Analyzing Spending of US Startups

Summary

This article explores how US startups allocate resources, with a focus on technology, operational expenses, and sector-specific innovations. It highlights major cost categories such as payroll, cloud infrastructure, and marketing. Case studies across sectors illustrate how startups use advanced tools, like AI-driven data platforms and automation, to streamline operations, minimize costs, and foster growth.

Key insights:

Technology Investments: Technology expenses are often startups’ largest cost, essential for scalability and innovation.

Payroll and Office Costs: Payroll typically accounts for a major portion of budgets, while coworking spaces are popular among early-stage companies.

Sector-Specific Expenditures: Different industries require tailored investments, such as AI-driven tools in tech or data solutions in healthcare.

Cloud and Automation: Cloud-based and automated solutions allow for flexible scaling and reduced operational costs.

Financial Planning: Understanding spending categories helps startups avoid budget underestimations, a common cause of failure.

Innovation for Growth: Advanced tech solutions in AI, cloud-native, and automation enable startups to compete and adapt rapidly.

Introduction

Startups in a wide range of industries are devoting significant resources to cutting-edge technologies that enhance their goods, services, and business processes in the rapidly evolving US technology market. Unquestionably one of the most important investments, technology is essential to the expansion of startups. Spending patterns vary greatly between industries and are influenced by the unique requirements of each startup. On the other hand, necessary costs usually consist of human resources, office space, personnel, logistics, and significant technology investments.

Scaling, staying competitive, and advancing industry-specific advancements all depend on these expenditures, especially in fields like automation, cloud-native solutions, and data infrastructure. The spending patterns of startups differ based on industry, business model, and scale. This guide provides a detailed breakdown of how much startups typically spend on different areas. By understanding these key expense categories, entrepreneurs can better plan their budgets and avoid common financial pitfalls. We also explore how startups are using cutting-edge technology to streamline operations, minimize expenses, and become scalable, emphasizing the critical role that tech spending plays in promoting innovation and growth in a variety of industries.

Defining Startups

A startup is a new business venture aimed at fulfilling a growing market demand through innovative products or services. Unlike traditional small businesses, which may prioritize steady growth and limited scale, startups are designed for rapid growth and often aim to disrupt or transform their industry. Startups typically begin with high costs, limited revenue, and an undeveloped business model, driving them to seek funding from venture capitalists, angel investors, or banks. This funding supports product development and market research, helping startups establish a sustainable business model and scale quickly.

Typical Spending Breakdown for Startups

Startups face a variety of costs depending on their industry, business model, and scale. These costs can be broadly categorized into technology-related expenses, operational costs, and other startup-specific expenses. Below is a detailed breakdown of how much startups typically spend in different areas

1. Technology-Related Costs

Technology is often one of the largest expense categories for startups, especially in sectors like SaaS (Software as a Service), fintech, and other tech-driven industries.

Software Development: Developing software or an app is a significant cost for tech startups. The cost depends on the complexity of the app or software:

Simple apps: $10,000 to $60,000

Average complexity apps: $60,000 to $150,000

Highly complex apps: $300,000 or more.

For SaaS startups specifically, development costs can range from $15,000 to $45,000 in the first year. Outsourcing development is a way many startups cut costs significantly. A developer in India might cost $20-30 per hour compared to $120-150 for a US developer with similar skill sets.

Servers and Cloud Infrastructure: Startups typically spend on cloud services to host their applications and data. The monthly spending on servers varies based on the company's size and needs. According to data from Brex (whose users are primarily early- to mid-stage tech startups), startups spending less than $25,000 per month spend around $2,603 on servers. Startups spending between $25K and $50K spend $3,765, those spending between $50K and $100K per month spend around $6,052, and the ones spending up to $250k in general spend approximately $7,151 on servers monthly.

Software Tools: Startups use various software tools for operations such as customer relationship management (CRM), design tools, and task management systems. The typical monthly expenses include $91 to $148 for CRM, $34 to $53 for design tools, and $42 to $101 for task management tools. Businesses can save on costs by using freemium versions of tools such as Zoom, Slack, and more.

Website Development: Building a professional website is another technology-related expense. Almost every business nowadays has a website. Startups can either hire developers or use website builders. While hiring a developer for a single website could cost anywhere from $1,000 to $10,000, using website builders like Wix or Squarespace would be around $40 per month.

Cybersecurity: As cybersecurity becomes increasingly important, many startups allocate a portion of their budget to security measures. Cybersecurity spending is expected to increase for 68% of businesses in 2024.

2. Operational Costs

Operational costs are ongoing expenses that cover daily business activities.

Payroll: Payroll is one of the largest operational costs for startups. Payroll typically accounts for 20% to 50% of a startup’s budget. For five employees in the US, payroll can cost around $300,500 annually.

Office Space: The cost of office space depends on location and the number of employees. Startups can expect to spend between $100 and $1,200 per employee/month for office space. There might be significant one-time investments required for office furniture and supplies too. Coworking spaces are also popular among early-stage startups, costing around $1,839 to $4,201 per month, depending on the size of the company.

Legal and Professional Fees: Legal fees are essential for ensuring compliance with regulations. Startups should budget between $2,000 and $10,000 annually for legal and professional services.

3. Other Business-Specific Expenses

Beyond technology and operational costs, startups incur several other expenses that vary depending on their business model.

Marketing and Advertising: Marketing is crucial for customer acquisition. Early-stage startups often allocate less than 10% of their budget to marketing. Advertising spending can range from around $6,530 per month for smaller startups to over $15,034 per month as they scale.

Business Licenses and Permits: Depending on the industry and location, startups need various licenses and permits. Licensing fees range from $1,000 to $5,000.

Equipment Costs: Startups need equipment such as computers or specialized tools depending on their industry. Equipment costs can range from $10,000 to $125,000, depending on the type of business (e.g., construction vs. a law firm).

Insurance: Business insurance protects against liabilities such as lawsuits or disasters. Insurance costs range from $500 to $1,500 annually, depending on the size and nature of the business. According to research, one of the biggest challenges to the survival of startups is the cost of health insurance.

4. Miscellaneous and Hidden Costs

Research and Development: For product-based startups, research costs are notable. Industry analysis and prototyping require capital, with R&D expenses varying based on the product type and market readiness.

