Creandum's Seed Deck Template: A Deep Dive into Effective Startup Pitching

Summary

Creandum’s Seed Deck Template provides a structured, investor-aligned approach to pitching. It emphasizes clarity, data-driven insights, and storytelling to maximize funding success. Key sections include problem validation, solution differentiation, product depth, and market opportunity. By following this framework, startups can craft a compelling pitch that enhances investor confidence and improves their chances of securing capital.

Key insights:

Clear Problem Definition: Investors must quickly grasp the urgency and scale of the pain point.

Compelling Solution & UVP: Show how the product uniquely addresses the problem with measurable benefits.

Product Deep Dive: Demonstrate functionality, user experience, and real-world use cases for credibility.

Market Opportunity Validation: Use TAM, SAM, and SOM to present a realistic, data-backed market sizing strategy.

Investor-Centric Narrative: Structure the deck for clarity, ensuring seamless storytelling that aligns with investor expectations.

Introduction

For startups at the seed stage, securing venture capital is a pivotal milestone. The pitch deck serves as the first impression on investors, and its clarity, structure, and data-driven insights can significantly influence funding outcomes. Recognizing this, Creandum, a leading European venture capital firm, has developed a Seed Deck Template to help founders craft compelling and structured pitch decks that resonate with investors.

This article provides an in-depth examination of Creandum’s Seed Deck Template, breaking down each section and offering insights into best practices, common pitfalls, and strategies to enhance investor appeal.

1. The Problem Statement: Establishing Relevance and Urgency

The foundation of any compelling pitch begins with a clear articulation of the problem the startup is addressing. This slide must succinctly define the pain point, its impact on the target audience, and the urgency for a solution. The problem statement should be as concise as possible while maintaining clarity, ensuring that investors quickly grasp the necessity of the proposed solution. Overloading this section with excessive detail or technical jargon can dilute the impact, making it crucial to strike a balance between brevity and informativeness.

A well-crafted problem statement must include quantifiable data that demonstrates the scale and significance of the issue. By incorporating industry statistics, relevant research, or customer pain points backed by numbers, startups can reinforce their claim that the problem is real and pressing. Without clear evidence, investors may perceive the problem as anecdotal rather than widespread, reducing their confidence in the startup’s ability to capture market demand.

Equally important is the relatability of the problem, as investors need to understand why it matters. A problem that is too niche or disconnected from industry trends may fail to resonate. The best problem statements allow investors to visualize the gap in the market and recognize the startup’s opportunity to fill it effectively. By positioning the problem in a relatable context, startups can make a strong case for why their solution is both necessary and valuable.

