A Guide to Creating the Perfect Pitch Deck

Summary

This article is a comprehensive guide to crafting the perfect pitch deck, drawing on advice from experts from Forbes, Harvard, Stanford, and others. It will walk you through the essential elements required to ensure that the vision and potential of your venture stand out to investors.

Key insights:

Title Page Matters: The title page sets the first impression with a bold brand logo, catchy tagline, and presenter information. It should be visually appealing to intrigue investors.

Highlight the Problem: Clearly outline the target market's pain points and why current solutions are inadequate. Use metrics to quantify the issue and make it compelling.

Show Market Opportunity: Present the market size, trends, and addressable market to demonstrate potential returns and the significance of the problem. This assures investors of the growth potential.

Describe Your Solution: Use a narrative approach and visuals to humanize your product. Demonstrate the value proposition and how your solution effectively addresses the problem.

Understand the Competition: Identify direct competitors and substitutes. Highlight your unique advantages and barriers to entry to reassure investors of your market position.

Demonstrate Traction and Financials: Show early successes, social proof, and financial projections. Provide a clear picture of your financial health and future projections to build credibility and show growth potential.

Introduction

Creating a pitch deck can be one of the most critical steps for any startup looking to secure investment. It is not just about presenting your business idea; it is about telling a compelling story that captures the essence of your vision and the potential of your venture. With advice from industry experts from Forbes, Harvard, Stanford, and others, this comprehensive guide will walk you through the essential elements of an effective pitch deck and help you develop a presentation that stands out and resonates with investors.

Title Page (Introduction)

1. Key Elements

Brand Logo: Make it big and bold.

Catchy Tagline: Include a short, declarative sentence that defines your venture and highlights its unique advantage.

Presenter Information: Date and name of the presenter.

2. Why It Matters

The title page sets the stage and creates the first impression. Ensure it is visually appealing and intriguing. This page should capture the essence of your business and make investors excited about what is to come.

Problem Statement

1. Key Elements

Pain Point: Outline the issue your target market faces.

Current Solutions: Explain why existing solutions are inadequate.

Quantify the Pain: Use metrics like time lost or money spent.

2. Why It Matters

Selling the problem is just as important as selling the solution. Investors need to empathize with the pain point to appreciate your solution. This section should make the problem so clear and compelling that the need for a solution becomes undeniable.

Market Opportunity (Overview)

1. Key Elements

Market Size: Provide a bottoms-up market sizing.

Trends and Drivers: Discuss changing trends, new technologies, and driving forces in your market.

Addressable Market: Highlight the scope and scale of the opportunity.

2. Why It Matters

This slide provides context and scale, showing investors the potential returns and the significance of the problem. Demonstrating a large and growing market assures investors that there is room for your business to grow and succeed.

Solution (Your Product or Service)

1. Key Elements

Value Proposition: Demonstrate how your product improves the customer’s life.

Narrative Approach: Share stories of customer experiences.