Debt Financing and Interest: Many startups take small business loans to get off the ground. Interest rates can be significant, affecting long-term financial planning. It is advisable for startups to be cautious about borrowing and to account for interest in their budgeting.

To summarize, the total cost of starting a business varies widely based on the type of startup and its specific needs. On average small businesses typically require between $50K and $1 million in startup capital.

Tech-driven startups may have higher upfront technology costs due to software development (up to $400K), cloud infrastructure (up to $7K per month), and cybersecurity investments. Founders also need to analyze the time and money tradeoffs they are willing to make - what is worth spending less money on and what would take unnecessarily huge amounts of time if money is not invested into it.

Understanding these key expense categories helps entrepreneurs plan more effectively and avoid underestimating their startup costs—one of the leading causes of failure among new businesses. The next few sections will discuss how startups in different sectors can optimize their technical spending.

IT Sector Startup Technical Spending

Startups are investing heavily in cutting-edge technology in the constantly changing IT landscape in order to fuel their inventions and grow their businesses. An example of a startup that specializes in developing high-performance data platforms for artificial intelligence, containers, and other enterprise-level applications is called Vast Data. Their strategy is creating cutting-edge solutions that provide enterprises with unmatched speed and scalability while enabling them to effectively manage and process massive volumes of data.

1. AI-Optimized Data Infrastructure

Workloads involving artificial intelligence necessitate reliable data pipelines that can manage large amounts of data at several stages, including data collection, preparation, serving, and training models. These procedures are made possible by an AI data architecture that has been streamlined, which lowers operational bottlenecks and accelerates time-to-insights. For instance, Vast Data created its platform especially for AI, providing the scalability, dependability, and speed required for these kinds of tasks. By providing parallel data access and eliminating data copies between phases, Vast Data helps enterprises decrease infrastructure expenses while boosting AI-driven innovation.

2. Cloud-Native Data Management

The goal of cloud-native data management is to store, manage, and analyze data in cloud environments. By scaling resources up or down as needed, this method enables businesses to take advantage of the cloud's flexibility, which has a direct impact on resource allocation and cost control. For instance, cloud-native data management tools from Vast Data enable businesses to use a hybrid approach that combines on-premises and cloud storage. Due to this flexibility, organizations can maximize their expenditures by only purchasing the resources they truly require, guaranteeing that technical expenses are in line with current data requirements and free of needless waste.

3. Containerized Data Management

Businesses want adaptable, scalable storage solutions that can handle dynamic situations as the use of containers in cloud-native applications continues to expand. While containers offer the flexibility needed to handle workloads effectively, traditional storage architectures are unable to meet the demands of contemporary applications. In order to address these issues, Vast Data, for example, provides a platform that fully supports the Container Storage Interface (CSI) and offers sophisticated capabilities including storage classes, clones, and snapshots. This allows companies to take advantage of all-flash performance and cut down on technical expenditures on storage infrastructure, all while efficiently scaling container workloads.

4. Data Compression and Storage Optimization

This innovation entails creating sophisticated algorithms that compress big datasets while preserving the information's accessibility and integrity. It dramatically lowers storage costs, which is essential given that data quantities in contemporary enterprises are growing at an exponential rate. Additionally, data compression speeds up retrieval, which increases productivity for businesses handling large amounts of data. Vast Data, for instance, used sophisticated data reduction methods including compression and deduplication in its Universal Storage platform to achieve this. Organizations may store and handle enormous volumes of information more economically by concentrating on lowering the total cost of ownership with the help of large data.

5. All-Flash Storage Solutions

When compared to conventional disk-based storage, the performance, robustness, and efficiency of all-flash storage systems have significantly increased. By accelerating data processing and analysis, these solutions let firms obtain critical information more quickly. All-flash storage is particularly helpful for sectors managing high-speed transactions or real-time analytics. For instance, Vast Data has created an all-flash storage solution that, by fusing its software-defined architecture with inexpensive flash, reduces operating expenses. Thanks to this innovation, businesses can obtain great performance while spending less overall on technical infrastructure for data storage.

6. Scalable Object Storage

Scalable object storage is critical for enterprises managing unstructured data, such as multimedia files, backups, or logs. This kind of storage system can expand in capacity without affecting accessibility or performance. By allowing companies to grow in response to demand without having to make significant upfront investments, it promotes cost savings. For instance, Vast Data uses its Universal Storage platform to offer infinitely scalable object storage, enabling enterprises to handle enormous volumes of unstructured data without being concerned about capacity constraints. Their method offers a more effective solution to handle increasing data needs by minimizing the need for expensive modifications as data requirements increase.

7. Software-Defined Storage (SDS)

Software-Defined Storage offers flexibility and cost-effectiveness by keeping storage hardware and software management separate. Businesses can select hardware that meets their budget while taking advantage of enhanced storage functions via software by abstracting the storage management layer. This strategy lowers operating and capital expenses dramatically. For example, Vast Data delivers excellent performance on commodity hardware using an SDS paradigm, allowing businesses to optimize their storage systems without having to rely on pricey, proprietary hardware solutions. As a result, a more affordable storage infrastructure that grows with the company is made possible.

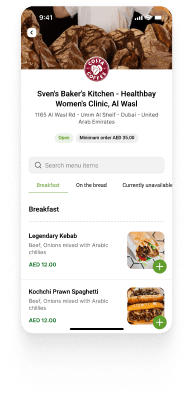

Startup Technical Spending in the Health Sector

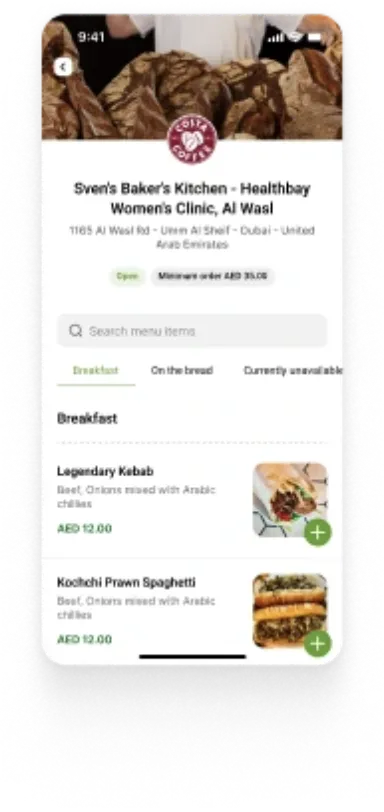

The health sector in the USA is experiencing a substantial transition spurred by technological innovation. This shift is being spearheaded by startups like Tendo Insights, which are substantially investing in technology to boost patient experiences, improve clinical results, and maximize income for healthcare providers. These firms help healthcare organizations alleviate the financial strains on the sector while streamlining operations and improving patient care through the use of data and actionable insights.

