities. However, their core strengths cater to different developer needs. Stripe is ideal for those who require a broad, customizable payment system that spans across various platforms and transaction types. On the other hand, Revenue Cat is tailored for developers focusing specifically on mobile applications, seeking to streamline the process of subscription management and integration simplicity with native store billing systems. This makes Revenue Cat the better option for mobile-first businesses that prioritize quick deployment and ease of use in subscription handling.

Payment Testing and Flexibility

Testing payment systems is essential for ensuring that transactions are processed smoothly and securely. Stripe and Revenue Cat both offer different capabilities and tools for testing payment processes.

1. Stripe

Known for its testing capabilities, Stripe allows developers to simulate a wide array of payment scenarios including transaction failures which is crucial for testing the resilience of payment systems before going live. This is made possible through a comprehensive sandbox environment that simulates real-world transaction conditions. Developers can use this feature to verify the platform’s response to different payment statuses and ensure that their application handles all scenarios correctly.

2. Revenue Cat

While Revenue Cat provides tools for testing in-app purchases, its focus is more toward simplifying the overall subscription management rather than providing a broad testing environment like Stripe. Revenue Cat allows developers to test subscription scenarios across platforms using its sandbox testing feature, which is integrated with its SDKs. Their testing capabilities are primarily focused on the subscription lifecycle, such as sign-ups, renewals, ensuring that the subscribed content is available, and cancellations rather than a wide array of payment failures and edge cases.

Both Stripe and Revenue Cat support the testing needs of mobile applications, but their offerings are tailored to different aspects of payment processing. Stripe offers a more detailed testing environment that is suitable for applications that require thorough testing across a variety of payment methods and scenarios whereas Revenue Cat focuses on ensuring that subscription models are robust and reliable. This makes Revenue Cat ideal for developers who prioritize ease of subscription management over extensive payment scenario testing.

Financial Management and Metrics

Financial management and the ability to analyze key metrics are essential for any developer looking to maximize revenue through in-app purchases and subscriptions.

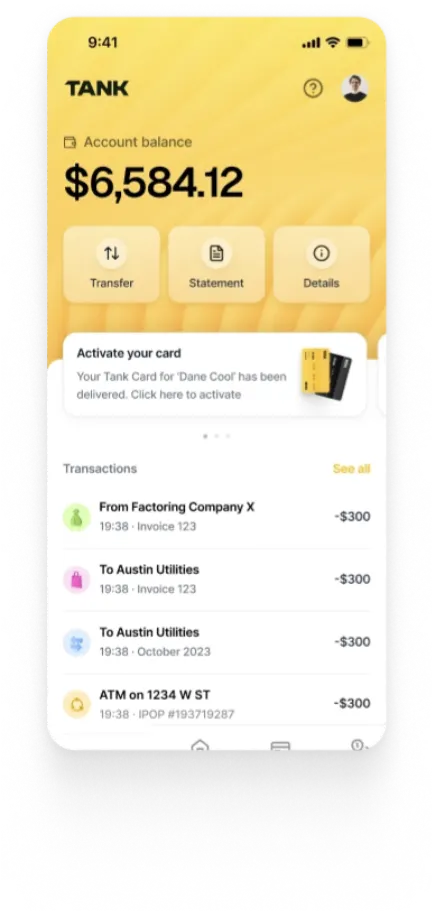

1. Stripe

Stripe provides a comprehensive financial toolkit that extends beyond simple payment processing. It integrates seamlessly with a range of business tools, allowing for detailed financial tracking and management. Developers can access real-time data on transactions, manage refunds, and handle disputes directly through the Stripe dashboard. Furthermore, Stripe supports processes like handling multiple currencies and tax calculation which makes it an ideal choice for applications with a global user base. The platform also offers advanced reporting features that enable developers to analyze payment data deeply to make informed decisions based on user payment behavior and revenue trends.

2. Revenue Cat

Revenue Cat provides a centralized platform where developers can track subscriber behavior, analyze churn rates, and monitor revenue streams specifically from subscriptions. It simplifies the management of subscription tiers and offers detailed insights into the effectiveness of different subscription models. Furthermore, the platform integrates with a popular analytics tool which enhances its benefits for subscription-based applications. This allows developers to track detailed metrics such as lifetime value (LTV) and customer acquisition costs directly linked to subscription data.

Handling Platform-Specific Requirements

When deploying mobile applications with in-app purchases, following the specific requirements set by Apple and Google is essential.

1. Stripe

Stripe offers powerful and flexible APIs that can be integrated with both payment systems. However, using Stripe for in-app purchases requires careful consideration of the guidelines provided by Apple and Google. Developers using Stripe must ensure that they are compliant with these rules by using Stripe primarily for physical goods, services outside the application, or additional features not considered digital goods. This might involve additional overhead in terms of integration and compliance checks to ensure that transactions meet the specific conditions laid out by each platform.

2. Revenue Cat

Designed specifically for mobile applications, Revenue Cat provides a more straightforward approach to dealing with platform-specific billing requirements. It acts as a layer on top of Apple’s StoreKit and Google Play Billing and handles most of the complexities involved in managing subscriptions and in-app purchases. Revenue Cat ensures that all transactions comply with the latest guidelines from Apple and Google, reducing the work for developers to keep up with the requirements of each platform’s billing policies. The platform’s integration simplifies the implementation process, making it easier for developers to launch and maintain their applications across different platforms without worrying about direct API integrations for payment processing.

In summary, Stripe offers more control and flexibility but also requires a deeper understanding of platform-specific rules to avoid potential issues related to compliance. Revenue Cat, on the other hand, provides a tailored solution that is designed to meet these requirements by default. This makes Revenue Cat valuable for developers looking for an efficient and compliant way to manage app subscriptions and purchases.