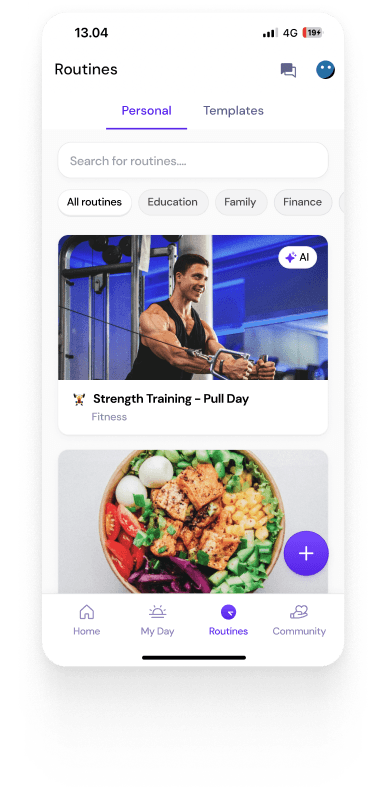

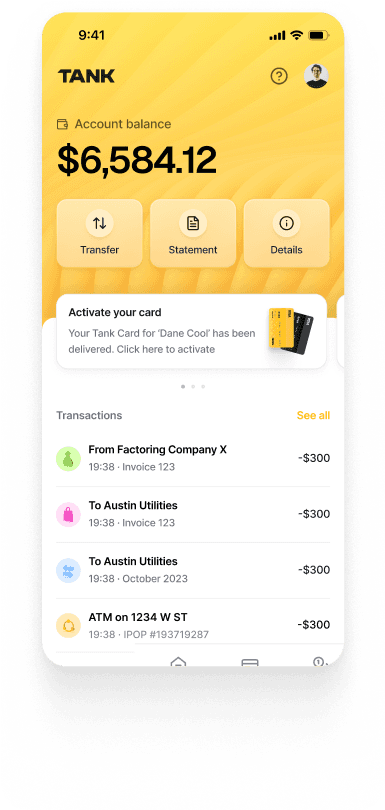

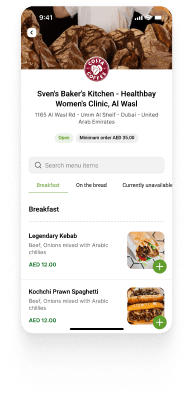

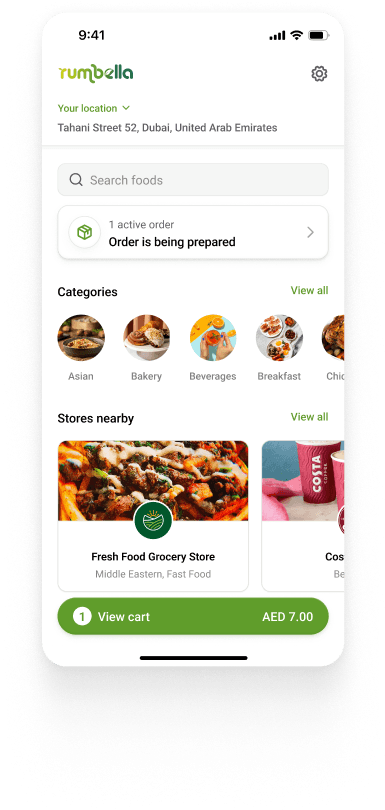

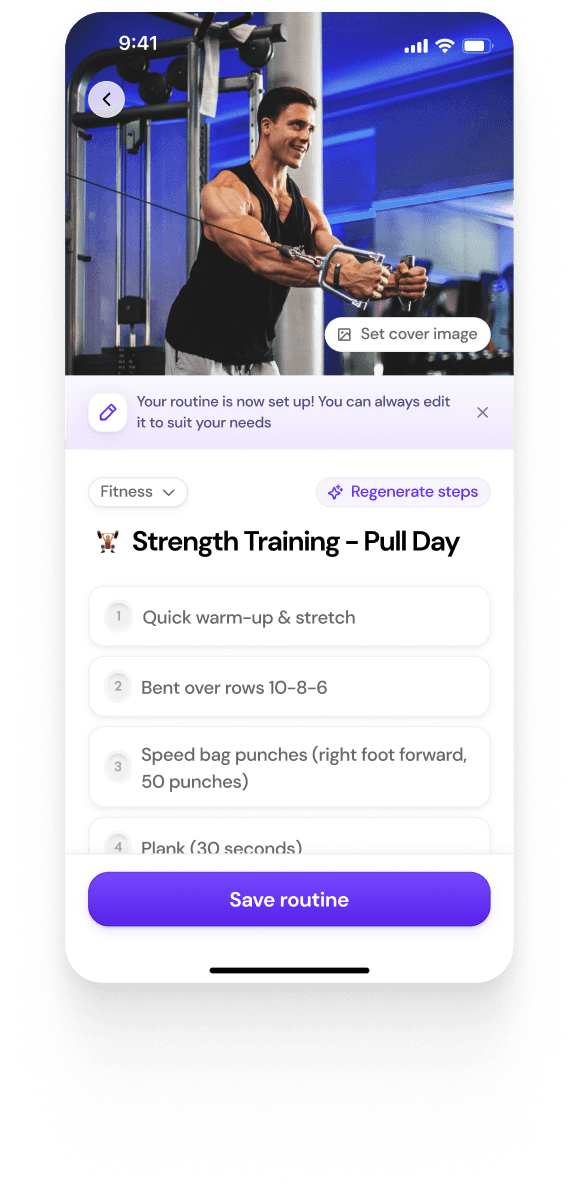

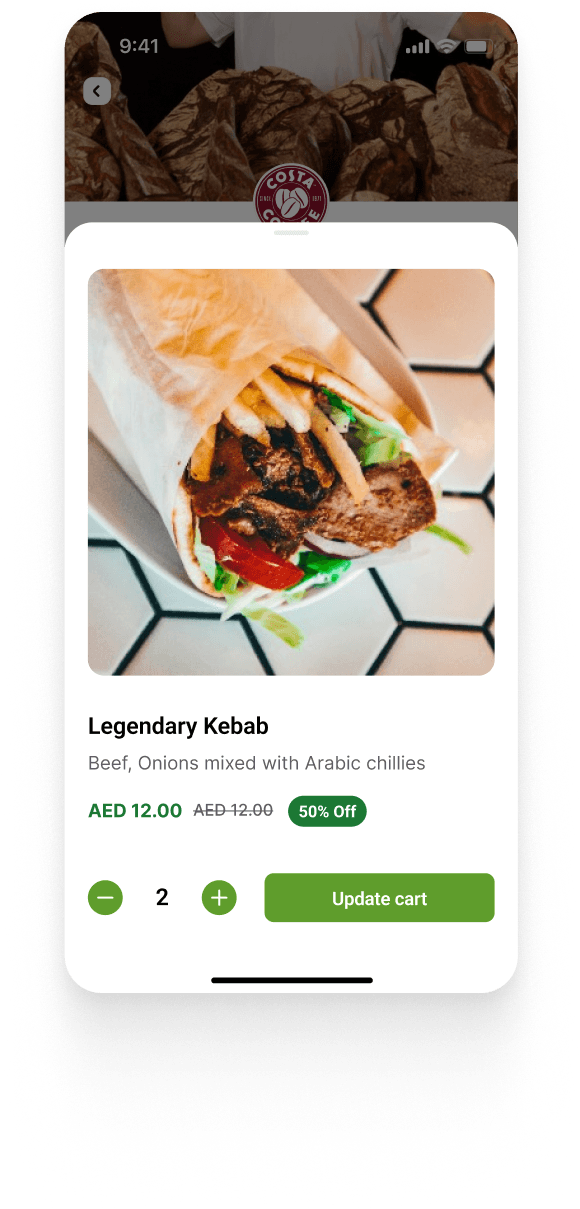

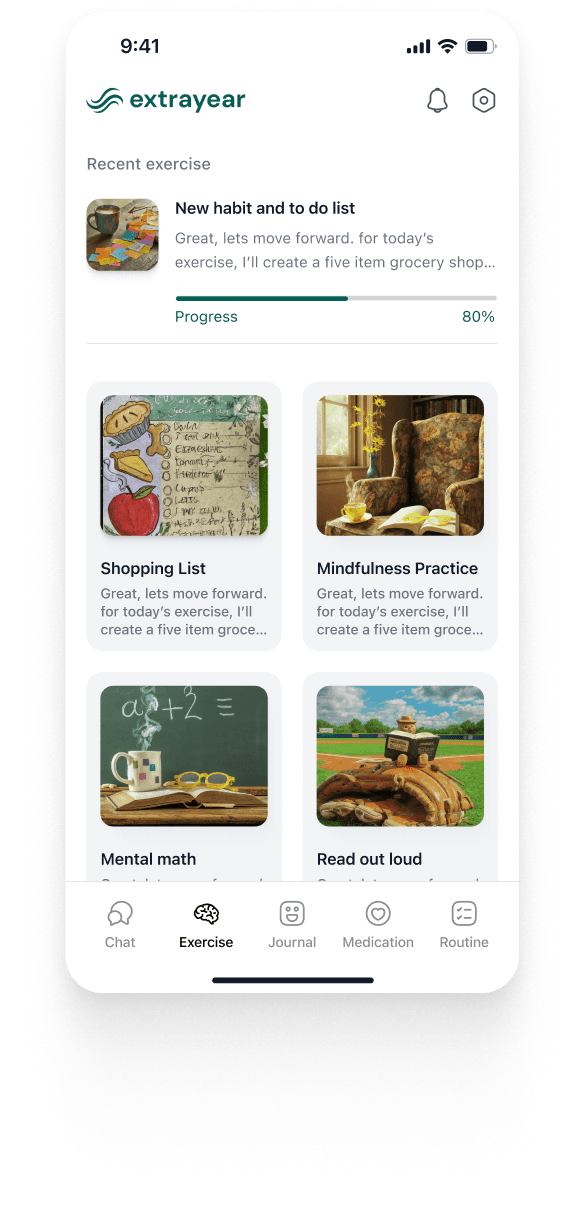

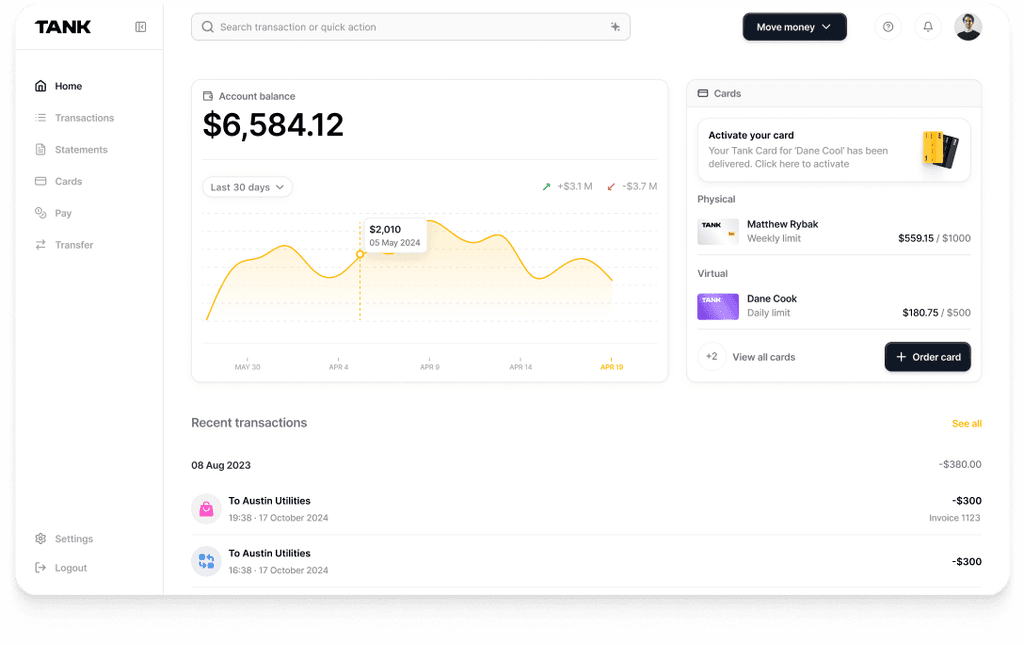

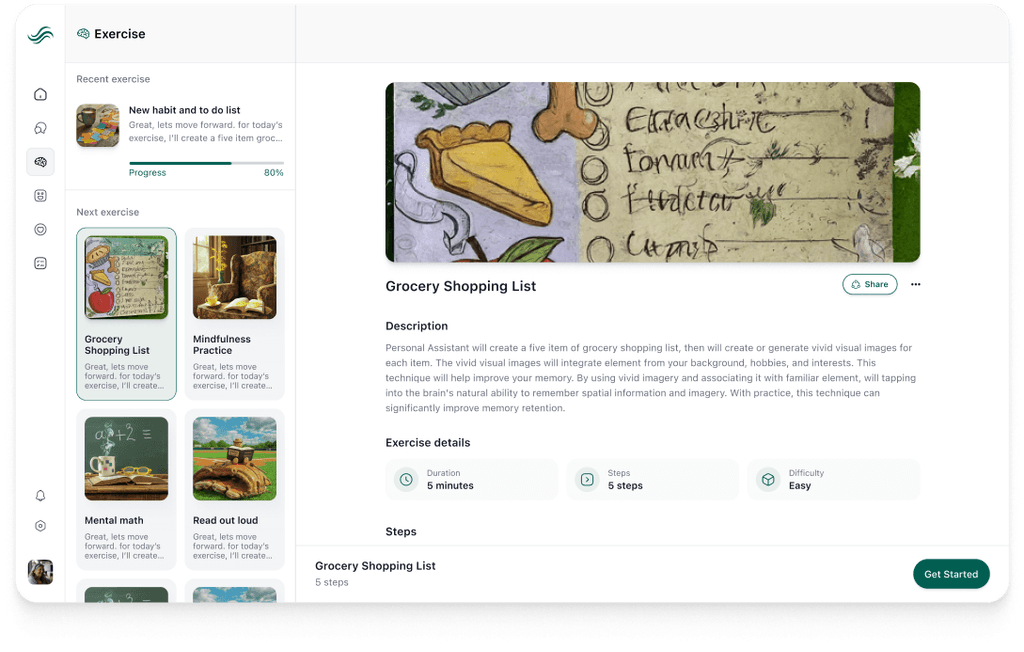

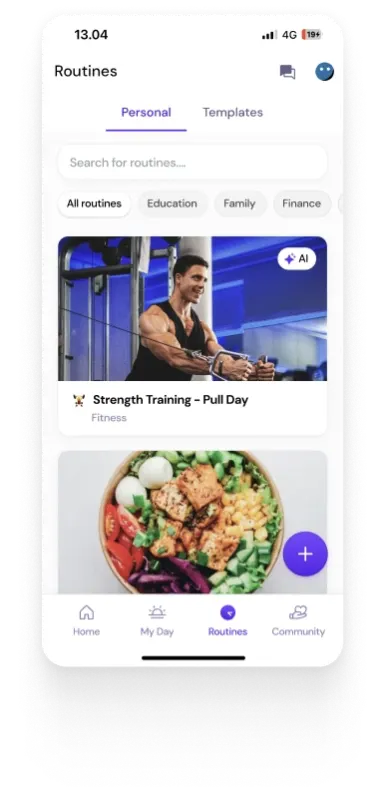

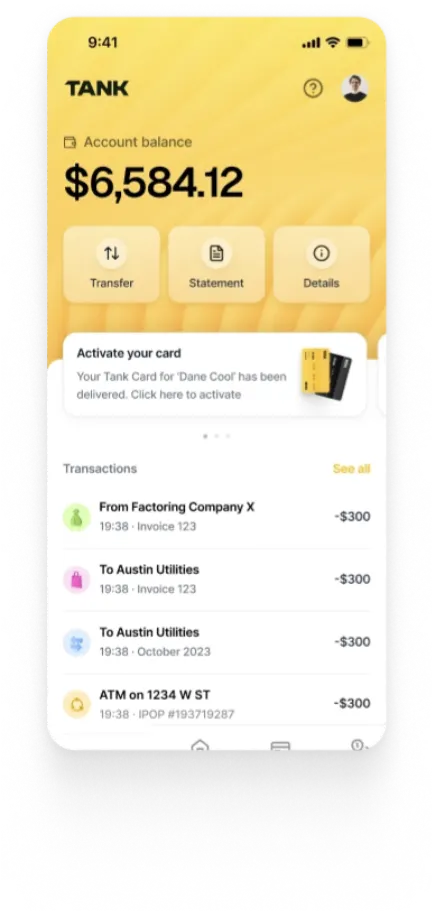