1. Actionable Data Insights

Using actionable data insights to inform decisions is one of the most notable advances in the health business. Tendo Insights specializes in providing healthcare businesses with recommendations that empower clinical, quality, clinical documentation improvement (CDI), and revenue teams. This capacity is essential for boosting patient satisfaction and clinical results, which can result in higher quality ratings and more income. Tendo provides healthcare facilities with tools such as the Income Opportunity Card and the CMS Penalty Avoidance Card, which enable them to pinpoint areas that require improvement and take advantage of possibilities that yield income. Tendo assists companies in making data-driven decisions that lead to improved patient care and financial outcomes by offering comprehensive national benchmarking datasets and "what if" scenarios.

2. Streamlined Workflows

The establishment of efficient workflows for healthcare teams is another important breakthrough. Staff productivity is greatly increased by Tendo's technology, which makes it easier for clinical, revenue, and CDI teams to automate and align. Healthcare companies can effectively manage documentation improvement opportunities and achieve a 20% increase in comorbidity capture across all conditions by implementing the Quality Documentation Improvement (QDI) tool. By putting an emphasis on process efficiency, healthcare practitioners may focus on providing high-quality care, which will ultimately improve patient outcomes, while simultaneously reducing administrative responsibilities.

3. Enhanced Patient Care Journeys

The significance of individualized patient care journeys is also emphasized by Tendo Insights. Healthcare professionals may proactively engage patients and ensure they receive timely care and follow-ups by using the company's Patient Care Journey app. For instance, Robin, a patient at high risk who has to schedule her annual wellness visit (AWV), can be found with the app's assistance. Tendo uses intelligent workflows to help patients and care teams communicate by sending reminders and personalized educational materials based on each patient's health needs. This unique strategy promotes patient participation and happiness while decreasing gaps in care, ultimately leading to better health outcomes and reduced readmission rates.

4. Real-Time Performance Monitoring

Another big innovation in the health sector is the capacity to assess performance in real time. With its user-friendly dashboards, Tendo Insights gives healthcare organizations visibility into key performance data. These insights allow senior leadership to assess clinical care outcomes and operational efficiencies in real time. For example, teams can monitor their progress on documentation enhancement projects using the QDI task dashboard. Tendo helps healthcare organizations stay financially viable by empowering them to continuously enhance their services and lower expensive fines through the provision of benchmarking and quick performance feedback.

In conclusion, with wise technological investments, businesses like Tendo Insights are reshaping the health sector. These organizations are significantly improving clinical results and financial performance by concentrating on actionable data insights, efficient workflows, individualized patient care journeys, and real-time performance monitoring. The result is a more efficient and effective healthcare system that prioritizes patient care while navigating the intricacies of the industry.

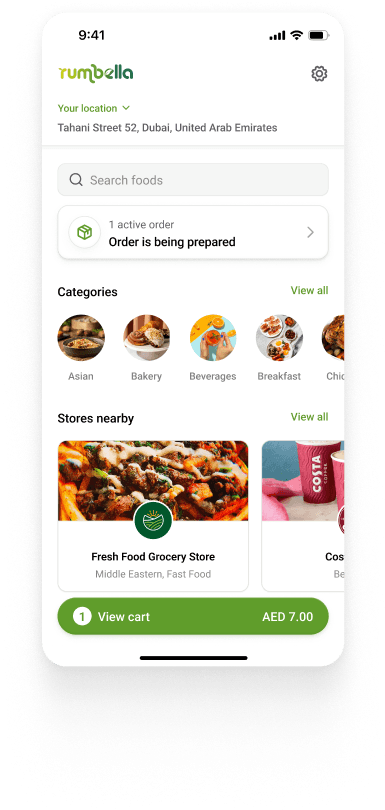

Technology Spending in Transportation and Logistics Startups

US-based entrepreneurs in the transportation and logistics sectors are utilizing cutting-edge technologies to streamline business processes, increase productivity, and preserve their competitive advantage. Cloud computing, automation, and sophisticated data integration systems are some of these developments that enable businesses to better manage intricate supply chains. In a very dynamic market, startups are investing more and more in these technologies to help them grow, cut expenses, and improve the services they offer.

1. Cloud-Based Technology for Scalability

Startups can expand their operations without requiring a large physical infrastructure thanks to cloud-based technology. Businesses may easily manage growth by using cloud computing to instantly modify their resource utilization in response to demand. For example, Mastery achieves this through its MasterMind platform, a cloud-based SaaS solution geared for scalability. Logistics companies may easily increase their resources with MasterMind's dynamic architecture without having to invest in expensive physical equipment. This helps companies save time and money so they can optimize their operations and respond swiftly to shifts in market demand.

2. Automation for Operational Efficiency

Automation is a crucial breakthrough that companies in logistics and transportation may use to optimize their operations and lower the cost of physical labor. Automated operations in areas such as billing, contract administration, and procurement can increase overall corporate efficiency. By providing back-office automation tools through MasterMind, Mastery incorporates automation into its platform. Logistics companies utilizing MasterMind may lower the risk of errors and save time and money by automating regular operations like contract approval and invoice verification. Large administrative teams are not as necessary with this type of automation, which lowers operating expenses without sacrificing service quality.

3. Real-Time Data Integration and Visibility

Real-time data integration in logistics is crucial for enhancing decision-making and preserving operational transparency. Businesses that make platform investments are better able to manage their fleets, shipments, and customer relationships by enabling smooth data flow between different systems. This is best demonstrated by Mastery's dynamic load ETA and API connections, which offer real-time visibility into supply chain activities. By utilizing these capabilities, logistics organizations may increase customer satisfaction and decrease delays by keeping an eye on shipments, making well-informed decisions, and allocating resources more effectively. By reducing shipment errors and optimizing resource allocation, startups can save a lot of money by having the capacity to integrate data and track performance in real time.