2. The Solution: Articulating the Unique Value Proposition

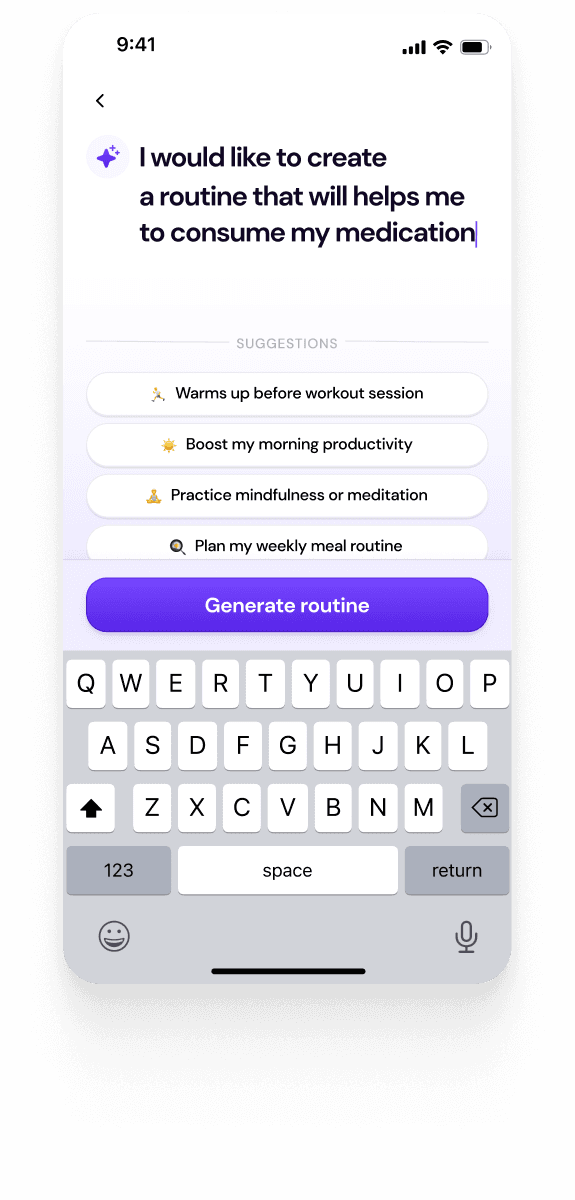

With the problem established, the next step is to introduce the solution—your product or service. This section must concisely convey the product’s core functionality, explaining exactly how it addresses the problem in a manner that is both compelling and easy to grasp. Investors should immediately see how the solution fits into the broader industry landscape and why it has the potential to succeed.

The Unique Value Proposition (UVP) is critical to this section, as it highlights the distinctive elements that set the startup apart from competitors. Merely stating what the product does is not sufficient; it must be clear why it is superior to existing alternatives. This could be due to proprietary technology, improved user experience, a disruptive business model, or a combination of these factors. The UVP should be framed in terms of the tangible benefits it delivers to users.

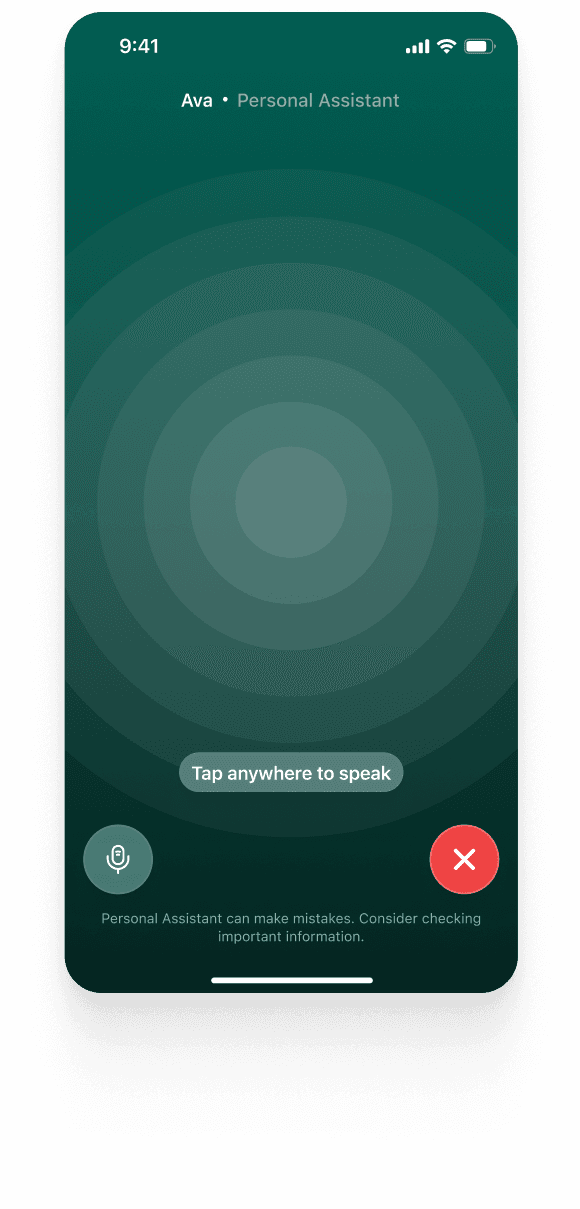

Rather than focusing solely on features, an effective solution slide should emphasize measurable benefits that users gain. These benefits might include cost savings, enhanced efficiency, improved accessibility, or better customer experience. Investors care about the impact of the solution more than its technical specifications, meaning that a strong pitch deck must communicate why customers will choose this product over other available options.