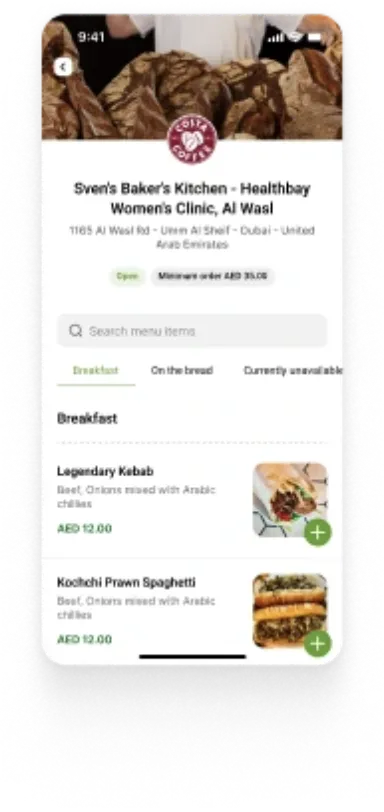

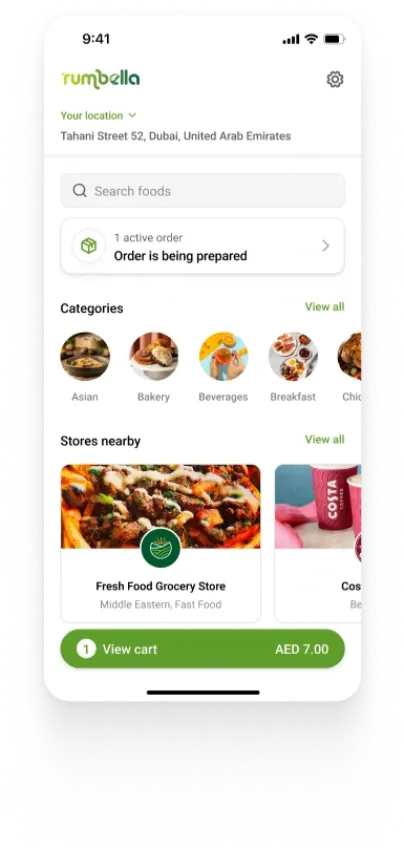

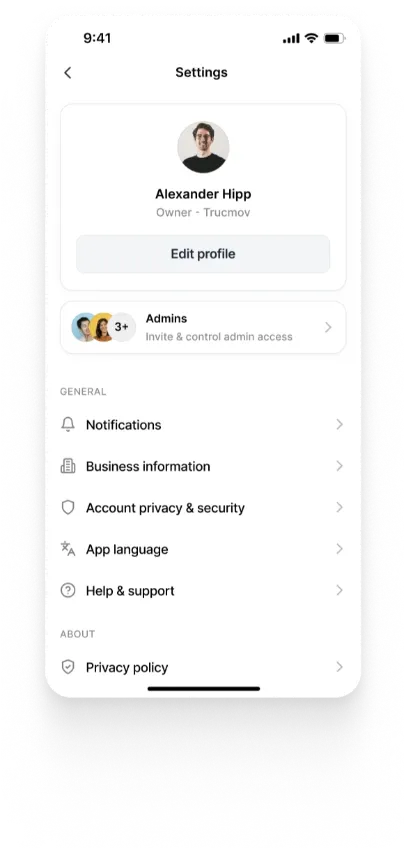

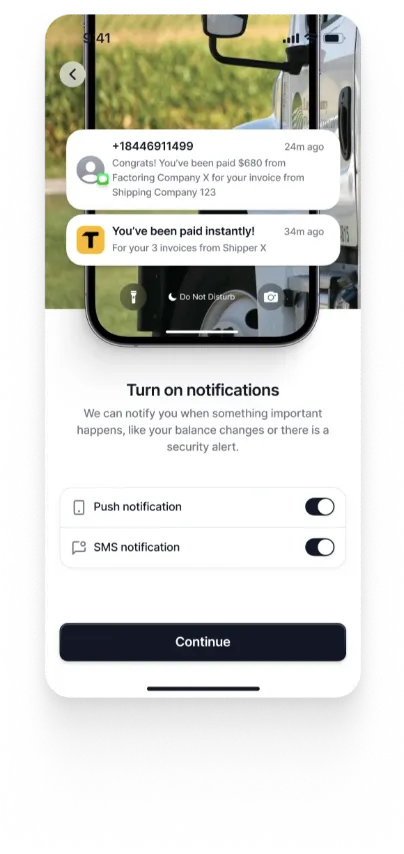

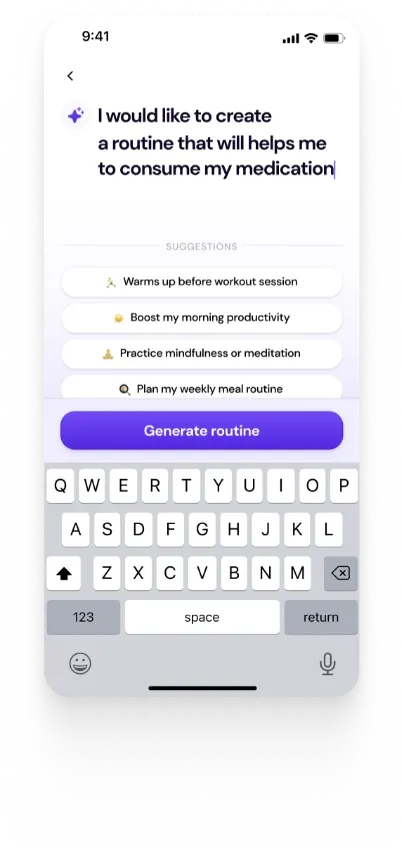

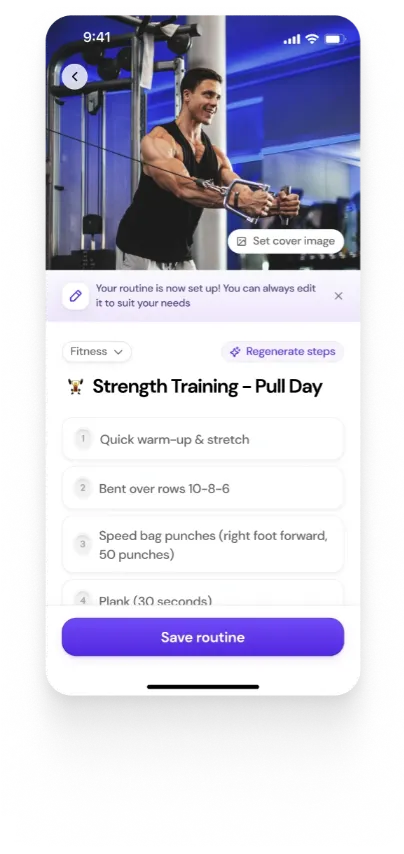

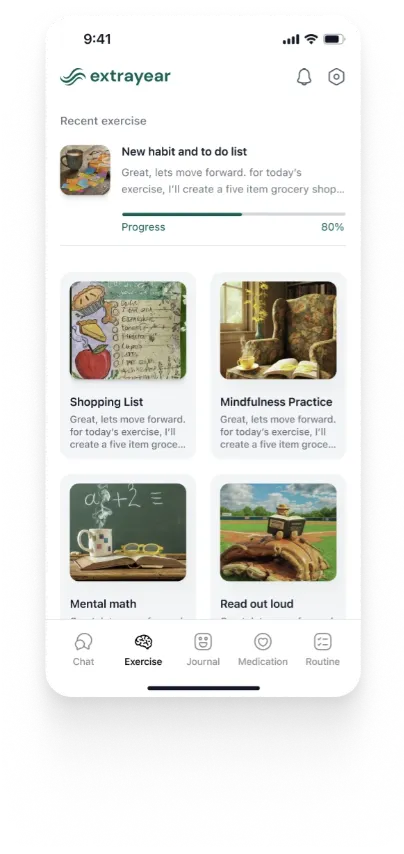

Visuals: Include photographs, screenshots, or a demo video.

2. Why It Matters

Humanizing your product through stories and visuals makes your pitch more relatable