4. Startup Technical Spending

For transportation companies handling sensitive consumer data, security is a top priority. It is imperative to invest in robust cybersecurity solutions in order to avert data breaches, safeguard customer confidence, and adhere to industry rules. Mastery takes on this task by staffing its platform with a security team that is solely in charge of observation, evaluation, and reaction. To guarantee that data is safe and recoverable, the system uses redundant data storage and ongoing vulnerability scanning. Businesses that use MasterMind gain from improved data security, which helps them avoid the hefty expenses linked to security breaches, which may cost up to $4 million on average.

5. Startup Technical Spending

Logistics businesses seeking to reduce transportation expenses must prioritize fleet operations optimization and route selection. The use of sophisticated algorithms to match shipments with available drivers and optimize routes can greatly save fuel costs and speed up deliveries. Technologies like Mastery's fleet optimization tools and Dynamic Load ETA are ideal illustrations of how startups might use technology to accomplish this. By offering optimum routing choices and real-time cargo tracking, these systems help businesses cut transportation expenses by up to 20%. Startups can lessen their operations' environmental effects and enhance fleet management by putting these technologies into practice.

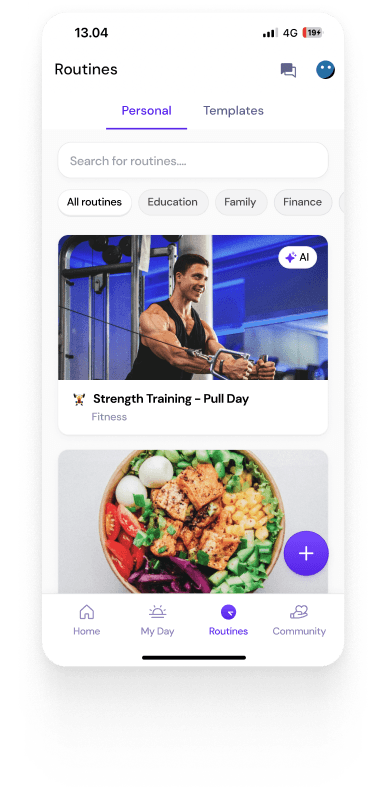

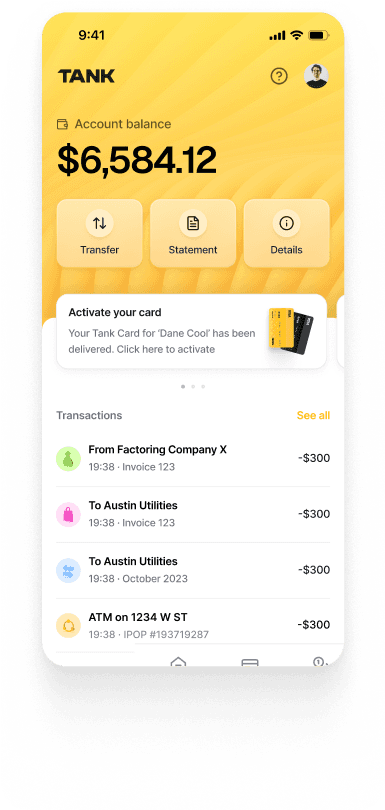