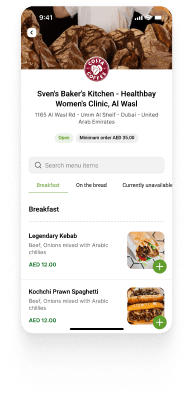

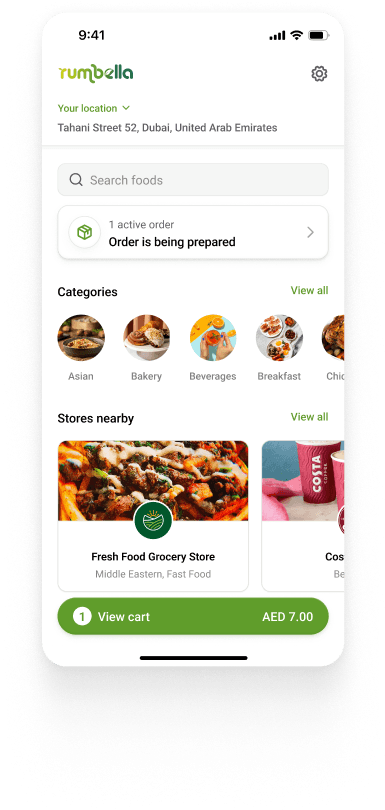

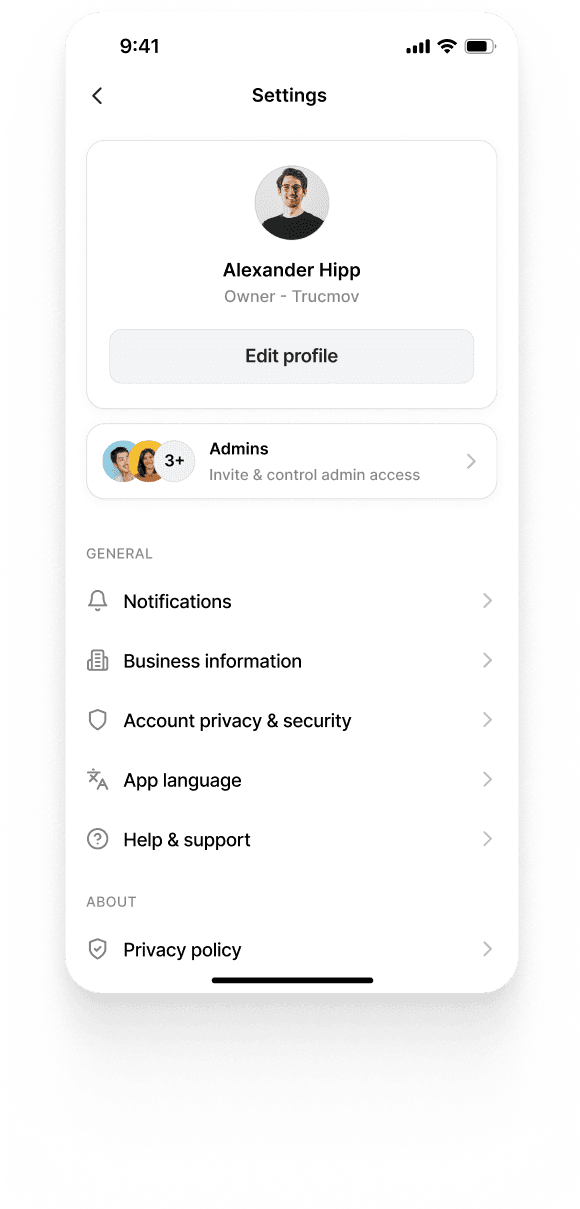

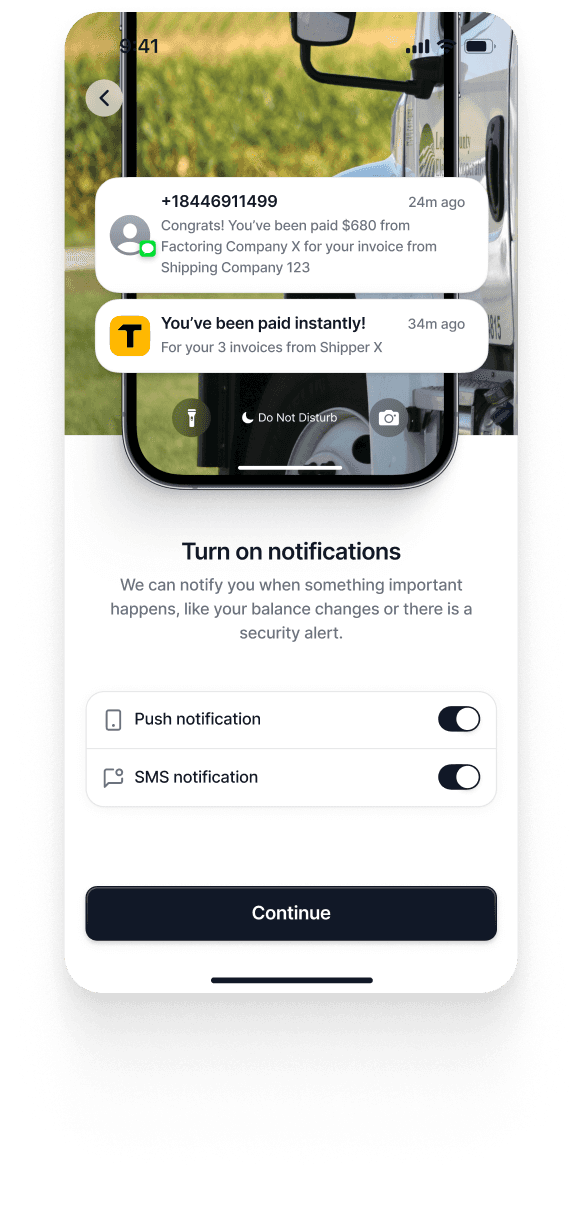