and memorable. Investors should see how your solution effectively addresses the problem and why it is the best option available.

Competitive Analysis

1. Key Elements

Competitors: Identify direct competitors and substitutes.

Differentiation: Explain why your solution is superior.

Barriers to Entry: Discuss what prevents new competitors from entering the market.

2. Why It Matters

Understanding your competition and highlighting your unique advantages reassures investors of your market position. This section should demonstrate that you have a thorough understanding of the competitive landscape and a clear plan to maintain your edge.

Unique Value Proposition

1. Key Elements

Key Benefits: Clearly communicate what sets your product apart.

Pain Points: Show how your product addresses these pain points better than competitors.

Visuals: Use visuals and examples to illustrate your points.

2. Why It Matters

A strong unique value proposition is crucial for standing out in a crowded market. This section should leave no doubt in the investors’ minds about why customers would choose your product over others.

Team Introduction

1. Key Elements

Founders and Key Members: Highlight relevant skills and experiences.

Board of Directors / Advisors: Include notable influencers.

Team Proficiency: Demonstrate the team’s capability to execute the plan.

2. Why It Matters

Investors invest in people as much as they do in ideas. Show that your team is capable and credible. Highlighting your team’s expertise and experience will give investors confidence in your ability to execute the business plan. If you are lacking team members with a particular expertise, explain your hiring plan to mitigate this need.

Business Model / Marketing and Sales Strategy

1. Key Elements

Revenue Model: Explain how you make money.