Tax and Legal Compliance

Understanding how each payment processing platform addresses tax calculations and compliance management is essential for developers and business stakeholders to make an informed decision regarding their choice of payment processing tool.

1. Stripe

Stripe provides a robust system for handling taxes and compliance. It automatically calculates and collects taxes based on the transaction details and the geographical location of the user. This feature simplifies the developer’s need to understand and implement region-specific tax laws, reducing the risk of non-compliance. However, Stripe does not manage tax remittance or compliance on its own - it requires integration with third-party services to fully manage these aspects.

2. Revenue Cat

Revenue Cat does not directly manage tax calculations or legal compliance for transactions. Instead, it offers tools that estimate taxes and store commissions, reporting net revenue after those deductions. This approach simplifies financial management for developers but requires them to handle actual tax payments and legal compliance with the assistance of third-party services. Revenue Cat’s focus is on easing subscription management across platforms.

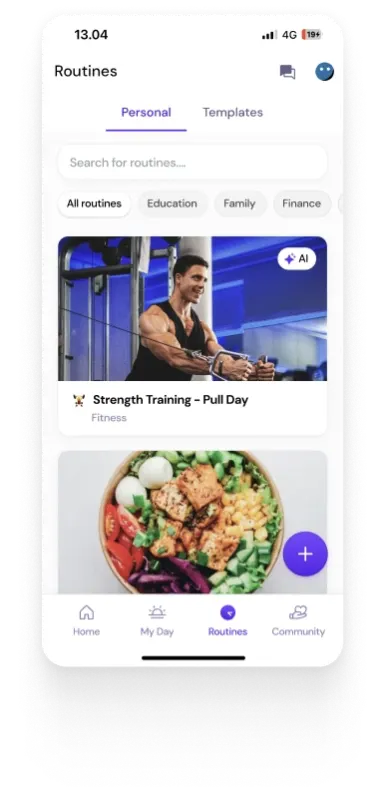

Stripe and Revenue Cat’s Collaboration for In-App Subscriptions

Stripe and Revenue Cat have collaborated to streamline the process of managing in-app subscriptions. This partnership provides a seamless experience for both developers and users, focusing on simplifying subscription management and payment processing in mobile applications.

Unified Dashboard: By integrating Revenue Cat’s capabilities into Stripe, developers can now view and manage in-app subscription data directly from the Stripe dashboard. This integration merges Stripe’s comprehensive payment processing tools with Revenue Cat’s specialized subscription management features, allowing for a centralized view of customer and transaction data.

Cross-Platform Management: Revenue Cat enhances the Stripe platform by ensuring consistent subscriber identity across different platforms. This is useful for applications that operate on multiple platforms as it simplifies the management of user entitlements and access to content or features based on their subscription status.

Simplified Data Handling: Revenue Cat’s backend manages and validates receipts from Stripe and in-app purchases, maintaining a continually updated subscription status. This setup provides developers with reliable data for reporting, marketing, and analytics.

Ease of Implementation: The collaboration allows developers to implement and scale their subscription businesses more easily when expanding to mobile platforms. The combined strengths of Stripe and Revenue Cat in handling payments and subscriptions reduce the complexity and technical challenges typically associated with these processes.

Enhanced User Experience: For users, this integration means smoother and more reliable subscription management. The seamless interaction between Stripe and Revenue Cat ensures that users have a consistent experience across platforms with minimal disruptions.

Conclusion

In conclusion, the choice between Stripe and Revenue Cat requires a clear understanding of each platform’s strengths and your specific needs.

Stripe is ideal for businesses that require extensive payment options, global operations, and deep financial management capabilities. However, it also requires manual handling of certain aspects like compliance and integration.

Revenue Cat is best suited for businesses looking for a user-friendly platform that simplifies subscription management across various platforms. It focuses on streamlining the subscription process without the need for extensive payment infrastructure, making it a good choice for developers prioritizing ease of integration and operational efficiency.

Authors

Optimize Your Mobile App Payments with Walturn

Choosing the right payment processing system is crucial for maximizing revenue and enhancing user experience. At Walturn, we specialize in integrating leading platforms like Stripe and Revenue Cat into your mobile applications, ensuring seamless payment processing and subscription management. Partner with us to implement the best payment solutions tailored to your app's needs.

References

Rabazinski, Corey. “Can You Use Stripe for In-App Purchases?” Www.revenuecat.com, 31 Oct. 2022, www.revenuecat.com/blog/engineering/can-you-use-stripe-for-in-app-purchases/. Accessed 24 June 2024.

“RevenueCat and Stripe.” Www.revenuecat.com, www.revenuecat.com/integrations/stripe/. Accessed 24 June 2024.

Sahli, Jesse. “IOS Renewable Subscriptions Overview: Stripe vs. in App Purchases.” Medium, 13 Sept. 2018, medium.com/@jessesahli3/ios-renewable-subscriptions-overview-stripe-vs-in-app-purchases-4fdb02bec0da. Accessed 24 June 2024.

“Stripe Tax | Tax Automation with a Single Integration.” Stripe.com, stripe.com/tax. Accessed 24 June 2024.

“Taxes and Commissions | In-App Subscriptions Made Easy – RevenueCat.” Www.revenuecat.com, www.revenuecat.com/docs/dashboard-and-metrics/taxes-and-commissions. Accessed 24 June 2024.

“Test Payment Methods.” Docs.stripe.com, docs.stripe.com/testing. Accessed 24 June 2024.