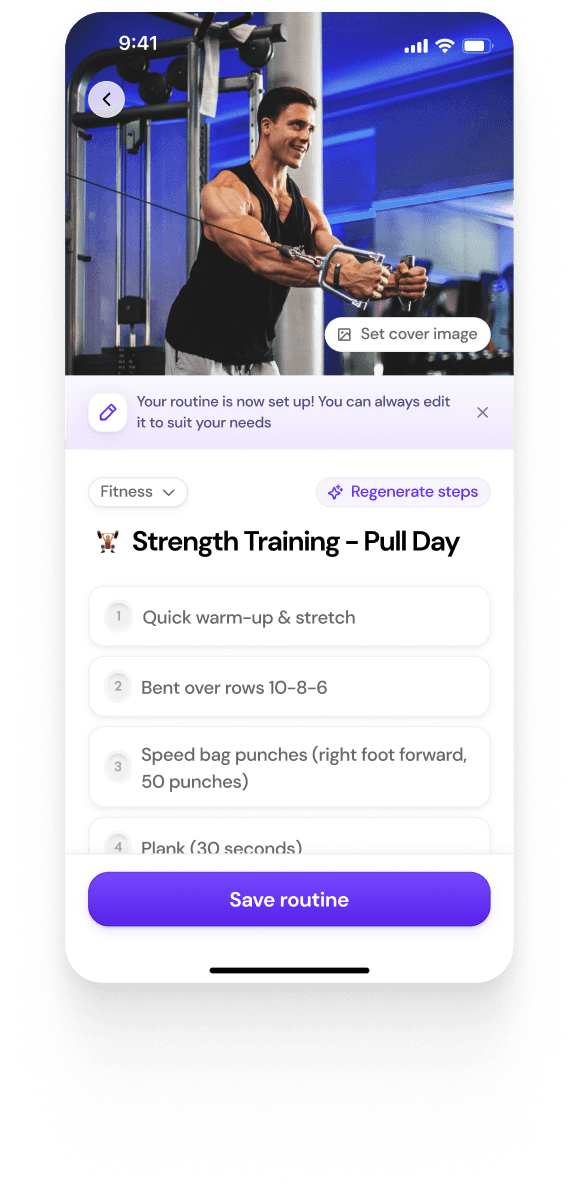

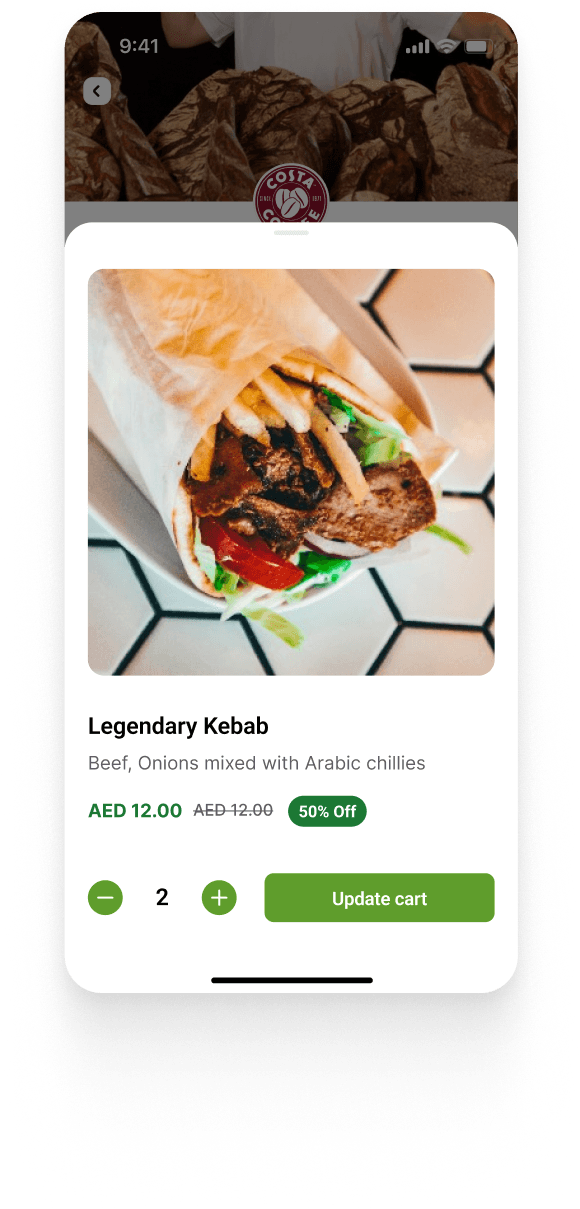

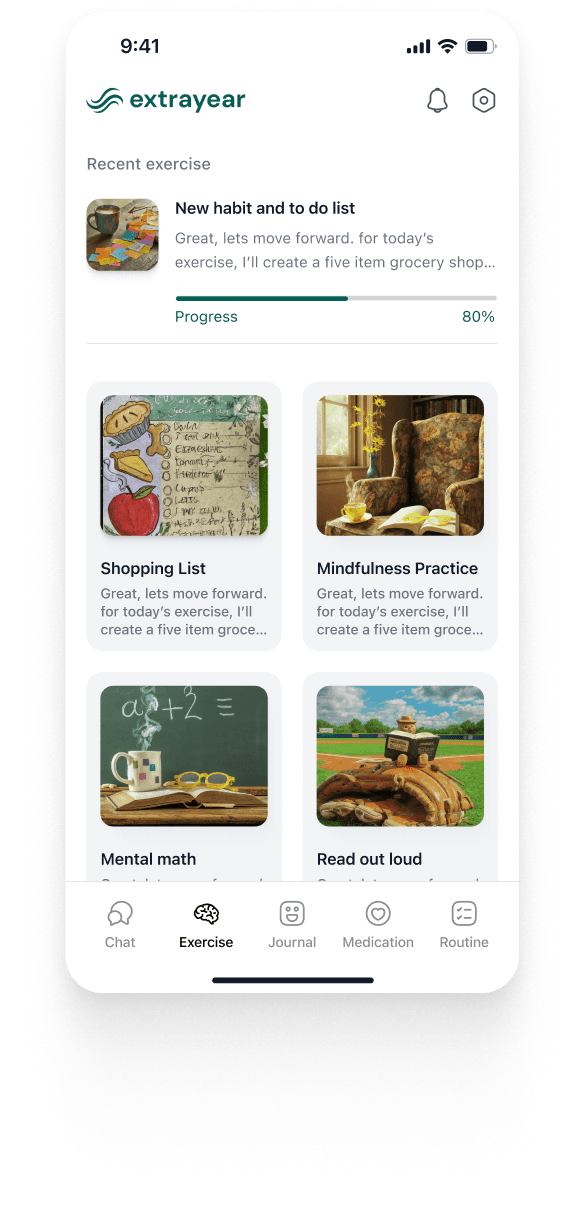

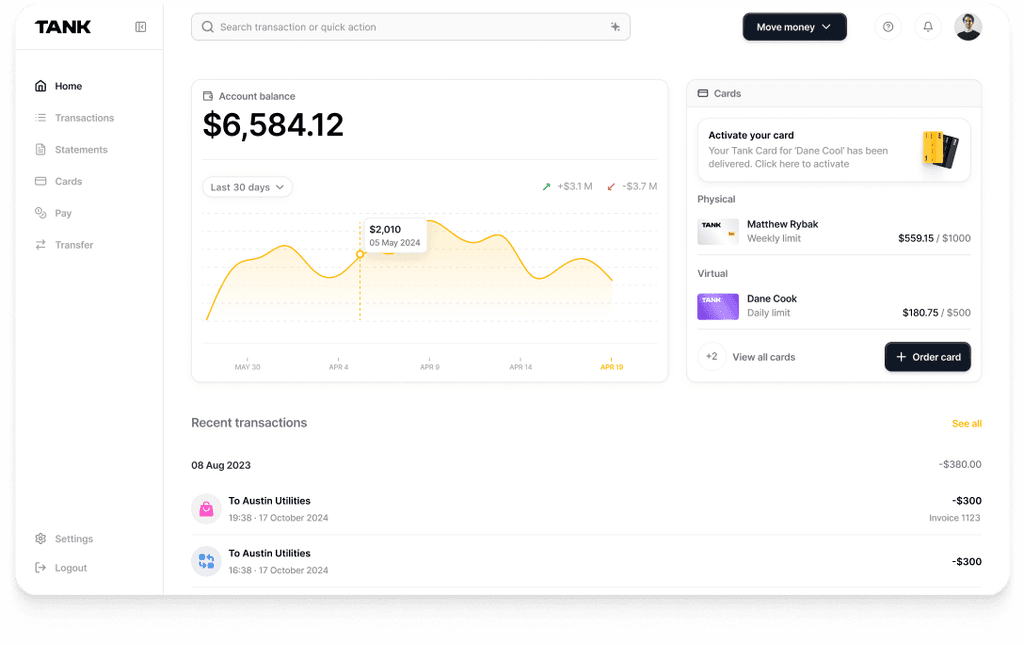

Finally, supporting visuals play a crucial role in bringing the solution to life. Screenshots, product mockups, or diagrams can provide clarity that words alone cannot. A well-designed visual can instantly communicate functionality and reinforce the startup’s value proposition, making it an essential part of the pitch.