Pricing and Sales Strategy: Outline your pricing structure and sales approach.

Marketing Plan: Describe how you will reach and acquire customers.

2. Why It Matters

A clear and viable business model reassures investors of the potential for profitability. This section should show that you have a solid plan for generating revenue and scaling your business.

Traction and Social Proof

1. Key Elements

Current Progress: Show early successes, user numbers, and engagement.

Social Proof: Include partnerships, press coverage, and awards.

Financial Projections: If available, provide financial forecasts.

2. Why It Matters

Demonstrating traction and social proof builds credibility and shows that there is a demand for your product. This section should provide evidence that your business is gaining momentum and has the growth potential.

Financial Snapshot

1. Key Element

3-Year Forecast: Include revenue, net income, and key metrics.

Assumptions: Clearly define the assumptions behind your financial model.

Supplemental Information: Be ready to provide detailed financial plans if requested.

2. Why It Matters

Investors need to see that you have a realistic and well-thought-out financial plan. This section should give a clear picture of your financial health and future projections, showing that your business is financially viable.

Capital Requirements

1. Key Elements

Funding Needs: Specify how much capital you need.

Use of Funds: Explain how the funds will be allocated.

Milestones: Highlight the key milestones you aim to achieve with the investment. Ideally, have the milestones for the next 6-12 months planned out.

2. Why It Matters

Clearly defining your capital requirements and planned use of funds builds trust with investors. This section should provide a clear and detailed plan for how the investment will be used to achieve business goals.

Call to Action (The Ask)

1. Key Elements

Next Steps: Provide a clear call to action, such as scheduling a follow-up meeting or product demo.

Funding Request: Explicitly state the amount of funding you are seeking.

2. Why It Matters

Ending with a strong call to action motivates investors to take the next step with you. This section should leave investors with a clear understanding of what you need from them and what the next steps are. You may add a thank you slide with your contact information and any quotes from the press or other influencers who praise your company.

Additional Tips

Keep it Concise: Aim for 10-15 slides.

Use Visuals: Include charts, infographics, and tables to make your data more engaging.

Design: Keep the design simple and uncluttered.

Font Size: Use at least a 30pt font to ensure readability.

Anticipate Questions: Leave room for questions and prepare answers in advance. Add an appendix that has answers to frequently asked questions, and keep updating it every time you pitch.

Conclusion

A well-crafted pitch deck is more than just a collection of slides: it is a strategic tool that communicates your vision, validates your business model, and builds confidence in your team’s ability to execute. By following the expert insights and structured approach outlined in this guide, you will be well-prepared to present a compelling case to potential investors. To conclude, the goal is to tell a story that highlights your unique value proposition, showcases your market opportunity, and clearly outlines the path to success.

Authors

Create a Winning Pitch Deck with Walturn’s Expertise

Transform your startup's vision into a compelling pitch that resonates with investors. At Walturn, we provide tailored guidance and resources to help you craft a pitch deck that stands out and secures funding. From refining your problem statement to articulating your unique value proposition and building a strong financial snapshot, we’ve got you covered. Let's work together to turn your big ideas into reality!

References

Chipman, Ian. “10 Steps to Perfect Your Startup Pitch.” Stanford Graduate School of Business, 30 Apr. 2024, www.gsb.stanford.edu/insights/10-steps-perfect-your-startup-pitch.

Cremades, Alejandro. “Pitch Deck Template: Exactly What to Include.” Forbes, 10 Dec. 2021, www.forbes.com/sites/alejandrocremades/2018/07/28/pitch-deck-template-exactly-what-to-include.

“How to Create the Perfect Pitch Deck to Wow Investors.” Advance-CTR | Medical School | Brown University, advancectr.brown.edu/resources/professional-development/how-create-perfect-pitch-deck-wow-investors.

InsideIIM, Team. “The Perfect Pitch Deck Recipe to Win Over Investors in 2023.” InsideIIM, 3 May 2023, insideiim.com/the-perfect-pitch-deck-recipe-to-win-over-investors-in-2023.

Harvard Business School New Venture Competition Pitch Deck Example. presentation, www.alumni.hbs.edu/Documents/events/NVCPitchDeckTemplate.pdf.

Wharton Business Plan Competition First Round Template. slideplayer.com/slide/8887844.