Comparison of 5 Major Investment Apps for 2024

Mar 24, 2024

Guest User

Investment

Finance

Applications

Summary

This article reviews five key investment apps—Betterment, Robinhood, Webull, Acorns, and Marcus—highlighting their unique features and targeting different investor needs in 2024. From automated robo-advising and micro-investing to advanced trading platforms, these apps provide diverse options for both novice and seasoned investors.

Key insights:

Betterment: Ideal for passive investors, offering automated, low-fee investment management and access to financial advisors. It excels in creating personalized, tax-efficient ETF portfolios based on user goals.

Robinhood: Attracts active traders with commission-free trading of stocks, options, ETFs, and cryptocurrencies. Its user-friendly interface and fractional shares feature make it popular among younger investors.

Webull: Offers comprehensive tools for experienced traders, including advanced charting, multiple investment options, and extended trading hours. Its no-minimum, commission-free approach catifies flexible trading strategies.

Acorns: Best for beginners interested in micro-investing, turning everyday purchases into investment opportunities through its Round-Ups feature. It also provides an integrated financial wellness system with educational resources.

Marcus by Goldman Sachs: Focuses on providing a streamlined investment experience with a range of products, low fees, and robust research tools. It integrates well with other Goldman Sachs financial services, enhancing user experience with high-quality insights.

Introduction

In this article, we aim to look at five different Investment Apps to compare different features and services offered across these platforms. An investment app allows any user to manage their portfolio to buy or sell investments. In the landscape of Investment Apps in 2024, we focused in on five prominent platforms - Betterment, Acorns, Robinhood, Webull, and Marcus. Each offers distinct features tailored to different investor needs and preferences.

Betterment

Betterment is a pioneer in robo-advising and appeals to investors seeking a hands-off approach. Its automated investing platform constructs diversified ETF portfolios based on user goals and risk tolerance. Though lacking individual stock purchasing options, Betterment's low account fees (0.25%) and premium plan with access to financial advisors make it an attractive choice for beginners and advanced investors.

Betterment stands out for its robust automated investing platform, making it an ideal choice for passive investors seeking a hands-off approach. The app offers personalized portfolio recommendations based on individual goals, risk tolerance, and time horizon, leveraging modern portfolio theory and tax-efficient strategies.

With its goal-based investing feature, Betterment helps users set and achieve specific financial objectives, whether it's saving for retirement, a home, or education. Moreover, Betterment's socially responsible investing (SRI) and smart beta portfolios cater to users interested in aligning their investments with their values or seeking enhanced diversification.

Robinhood

Robinhood revolutionized commission-free trading and offers a wide array of investments, including stocks, options, ETFs, and cryptocurrencies. Its fractional shares feature enables users to invest in high-priced stocks affordably. While suitable for active stock traders, Robinhood's limited offerings in mutual funds and bonds may prompt users to diversify through other platforms.

Robinhood continues to appeal to a wide audience with its commission-free trading model and user-friendly interface, attracting both novice and experienced investors alike.

Additionally, the app's intuitive design and real-time market data provide users with a seamless trading experience, complemented by features like customizable watchlists and price alerts.

Webull

Webull stands out with commission-free trading on stocks, options, ETFs, and cryptocurrencies, coupled with no minimums. Its desktop platform and extended trading hours cater to more seasoned investors, with access to IRAs for retirement planning. Webull's robust app and customizable features make it an appealing choice for traders looking for comprehensive tools and flexibility.

Webull distinguishes itself with its advanced trading tools and in-depth market analysis, catering to traders and investors looking for more sophisticated functionalities. Its comprehensive charting tools, technical indicators, and research reports empower users to conduct thorough analysis and make informed investment decisions.

Moreover, the app's simulated trading feature, paper trading, provides users with a risk-free environment to practice trading strategies and hone their skills before committing the real capital.

Acorns

Acorns is renowned for its micro-investing approach. It targets novice investors looking to start small. Through its Round-Ups® feature, users invest spare change from everyday purchases into diversified ETFs. With plans starting at $3 per month, including a checking account, investment account, and retirement account, Acorns provides a user-friendly entry into the investing realm.

Acorns targets a younger demographic and beginner investors with its innovative approach to investing through round-ups and automated savings. The app rounds up users' everyday purchases to the nearest dollar and invests the spare change into diversified portfolios, promoting a disciplined approach to saving and investing.

Acorns' recurring investment feature allows users to set up automated contributions on a daily, weekly, or monthly basis, facilitating consistent investing habits over time. Acorns' Found Money program rewards users with cash-back bonuses when they shop with partnering brands, providing an additional incentive to save and invest.

Marcus

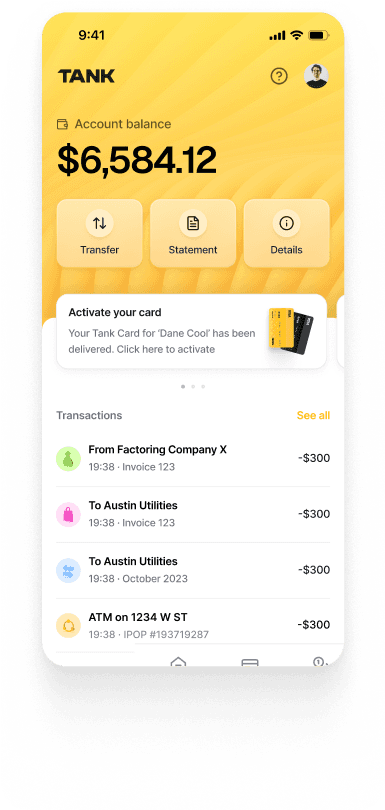

Marcus is an Investment App by Goldman Sachs, that offers users a streamlined and user-friendly platform to grow their wealth. With Marcus, investors can access a range of investment products and services designed to help them achieve their financial goals. Here are some key features of Marcus:

Diverse Investment Options: Marcus provides access to a variety of investment products, including stocks, bonds, ETFs, and mutual funds, allowing users to build diversified portfolios tailored to their risk tolerance and investment objectives.

Low Fees: Marcus boasts competitive pricing with low fees, ensuring that investors can keep more of their returns over time.

Robust Research and Insights: The app offers comprehensive research tools and market insights to help users make informed investment decisions, empowering them to navigate the complexities of the financial markets with confidence.

Seamless Integration: Marcus seamlessly integrates with other Goldman Sachs financial products and services, providing users with a holistic approach to managing their finances and investments.

Conclusion

Each of these investment apps caters to different investor preferences and goals, offering a range of features and functionalities to suit varying needs. Whether users prioritize automated investing, commission-free trading, advanced analysis tools, or innovative savings techniques, there's an app available to help them achieve their financial objectives in 2024.