3. Product Deep Dive: Demonstrating Functional Superiority

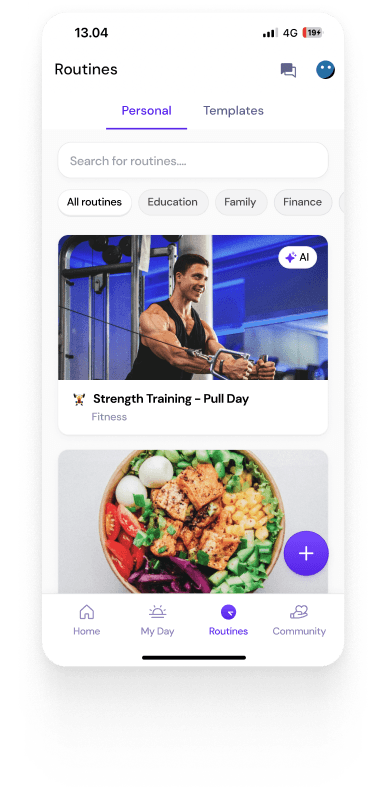

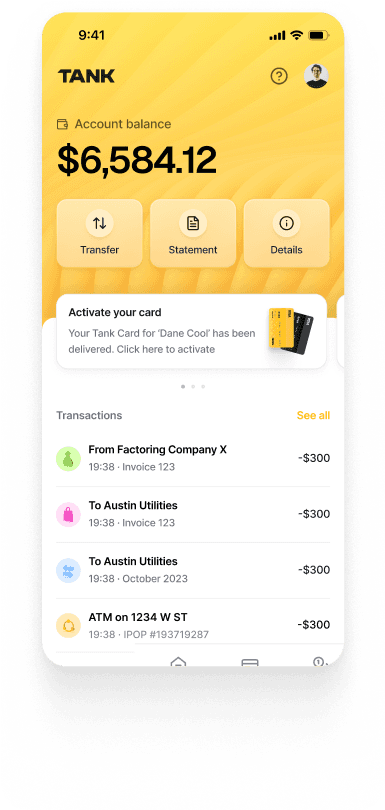

Creandum's template encourages startups to go beyond surface-level descriptions and showcase how the product works. This section typically consists of two slides: one that highlights core functionalities and another that illustrates the user journey or process flow. The goal is to help investors understand how customers interact with the product and how it delivers value.

The core functionalities slide should clearly articulate the primary capabilities of the product and explain why they are important. Rather than listing technical details, this section should focus on how each function contributes to solving the core problem. Highlighting usability, scalability, and technological advantages can strengthen the perceived value of the product.

The user journey or process flow slide provides a structured walkthrough of how customers experience the product. This can include step-by-step illustrations or workflows that demonstrate ease of use and the overall value proposition. A seamless and intuitive user experience can be a major selling point, as it suggests strong adoption potential.

To further bolster credibility, incorporating real-world use cases, case studies, or testimonials can provide concrete proof that the product is effective. Demonstrating how early users or pilot customers have successfully implemented the solution can help investors see its potential impact in a practical setting.

4. Market Opportunity: Validating Demand and Scale

Venture capitalists evaluate potential investments based on the size and accessibility of the target market. Creandum’s framework recommends a structured market sizing approach that includes Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM). Each of these categories provides a different perspective on the market opportunity, ensuring that the projections are realistic and well-founded.

Total Addressable Market (TAM) represents the full revenue opportunity assuming 100% adoption, providing investors with a broad understanding of the industry’s potential. However, TAM alone is not enough; investors need to see a clear strategy for how the startup intends to carve out its share of the market.

Serviceable Addressable Market (SAM) refines the opportunity by identifying the specific portion of TAM that is realistically within reach, given the startup’s capabilities and geographic scope. A well-researched SAM strengthens the investment case by focusing on a more attainable market segment rather than vague or inflated numbers.

Serviceable Obtainable Market (SOM) goes a step further, defining the realistic market share the startup expects to capture in the near future. This is where clear go-to-market strategies, customer acquisition plans, and competitive positioning become crucial. Investors look for data-backed justifications of these projections rather than speculative or overly optimistic estimates.

Many startups make the mistake of relying on broad industry figures without demonstrating an understanding of specific customer segments. Investors want to see that founders have done their research and can articulate a clear path to revenue generation. A compelling market opportunity section should be backed by reliable data, thoughtful segmentation, and a well-defined strategy for market penetration.

Conclusion

Creandum’s Seed Deck Template serves as a blueprint for clarity, impact, and investor alignment. It provides a structured approach to storytelling, ensuring that key aspects of the business—such as problem validation, solution differentiation, market opportunity, and traction—are communicated effectively. By following this framework, startups can create a compelling narrative that highlights their potential while addressing investor concerns in a logical and data-driven manner.

A well-crafted pitch deck is not just a formality; it is a strategic tool that influences investment decisions. Startups that take the time to refine their messaging, incorporate strong visuals, and present well-researched data will be better positioned to secure funding and build meaningful investor relationships. While the template offers guidance, the most successful founders adapt it to their unique business context, ensuring that their presentation remains authentic, engaging, and compelling.