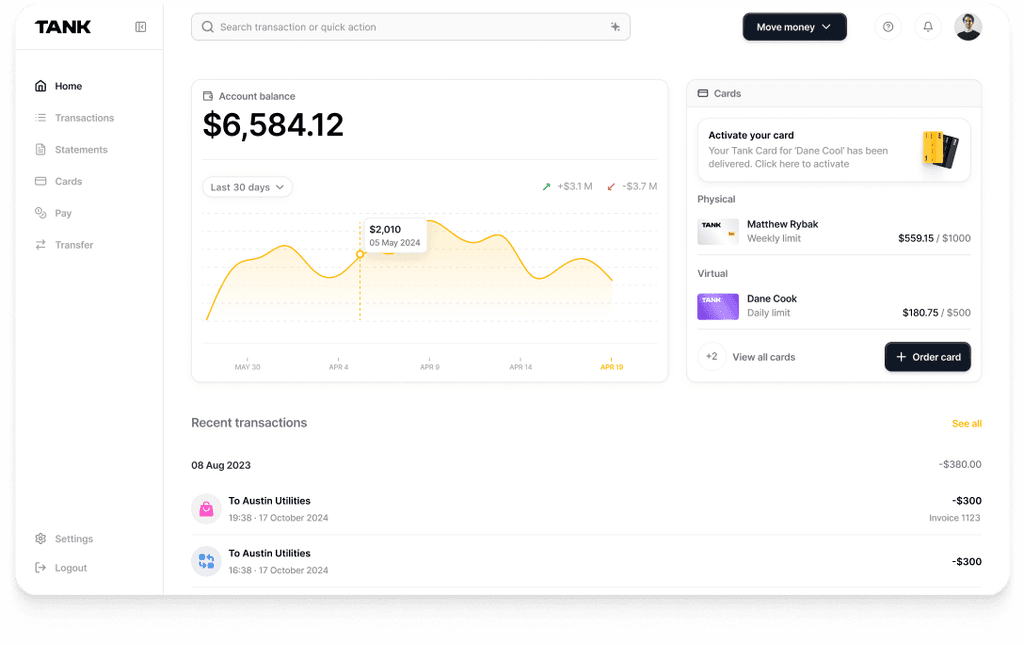

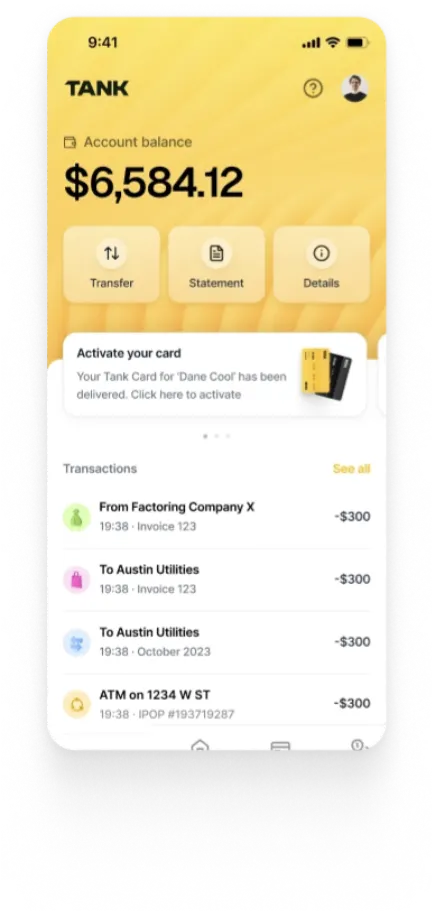

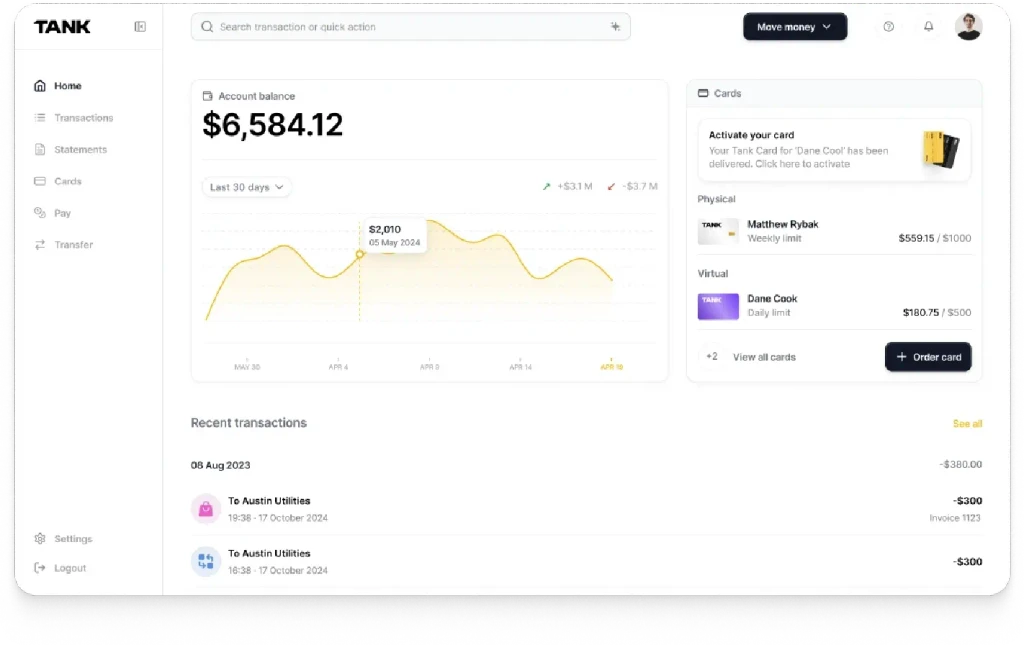

Technology Spending in Financial and Banking Startups

Financial and banking startups in the US are making considerable investments in technology to deliver more resilient, scalable, and efficient financial services. These firms are changing the financial environment by utilizing technologies like configurable APIs, automation, and embedded banking. This industry spends money on technology to assist companies become more competitive while growing quickly. It also aims to ensure regulatory compliance, enhance income streams, and improve user experience.

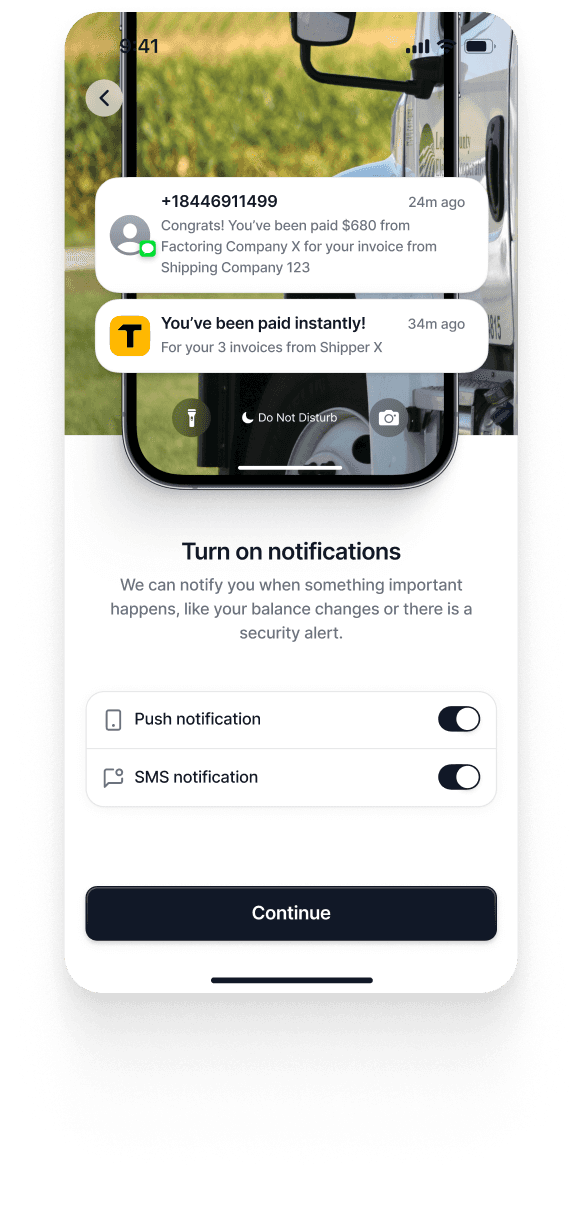

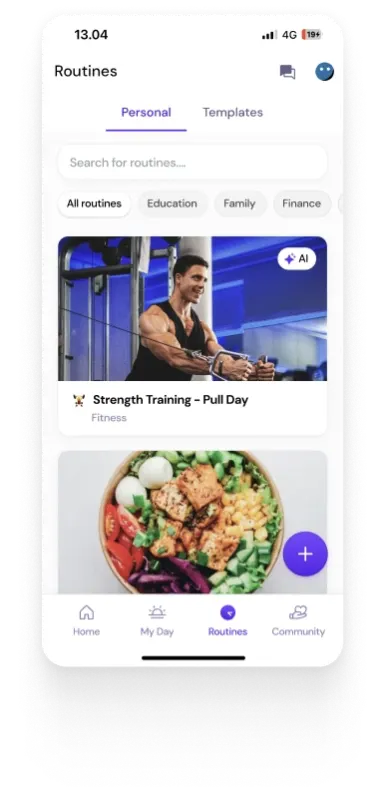

1. Embedded Banking for Revenue Growth

With the help of embedded banking, non-bank companies can now provide financial services like deposit accounts and payment options from within their current platforms. Through the integration of financial features such as cards, payments, and lending into their core products, this technology opens up new revenue streams for entrepreneurs. Unit showcases this technique through its White-Label App, which allows organizations to implement banking functions with a single line of code. Using Unit’s platform, entrepreneurs may raise revenue per user by up to 5 times by providing customized financial experiences. By utilizing interchange fees and interest on deposits, they can make significant additional revenue without having to become full-fledged banks.

2. Automation to Lower Customer Acquisition Costs

Financial services automation lowers the cost and complexity of customer acquisition and management for startups. Startups may reduce their cost of acquisition (CAC) and streamline operations by automating tasks like identity verification, account onboarding, and compliance. For instance, identity verification using Know Your Customer (KYC) and Know Your Business (KYB) standards is made easier by Unit's automated onboarding solution. This enables businesses to offer financial functions as an integrated, automated product, hence reducing CAC by up to 50%. Startups can lower the resources needed for manual onboarding and improve user retention by streamlining the integration of banking services.

3. Customizable APIs for Flexible Financial Solutions

Startups can design custom financial solutions to match the specific requirements of their clientele with the help of customizable APIs. Businesses can provide customized features, such as lending choices, card management, and customized deposit terms, all on the same platform thanks to these APIs. Unit offers businesses customizable APIs that enable them to fully tailor their loan and banking solutions, resulting in unique offerings that increase customer loyalty. By quickly launching new financial goods and adjusting to the demands of their consumers, startups that make use of these APIs can increase customer satisfaction and retention rates by up to 3.5 times when compared to non-banking products.

4. Compliance Simplification to Accelerate Growth

A major obstacle for startups entering the financial services industry is complying with financial rules. Regulatory obstacles can raise operating expenses and delay the launch of new products. However, technological systems that ease compliance can help businesses go to market faster while minimizing the need for big compliance staff. By incorporating compliance into its infrastructure, Unit's platform makes compliance easier and enables businesses to provide fully compliant banking and lending services without requiring significant regulatory investment. As a result, entrepreneurs are able to shorten their time to market and make sure they comply with all applicable financial rules while concentrating more on innovation and product development.

5. Embedded Lending for Customer Financing

A major obstacle for startups entering the financial services industry is complying with financial rules. Regulatory obstacles can raise operating expenses and delay the launch of new products. However, technological systems that ease compliance can help businesses go to market faster while minimizing the need for big compliance staff. By incorporating compliance into its infrastructure, Unit's platform makes compliance easier and enables businesses to provide fully compliant banking and lending services without requiring significant regulatory investment. As a result, entrepreneurs are able to shorten their time to market and make sure they comply with all applicable financial rules while concentrating more on innovation and product development.

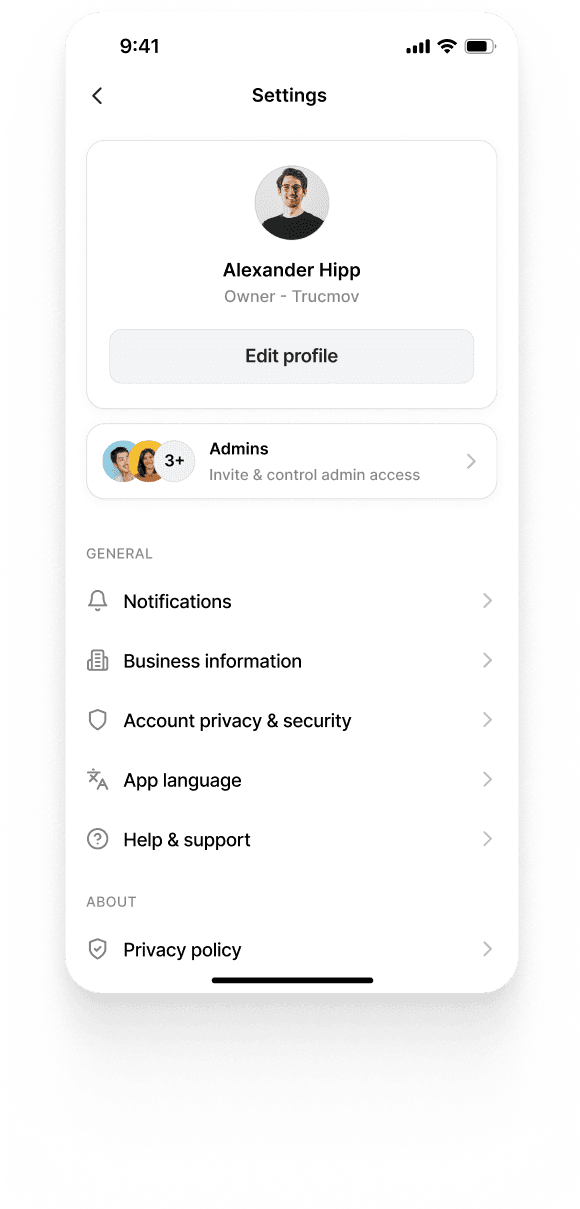

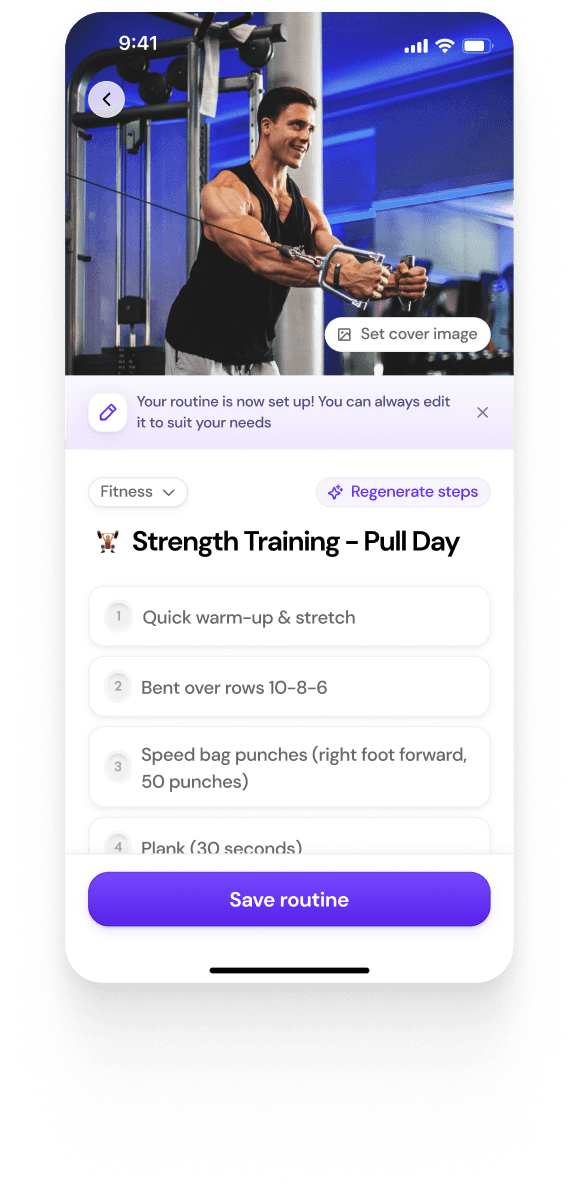

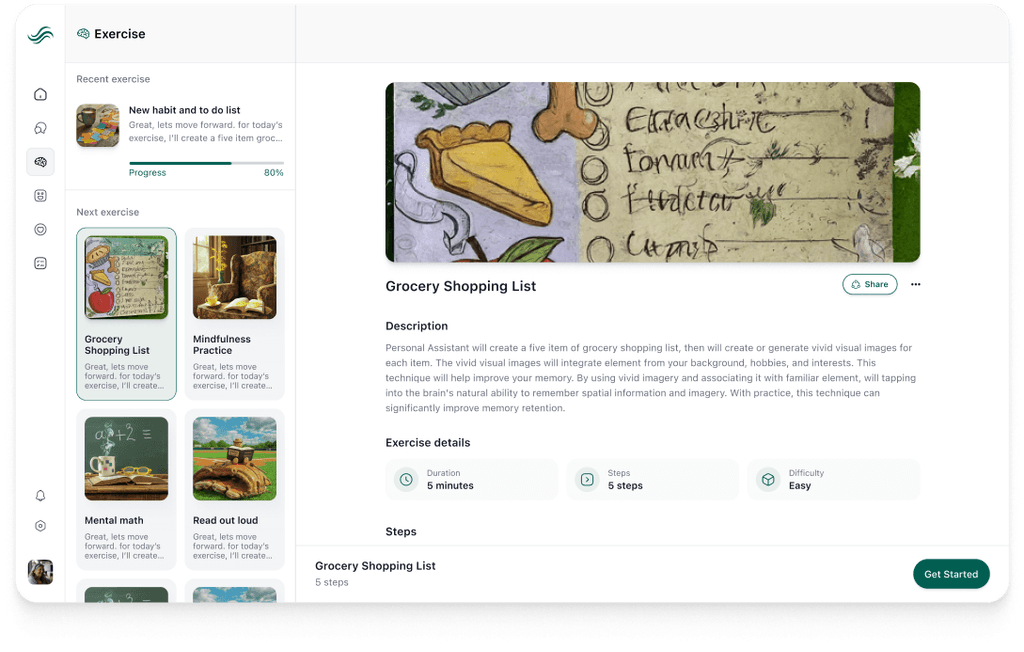

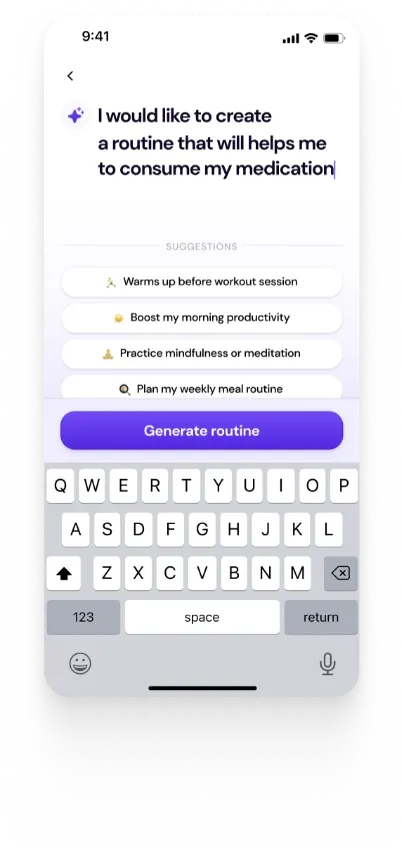

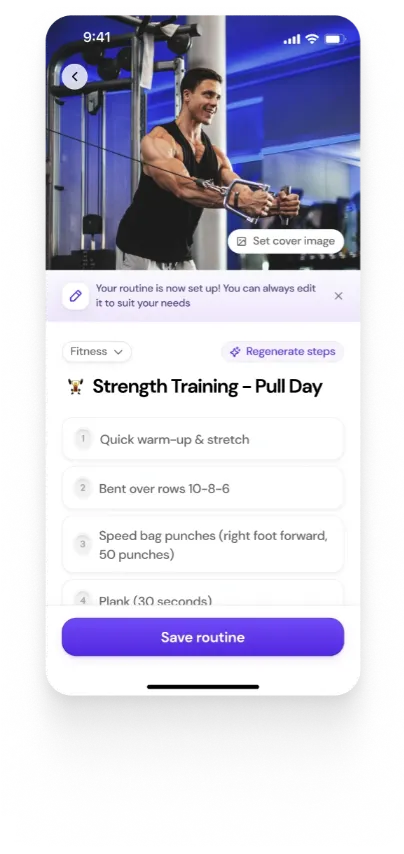

6. Design

Investment in design is an essential component for entrepreneurs hoping to provide a smooth user experience. Startups frequently set aside money to make sure that the design of their user interface (UI) and user experience (UX) is visually appealing, user-friendly, and consistent with their corporate identity. This includes making investments in unique design components that function flawlessly on desktop and mobile platforms, such as color palettes and typography. Startups can save a lot of money and time by integrating white-label components because these pre-built modules allow for complete customization without requiring the development of components from scratch. With this approach, entrepreneurs can effectively maximize their design expenses while preserving their distinctive brand presence.

In conclusion, by investing in technology that improves consumer experiences, simplifies compliance, and creates new revenue sources, financial and banking businesses are making tremendous progress. Unit is a shining example of how companies may create scalable financial solutions using technologies like customized APIs, automation, and embedded banking. Financial companies who invest in these technologies not only increase their operational efficiency but also set themselves up for long-term success in a highly competitive market.

Energy Startups and Technology Spending

American energy companies have led the way in developing cutting-edge answers to the expanding need for efficient, sustainable, and clean energy sources. These innovative firms, which concentrate on solar, battery technology, grid management, and intelligent applications, make significant investments in technology to create solutions that improve energy production, storage, and distribution. They hope to transform the energy industry and offer consumers affordable, sustainable options by utilizing these advancements.

1. Modular Solar and Battery Systems

One of the important advances in the energy business is modular solar and battery systems. These systems give users the flexibility to grow as their energy needs increase while enabling effective solar energy collecting and storage. A larger range of people can utilize modular designs because they shorten installation timeframes and labor costs. Lunar Energy, for instance, provides a modular system that works in unison with solar panels and makes it simple for homeowners to add storage blocks as needed. This innovation lowers the overall cost of energy systems for consumers while also improving energy independence.

2. Grid Integration Technologies

Modern energy systems depend heavily on grid integration technology to distribute and use power in an efficient manner. With the help of these technologies, households and the grid can link seamlessly, optimizing energy use and reducing waste. One such device that directs solar energy where it is most needed is the Lunar Bridge, which functions as an electrical panel to link a house to the grid. Through the effective use of existing resources, this innovative component helps homes reduce their energy expenses and improves energy reliability, especially during outages.

3. Enhanced Solar Panel Efficiency

The development of technology targeted at optimizing the efficiency of solar panels is another noteworthy advance in the energy sector. More sunlight is captured by solar panels thanks to solutions that increase their overall energy production. With the help of Lunar Energy's Lunar Maximizer, every solar panel's output can be maximized and all solar radiation can be transformed to useful energy. Efficiency is a key component of renewable energy's increased cost-effectiveness and sustainability, as well as increasing consumers' return on investment.

4. User Experience Through Intelligent Apps

In the energy industry, another revolutionary trend is the utilization of intelligent applications to improve user experience. By giving users access to real-time information on their system performance and energy usage, these apps empower users to make wise decisions regarding their energy use. This innovation is best demonstrated by the Lunar App, which provides comprehensive reports on energy savings, production, and consumption. Lunar Energy prioritizes user involvement through technology to make sure that consumers can efficiently track their energy usage, which increases customer happiness and facilitates more educated energy management.

To sum up, energy entrepreneurs are making large investments in technology advancements such as user-friendly applications, grid integration, modular solutions, and efficiency maximization. A great example of how these innovations are put into practice is Lunar Energy, which shows how companies in the energy sector may develop solutions that are efficient, sustainable, and focused on the needs of their customers.

Conclusion

In conclusion, startup costs vary widely depending on the industry and specific business needs, but technology remains a critical area of investment for most companies. From software development and cloud infrastructure to cybersecurity and operational expenses like payroll and office space, startups must carefully allocate their resources to ensure long-term success. By understanding these essential expense categories and making informed decisions about where to allocate funds, startups can optimize their spending and increase their chances of survival in a competitive market.

Startups in the United States have demonstrated a dedication to leveraging cutting-edge solutions that support their strategic objectives, as evidenced by their expenditure patterns. Through the utilization of innovations like automation, scalable infrastructure, and cloud-native services, startups are promoting sustainable growth in addition to increasing operational efficiency. Startups are able to fulfill the growing demands of the market, keep ahead of industry trends, and maintain their agility in the face of rapid technological breakthroughs thanks to these technological investments.

The current competitive environment demands constant investment in technology because it gives startups the capabilities they need to innovate, optimize processes, and grow quickly. Startups can position themselves for long-term success by making strategic investments in cutting-edge technologies. This allows them to navigate the complexity of their individual industries and provide customers with greater value.

Authors

References

Babych, Maksym. “How Much Does It Cost to Build an App in 2024 (Full Breakdown).” SpdLoad, 27 Aug. 2024, spdload.com/blog/app-development-cost.

Bubble. “How Much Does It Cost to Start a Business in 2024? | Bubble.” Bubble Blog | What You Need to Know About Building With No-code, 25 Oct. 2024, bubble.io/blog/cost-to-start-a-business.

“Cloud-Based TMS - Mastery.” Mastery, 17 Nov. 2023, www.mastery.net/product/.

Data, VAST. “Data Platform Built for Deep Learning and AI | VAST Data.” Vastdata.com, 2019, www.vastdata.com/.

Indeed Editorial Team. “What Is A Startup? (With Definition, Types And Advantages).” Indeed, 16 Aug. 2024, in.indeed.com/career-advice/career-development/what-is-a-startup.

“Lunar Energy: Endless Energy. Brilliant Design.” Www.lunarenergy.com, www.lunarenergy.com/.

Morah, Chizoba. “How to Estimate Business Startup Costs and What It Covers.” Investopedia, 12 June 2024, www.investopedia.com/articles/pf/09/business-startup-costs.asp.

“Newsroom | Mastery.” Mastery, 17 Apr. 2024, www.mastery.net/newsroom/.

PEACHMAN, RACHEL RABKIN. “America’s Best Startup Employers 2024.” Forbes, www.forbes.com/lists/americas-best-startup-employers/.

Team, Embroker. “106 Must-Know Startup Statistics for 2024 | Embroker.” Embroker, 20 Sept. 2024, www.embroker.com/blog/startup-statistics.

TechCrunch. “How Much Are Startups Spending for Their Top Needs? | TechCrunch.” TechCrunch, 27 Feb. 2020, techcrunch.com/sponsor/brex/how-much-are-startups-spending-for-their-top-needs.

“Tendo | Software for Healthcare.” Tendo, 21 Aug. 2024, tendo.com/.

“Unit | Docs | Unit.” Unit.co, 2024, www.unit.co/docs.

“Unit | Embedded Finance Platform.” Unit.co, 2020, www.unit.co/.

Upmetrics. “How to Calculate Business Startup Costs (2024 Guide).” Upmetrics, 3 Jan. 2024, upmetrics.co/startup-costs.